CONTENT

By: Ashley Dudarenok

Updated:

With more than 727 million online viewers (68.1% of Chinese internet users), live streaming is the most widely used video format in China among Chinese netizens. According to Forbes, livestream shopping is a $500 billion USD market in 2022, surpassing Western social media and e-commerce sites like Facebook, Amazon, or Twitter.

There is a ton of unique content available, with over 200 live streaming platforms for different markets and niches (e-commerce, fashion, tech, gaming, etc.). The differences in some of these platforms are getting increasingly small, so it’s important to know which platform suits your brand. Which platforms are widely used in the different sectors? What platform will work best with your brand and niche?

Taobao Live has a natural edge over its competitors. Established in 2016, Alibaba’s short-video platform has accumulated over 50 billion views and placed it as the top platform for e-commerce livestreams at sales conversions.

It has become a part of everyday life for Chinese consumers. The platform has a highly diverse and affordable product line-up. Consumers can choose from different market sectors easily, and the platform makes it easy for livestreamers to recommend a product to their viewers, resulting in higher conversion sales.

Taobao Live’s brands are as varied as any other platform, and they have immense viewership. Estee Lauder’s Double 11 livestream was a smashing success, with more than 500 million views and RMB $100 million in sales within just the first four hours of the event. An additional perk is that Taobao Live can be accessed all year round, which makes it easier for brands to conduct their own live streams.

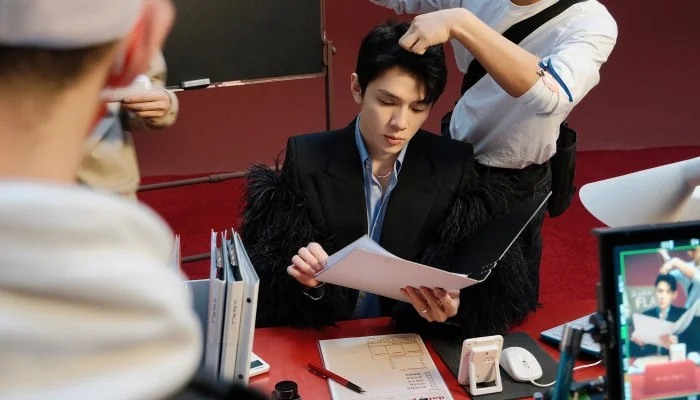

↑ Lijiaqi’s Return to Livestreaming

The most famous Taobao Live influencer is Lijiaqi. On his return after being missing on the livestream scene for 109 days, he racked up 63.53 million views during a 2-hour session. Multiple product links were immediately sold out following his stream, and he has since been dubbed the “adrenaline” of Taobao Live. There were fears that the star’s influence waned after his disappearance, but from the feedback of many brand merchants, Li Jiaqi’s power is still present. For example, 90,000 units of makeup remover creams from skincare brand Yuemu Mood sold out instantly and jumped to the top 3 of Tmall beauty single product sales that day, thanks to the power of Li Jiaqi.

Li Jiaqi’s return is celebrated by women, but Luo Yonghao’s entrance to Taobao Live appealed to men. On October 24, he appeared in the Taobao live broadcast room, and immediately 3.06 million consumers tuned in. At its peak, the room exceeded 10 million, and his livestreaming revenue total was about 210 million yuan.

Douyin is naturally strong in video content and KOLs, so it is not surprising that they are one of the industry leaders when it comes to live stream e-commerce. Douyin Livestream has more diverse categories ranging from food, workouts, traveling, online courses, fashion shows, and more.

However, people come to Douyin mainly looking for entertainment. It’s reflected in their popular livestream categories. The 2022 Douyin In-Depth Research Report shows that users in Douyin prefer quality streams, and among comparable video content platforms, it is Douyin that has the highest video quality. The core strength of Douyin is its quality content.

↑ Liu Genghong and wife

In fact, Douyin’s e-commerce report shows that the opportunity for “overnight explosion” is there for its livestreamers. The number of new creators entering the platform has increased by 172% compared to last year, and the Beijing Winter Olympics shifted consumers’ preferences to sports.

An example is the influencer Liu Genghong. He skyrocketed to have millions of fans in less than a month, and by April 23, he had as many as 42 million fans and increasing. He even overtook Li Jiaqi’s follower base, another famous KOL. Within just a few days, Liu Genghong has trended on major platforms. His content is focused on workout livestreams with his wife, Vivi Yang. One factor that contributed to his meteoric rise is that he was caught up with the turning year for Douyin, especially with the issues that rocked some live streamers last year.

While Douyin is mostly for entertainment, its capacity for sales conversion is also very formidable. Douyin Livestream has a low entry barrier to selling products, and KOLs can directly translate to sales. In fact, Coach collaborated with Bape and sold out within just 6 hours after their live stream with actress Qi Wei. Douyin Livestream also has been watched by at least 384 million consumers, which is half of the platform’s average user base.

Kuaishou is also a major player in the livestream scene in China with their 578 million MAUs. Major brands are breaking ground on this platform, and it signals the potential of Kuaishou in live streaming. At Kuaishou, any user can record and share their life experiences with short videos and showcase their talents. The platform provides products and services for each user’s needs like entertainment, online marketing, games, knowledge database, etc.

↑ Louis Vuitton’s record-breaking livestream during the Paris Fashion Week 2022

Kuaishou has an average DAU of around 363.4 million in 2022. It has increased by 9.3% compared to 2021. Most users spent an average of 129.3 minutes per day on the app watching livestreams and other short video content forms. Kuaishou’s total livestream GMV is 222.5 billion RMB. The platform is great for live streaming beauty products and luxury items.

In 2022, Louis Vuitton livestreamed their Spring/Summer 2022 menswear collection on Kuaishou, giving the platform significant luxury product credibility. The livestream earned 49 million views after it ended.

The success of the platform is evident in the unique trust and relationship between the livestreamers and their fans. This is a key reason for the amazing growth of Kuaishou’s e-commerce. Kuaishou took less than two years to break the 100 billion GMV mark, while JD.com took 10 years, Taobao took 5 years, and Pinduoduo took 2 years and 3 months.

JD Live started in 2016, which catapulted the e-commerce giant to new heights with its consumers. They ramped up their live streaming efforts by offering several livestream resources for local businesses. The platform supports MCNs (multi-channel networks) that, in turn, support other channel owners on the video platforms. JD Live also often holds livestream contests that encourage consumers and businesses to tune in.

↑ Wang Feng’s livestream.

Wang Feng, a famous KOL and mainland rock star, and his wife Zhang Ziyi livestreamed on JD Live. They endorsed products such Feihe milk powder, Xiaoxian stewed bird’s nest, and Libai products. He was ranked as second in live streaming goods within the platform, and despite his age, often livestreams the whole day.

More than 100,000 people watch his streams, and sometimes, consumers win goods like electronics or appliances so the draw to his streams is relatively strong. Wang Feng’s broadcasts have since brought revenue of more than 200 million yuan to the platform.

Young women dominate Xiaohongshu’s market, making up 98% of their user base. The platform has a reputation for authenticity and reliability, which is a key reason why they are highly respected. The main sectors in this platform with the highest sales are the skin care industry (874.87 million RMB) followed by makeup (216.54 million RMB) and parenting (192.7 million RMB).

Xiahoungshu started in 2019 and allowed brands to interact directly with their users. Companies can even respond to comments and convert sales and boost brand loyalty. The livestream platform makes it easier for users to purchase the product they like from a particular livestream. Usually, consumers are a click or two away from having their purchases delivered.

↑ Cheng Shi’an An aka Sister Cheng

Since women dominate this platform, the top livestreamers here are beauty bloggers or fashion enthusiasts. Most of the users here follow three personalities: Little Red Song, Cheng Shi’an An, and Lin Yilun. Together, their combined user base accounts for more than 98%.

Cheng Shi’an An alone has 3.15 million fans. Her content is mostly about sharing beauty tutorials, and how-to content — basically a reliable beauty blogger. Most fans of Sister Cheng are female college students who love beauty and fashion. There is also a growing approach of more down-to-earth and beauty-positive content like the “Seven Orangutans” which showcases the funny life of female college students. Currently, they have around 870,000 fans.

Live streaming has cemented its place within the Chinese market. It is an irreplaceable tool and strategy for any brand looking to enter and thrive in China. When brands plan to launch their live stream campaigns, the most important step is to choose the proper and suitable platform for their needs.

What’s the first step in opening an official brand account on these live-streaming platforms? How can brands use them for their marketing campaigns? How can you attract a substantial audience via live streams within a short time frame?

Know the answers to this question and any other Chinese live-stream queries with Chozan. Leave a comment below with your questions and insights.

DISCOVER OUR CHINESE SOCIAL MEDIA TRAININGS

To better understand Chinese social media marketing and how best to leverage it to serve your business, join ChoZan – a training and resources platform for Chinese social media marketers.

Please follow our official WeChat account to get more updates about the latest news, features, and case studies.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

WeChat VS Weixin, an Essential Guide for Marketers

5 Chinese Fashion Bloggers (KOLs) You Must Know in 2025

7 Digital Lifestyles of Chinese Gen Z Consumers

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.