How China Became the World’s E-Commerce King

By: ASHLEY DUDARENOK

Updated:

China’s e-commerce market reached US$3.1 trillion in 2024, growing 6.3% annually and climbing to US$3.85 trillion by 2028. Nearly half of all global online transactions now happen in China, making this the story of how China became the world’s e-commerce king.

But the story isn’t just about scale. It’s about how shopping became part of digital life for over a billion people. Platforms like Taobao, JD.com, and Pinduoduo are daily tools. Apps like Douyin and RedNote turn short videos into instant purchases. Every part of the journey—from discovery to checkout—happens inside an integrated system.

For global e-commerce entrepreneurs, retailers, and digital strategists, China is no longer a case study—it’s the blueprint.

China didn’t follow the West’s e-commerce model. Instead, it skipped desktops and credit cards and built something faster, more connected, and more responsive. Understanding how this happened means examining infrastructure, consumer behavior, and platform design together.

Laying the Digital Foundations of China’s E-Commerce Supremacy

China’s e-commerce dominance is not solely attributed to its large consumer base but also its robust infrastructure. A well-coordinated logistics, technology, and payment system ensures smooth, fast, and reliable transactions.

This combination of technology, logistics, and government investment has created a robust ecosystem that supports the scale and speed of China’s e-commerce revolution.

Smart Logistics Built for Speed

China didn’t simply digitize retail—it reengineered how goods move. Initially, logistics were treated as a national priority, not an afterthought. Several major platforms have built AI-powered fulfillment centers, robotic warehouses, and automated sorting systems at unprecedented scale.

As a result, rapid delivery became standard. In major cities, same-day shipping is routine. In second—and third-tier cities, next-day service is widely available. Every package moves through a data-optimized supply chain that adapts to real-time demand.

This private efficiency was made possible by public groundwork. Government investments in bonded warehouse zones and regional air cargo hubs allowed platforms to scale rapidly and reach even remote areas with consistent delivery speed.

China also leapfrogged into next-gen delivery. In 2024 alone, more than 2.7 million packages were delivered by drone. Multiple logistics firms now operate low-altitude drone corridors and autonomous ground vehicles as part of their daily operations. The market for drone logistics is projected to reach up to 150 billion yuan (around 20.9 billion USD) by 2025.

This convergence of public infrastructure and private execution created a logistics system that isn’t simply fast—it’s foundational. It turned delivery into a competitive weapon and made instant fulfillment a baseline expectation across regions, income levels, and device types.

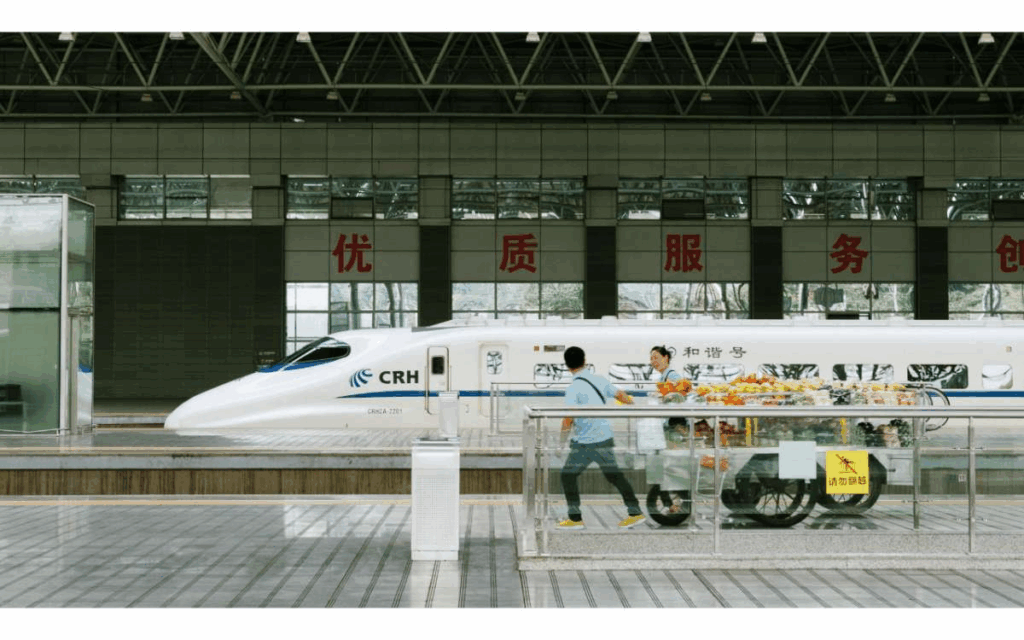

The Role of High-Speed Rail in E-Commerce Growth

Image from Canva. High speed rail on a station

The government’s investment in high-speed rail has been instrumental in advancing e-commerce logistics. China’s 48,000 km high-speed rail (HSR) network is set to grow to 60,000 km by 2030 and could reach 70,000 km by 2035. This expansion enables the rapid and efficient movement of goods nationwide.

As a result, it supports next-day and even same-day deliveries in areas far from major cities. High-speed rail offers a cost-effective and time-saving alternative to conventional freight methods, particularly for bulk shipments.

From Cities to Villages — How China’s E-Commerce Goes Deep

China’s e-commerce expansion now reaches far beyond major cities. Rural digital commerce is projected to hit 1.7 trillion yuan (around USD 240 billion) by 2025, fueled by state programs, platform investment, and deep infrastructure rollouts. This growth isn’t accidental—it’s strategic.

To close the urban-rural gap, the government introduced “Rural E-Commerce Demonstration Counties,” targeting underserved areas with:

- Logistics infrastructure and delivery stations

- Training programs for local sellers

- Incentives to attract platforms like Taobao

By the end of 2024, 1,489 counties had built nearly 3,000 logistics centers and over 158,000 village service points, offering residents support with product listings, digital tools, and last-mile delivery.

With 313 million rural residents now online, e-commerce participation has surged. A major success story is the rise of Taobao Villages—communities where at least 10% of households run e-commerce businesses. These villages sell everything from dried persimmons to handmade baskets, often to customers in far-off cities.

Taobao Villages have reshaped rural economies, supported by local subsidies and integrated supply chains. In places like Zhejiang, entire communities now rely on digital commerce for income and employment.

Instead of copying city models, China tailored rural e-commerce from the ground up—embedding infrastructure, education, and connectivity into local life.

How China’s Top Platforms Engineered E-Commerce Supremacy

China didn’t become the global e-commerce leader through individual apps. It rose to the top because its most powerful platforms—Alibaba, JD.com, and Pinduoduo—built full-stack ecosystems. Each platform solved for scale, speed, and integration in its way.

Together, they created a retail system where content, payment, logistics, and physical stores operate as one engine.

Alibaba: Building the Operating System of China’s E-Commerce

Alibaba didn’t simply connect buyers and sellers—it built the infrastructure of China’s consumer economy. Taobao (C2C) and Tmall (B2C) support millions of sellers operating inside a content-rich, mobile-native environment designed for commerce at scale.

Ele.me, Alibaba’s on-demand delivery platform, expanded everyday e-commerce by enabling grocery, medicine, and meal deliveries in under 30 minutes across major cities.

What set Alibaba apart was its ability to integrate marketplaces, payments, logistics, and offline retail into a unified system.

In 2024, Singles’ Day showcased this scale. Over 300,000 brands participated, and 45 generated over $4 billion in gross merchandise volume.

Alibaba turned the event into a media operation powered by livestreams, algorithmic targeting, and mobile-first checkout flows—all within its ecosystem.

Ecosystem Integration for Growth

Alibaba’s ecosystem is tightly interconnected:

- Alipay handles payment and credit scoring

- Cainiao manages nationwide delivery logistics

- Alimama powers data-driven ad targeting.

- Alibaba Cloud processes and syncs user behavior, inventory, and sales in real time

This integration gives Alibaba visibility across the entire customer journey. A livestream on Taobao can trigger retargeting through Alimama, optimized delivery via Cainiao, and seamless checkout through Alipay.

New Retail in Practice

Alibaba’s Freshippo stores reflect its New Retail strategy. Shoppers can scan items for details, recipes, or flash deals, check out in-store, or schedule a 30-minute delivery.

Browsing behavior informs store layouts, and promotions adjust based on app activity. These locations also function as fulfillment hubs, enabling faster last-mile delivery.

Offline and online reinforce each other through shared data and infrastructure—a model Alibaba exports through Lazada and Trendyol.

Innovation Through Immersive Tech

In 2024, Alibaba expanded its 3D showroom tools, letting users explore products like furniture and fashion in realistic detail. These tools help reduce returns and improve conversions in high-friction categories.

It also deployed AI livestream hosts, such as the virtual influencer Ayayi, who appears in campaigns and demos. These hosts operate continuously, personalize engagement, and reduce influencer-related costs.

Alibaba’s fast XR, AI, and loyalty tech rollout reinforces its position in China’s retail transformation.

JD.com: Full-Stack Control for Speed and Trust in China’s E-Commerce

While Alibaba empowered third-party sellers, JD.com built an end-to-end supply chain. From product sourcing to last-mile delivery, JD controls every step. This model earned it a reputation as one of China’s most trusted e-commerce platforms, especially in electronics, health, and fresh food categories.

JD.com operates over 1,500 warehouses across China, enabling fast delivery across urban and rural areas. JD NOW’s rapid delivery service reaches over 2,300 locations, with delivery times as short as nine minutes in select regions.

Over 700,000 employees and delivery riders support its logistics network. AI-powered warehouses, automated routing, and fleets of autonomous vehicles make large-scale fulfillment possible.

Infrastructure-Driven Ecosystem

JD’s ecosystem includes:

- JD Logistics: Full-service warehousing, freight, and last-mile delivery

- JD Digits: Consumer credit scoring and supply chain financing

- JD Cloud: Data management and retail forecasting tools

This setup allows real-time responses. If demand spikes in one city, JD adjusts inventory and pricing within hours, without third-party delays.

Smart Retail as a Default

JD’s 7FRESH stores represent its New Retail strategy. Shoppers use facial recognition to check out and receive personalized offers through the app. Store layouts adapt based on online behavior.

These stores also serve as micro-warehouses, supporting hyperlocal fulfillment. JD uses the same data infrastructure across physical and digital channels to ensure fast, precise, personalized service.

Future Commerce, Already Live

JD launched XR Mall in 2024, letting users browse 3D stores and purchase products inside the app. This solves common issues like sizing and visual comparison in categories such as furniture and appliances.

AI livestream hosts now present products in detail, especially in complex verticals. These automated hosts deliver consistent messaging, reduce costs, and allow 24/7 sales coverage.

JD doesn’t treat these tools as experiments—they’re deployed to scale trust, cut overhead, and expand reach with complete control over performance metrics.

Pinduoduo — Redefining Demand Through Social Commerce

Pinduoduo took a different path. While Alibaba and JD built infrastructure, Pinduoduo focused on demand generation. It turned group chats and social messaging into retail funnels, especially in China’s lower-tier cities and rural areas.

Its core feature is group buying. Users invite others via WeChat to join deals, unlocking discounts and rewards. The more users engage, the lower the price. This model prioritizes virality over search, turning participation into savings.

Unlocking Untapped E-Commerce Markets

While other platforms targeted urban consumers, Pinduoduo reached underserved regions. Pinduoduo is recognized as a major platform for rural talent development. It actively addresses the rural e-commerce talent gap by reaching 3.5 million in 2025.

Its lightweight app runs on low-end smartphones and delivers affordable goods, including direct-from-farm products, to price-sensitive buyers.

This approach supported China’s rural revitalization goals and rapidly expanded e-commerce access. It helped turn local producers into sellers and made online retail a sustainable income stream.

Ecosystem, Light but Precise

Pinduoduo doesn’t own warehouses or delivery fleets. Instead, it developed internal tools to manage supplier relationships, pricing, and recommendations.

Its AI tracks what users share, watch, and click in real time and adjusts the feed to match emerging interests. Rather than controlling the supply chain, Pinduoduo controls demand patterns.

This model helped it become one of China’s fastest-growing platforms and a key player in global expansion through Temu.

Douyin: Scaling Instant Commerce Through Content Algorithms

Douyin has reengineered how Chinese consumers discover and buy products, replacing search with real-time behavioral feeds. In 2024, the platform generated an estimated ¥3.5 trillion (USD 509 billion) in e-commerce GMV, ranking it among China’s top three retail platforms by transaction volume.

Turning Entertainment Into E-Commerce Infrastructure

Douyin turned shopping into a background behavior. Instead of waiting for intent, it delivers products based on user engagement—scrolls, taps, and watch time—making discovery seamless and conversion immediate.

Key mechanics driving this shift include:

- Personalized feed logic based on scroll speed, dwell time, and tap behavior

- Shelf-based commerce, where storefronts and product bundles appear mid-scroll

- In-feed checkout that completes transactions without leaving the video stream

- Reduced dependence on influencer livestreams, as algorithmic discovery now drives most sales

Driving Inclusivity at Scale

Douyin built tools for in-app stores, logistics integration, and automated content generation. AI avatars, real-time bundling, and dynamic pricing helped creators run storefronts nationwide without warehousing or live staff. It became a foundational driver of China’s shift to attention-first retail, turning discovery into transaction at unprecedented speed.

RedNote: Building China’s High-Trust Consumer Engine

RedNote didn’t enter China’s e-commerce ecosystem as a transaction platform. Instead, it emerged as a behavioral bridge, linking product discovery with real-world reassurance. By Q4 2024, RedNote averaged nearly 600 million daily search queries, reaching roughly half the search traffic of Baidu. Its algorithm—a mix of engagement signals, tags, and personalized behavior—drives high-intent discovery and boosts content virality.

Trust-Driven Ecosystem Design

RedNote doesn’t push direct sales. Instead, it creates a multi-step conversion funnel:

- Discovery through relatable content: Notes trend via user search and social recirculation.

- Engagement via keyword clustering: Tags like “acne-safe sunscreen” or “budget baby stroller” build high-intent micro-communities.

- Conversion through cross-platform linkage: RedNote integrates with Taobao, JD, and Xiaohongshu Mini-Programs, enabling seamless transitions to checkout on external platforms.

This model turns high-trust content into intent magnets. Brands that perform well on RedNote often see a 30–45% lift in conversion rates across linked e-commerce stores.

Meituan: Anchoring Local Commerce with Instant Retail Scale

Meituan dominates China’s local commerce, including food delivery, in-store services, and instant retail. In Q4 2024, revenue hit ¥88.5 billion (USD 12.4 billion), underlining its central role in China’s e-commerce engine.

Blazing Fast Instant Retail

Its Instashopping arm processed over 10 million orders daily by late 2024. With an estimated GMV of ¥270 billion (~USD 37 billion) during the year, this service introduces grocery-and-essential delivery within minutes to urban users.

Cementing Its Role in China’s E‑Commerce Supremacy

Meituan isn’t a niche service—it’s a core pillar of China’s e-commerce matrix. It brings commerce to the consumer’s doorstep in near real time and wraps it in AI-powered convenience. Its massive instant-retail scale, local service saturation, and structure make it a foundational engine for China’s vision of everyday e-commerce supremacy.

Other Key Platforms That Strengthened China’s E-Commerce Ecosystem

Beyond the giants like Alibaba, JD.com, Pinduoduo, Douyin, and Meituan, several other platforms quietly fueled China’s retail dominance by unlocking niche behaviors and scaling specialized commerce:

- Kuaishou empowered creators in rural and lower-tier cities to run livestream storefronts, democratizing access to e-commerce through relatable, grassroots content. In 2024, over 70% of its e-commerce GMV came from livestream sales.

- Vipshop scaled time-sensitive flash sales for value-focused users. Its discount model supported brand inventory clearance without hurting flagship pricing.

- Kaola streamlined cross-border shopping with bonded warehouses and a quality-first reputation. It made overseas goods—from Korean skincare to Australian supplements—accessible with local-level speed.

- Dianping integrated reviews, e-vouchers, and group-buying into local service discovery. It turned browsing for restaurants or salons into transactional moments inside the app.

- Weidian and Youzan provided backend tools for small merchants and WeChat sellers, powering millions of micro-storefronts without centralized platforms.

Together, these platforms built the connective tissue of China’s e-commerce machine, handling everything from livestream production and cross-border logistics to hyperlocal retail and AI-driven personalization. Their diversity reflects the country’s ability to scale every type of commerce behavior, not just transactions, making China’s e-commerce supremacy both deep and defensible.

Consumer Behavior — What Makes the Chinese E-Commerce Shopper Unique?

According to a 2024 report, the social commerce market size in China was valued at approximately $497.38 billion USD and is expected to grow to $769 billion by 2030.

China’s e-commerce ecosystem wasn’t built solely on platforms or logistics. It was shaped by a consumer base that behaves unlike any other—mobile-first, feedback-driven, and constantly experimenting with new formats.

A Mobile-First Generation

In 2024, over 99.7% of Chinese internet users accessed the web through mobile devices, most of whom skipped desktops entirely. That shift didn’t just influence screen size—it reshaped how platforms are built. Discovery happens through endless scrolls, not search bars. Checkout flows are optimized for thumb taps, not mouse clicks.

Trust Built Through Social Proof

Chinese consumers rarely buy in isolation. Before transacting, they seek confirmation from peers, creators, or digital communities. Platforms responded by integrating social validation directly into the buying flow:

- Product pages now embed customer videos and Q&A threads.

- Group-buying features on platforms like Pinduoduo reward collective action.

- Livestreams offer live chat, polls, and instant discounts to mimic in-store conversation.

This feedback culture compressed the path from awareness to conversion. It also led platforms to prioritize UGC, rating systems, and creator tools that amplify credible voices over static brand messaging.

Livestreams and Instant Influence

Livestream e-commerce remains a dominant force, but not because of celebrities alone. Many hosts are store owners, creators, or even AI-generated avatars. What matters is real-time interaction. Forecasts predict that the live commerce market will grow steadily and surpass the US$1 trillion mark by 2026.

Shoppers join sessions to ask questions, see close-ups, request bundles, and get time-limited deals. The format combines trust, urgency, and entertainment—three forces traditional e-commerce struggles to capture.

Speed, Feedback, and Product Iteration

Platform promises don’t drive the expectation of near-instant delivery—it’s driven by consumer pressure. Shoppers expect same-day or next-day shipping even for non-urgent items. In 2024, over 71% of online orders in Tier 1 and Tier 2 cities were fulfilled within 24 hours, according to Ministry of Commerce data.

This urgency pushed platforms to build predictive inventory tools, AI routing systems, and urban micro-warehouses. Without a user base that prioritizes speed, that infrastructure wouldn’t exist.

Voice Commerce and the Shift Beyond Screens in China

While many markets treat voice shopping as a novelty, China has already turned it into a functional retail channel.

Hands-Free Commerce in Daily Life

Voice commerce thrives in China because it’s embedded into tools people already use. Tmall Genie is directly tied to Alibaba’s commerce and payment platforms. It can reorder household items, confirm account details, check delivery status, and even activate flash sale alerts—all with a single voice command.

The experience isn’t limited to shopping. Smart speakers also connect with Meituan (food), Didi (transport), and JD (retail), turning homes into frictionless transaction hubs.

Unlike in Western markets, where privacy concerns slow adoption, Chinese users are more accustomed to digital integration, especially if it offers speed and convenience.

Platform-Level Integration Is the Key

What sets China apart is that voice assistants aren’t separate gadgets but extensions of existing super apps. Whether placed in homes or embedded in smart cars, they plug into payment gateways, loyalty programs, product history, and personalized recommendations.

- Tmall Genie connects to Alipay, Taobao, and Cainiao logistics.

- Baidu’s Xiaodu integrates with Baidu Search, iQIYI (video), and retail partnerships.

- Xiaomi’s Xiao Ai serves smart home control and product ordering through Mi Home stores.

This level of integration means users don’t start over when using voice—they continue the same retail journey that began on their phone.

Beyond Convenience: Strategic Ecosystem Expansion

Voice commerce is part of a broader shift toward ambient shopping—a model where purchases happen naturally through daily interactions, not formal website sessions. It’s especially effective for routine categories like household goods, beauty, and groceries.

This shift reflects a deeper trend for China: turning commerce into an always-on experience that follows the user across devices, platforms, and environments. That continuity makes voice shopping more than a gimmick—it is another channel in a fully integrated system.

Global Expansion: How Chinese E-Commerce Platforms Go Abroad

China’s e-commerce giants have expanded far beyond their home turf, reshaping global consumer habits and setting new standards for speed, convenience, and social shopping. Leading platforms like Shein, Temu, and ByteDance’s TikTok Shop have significantly impacted the U.S., Europe, and Southeast Asian markets.

Shein’s U.S. Market Dominance

Shein, the fast-fashion giant, now claims roughly 46% of the U.S. fast-fashion market as of 2024. Despite its massive scale, Shein continues to grow at a rate exceeding 20% YoY, a testament to its ability to leverage China’s supply chain and app-driven user engagement.

By tapping into China’s highly efficient manufacturing network and adapting it for global markets, Shein has disrupted Western retailers and set new benchmarks in fast fashion.

Temu’s Rapid Growth and Expansion

Launched in 2022, Temu quickly gained traction and reached $70.8 billion in GMV by 2024. Its gamified shopping model and aggressive social media marketing—combined with the deep integration of Pinduoduo’s social commerce strategy—helped Temu outpace several traditional retailers in app installs and user engagement.

It’s now a key player in the global discount e-commerce segment, with rapid growth in markets like the U.S. and Europe.

ByteDance’s TikTok Shop Revolution

ByteDance, the parent company behind TikTok, has expanded its commerce operations with the launch of TikTok Shop in the U.S. and the UK. This platform takes Douyin’s (China’s version of TikTok) integrated shopping experience to international markets, seamlessly blending livestreaming with product discovery.

With its ability to transform viral content into instant purchases, TikTok Shop is revolutionizing how brands engage with younger audiences and reshaping e-commerce expectations.

These rapid expansions from Shein, Temu, and ByteDance underscore how Chinese platforms redefine e-commerce globally. With their focus on speed, convenience, and social integration, these platforms have set new customer experience benchmarks and reshaped e-commerce in the U.S., Europe, and beyond.

The key to success for global businesses is adopting strategies that blend content and commerce seamlessly.

Lessons From How China Became the World’s E-Commerce King

China’s e-commerce system isn’t easily copied but offers valuable lessons for companies everywhere. From product design to platform strategy, the most successful global brands are watching what works in China and adapting where possible.

What Global Companies Can Learn

One clear takeaway is the power of ecosystems. Chinese platforms remove friction by connecting every part of the buying journey. Global firms can do the same, linking content, checkout, fulfillment, and support in one loop.

Another lesson is speed. Chinese brands launch fast, test in-market, and scale based on response. Western companies tend to over-plan and under-ship. Moving faster doesn’t mean lowering standards. It means listening earlier.

Finally, there’s content. Static product pages are no longer enough. Livestreams, social reviews, and short videos give consumers richer, more trusted experiences. Brands that rely only on paid ads risk losing attention in a feed-first world.

What Can’t Be Replicated Easily

Cultural expectations matter. Chinese consumers accept algorithmic feeds, QR codes for everything, and social shopping as usual. Western users value privacy more and trust ads less. This affects how platforms grow and how much data they can use.

China also benefits from high platform density. Most users shop through super apps that offer payments, chat, and media all in one place. In markets like the US or Europe, services are spread across apps with less coordination.

There’s also the regulatory gap. Chinese platforms evolved in an environment with government support and flexibility, until the recent antitrust action. In contrast, Western platforms face strict oversight from the start, especially in areas like data use and competition.

The Road Ahead for Global E-Commerce

In 2025, China will still lead in e-commerce scale, speed, and experimentation. But that lead isn’t guaranteed. User growth is slowing. Domestic competition is fierce. Global expansion brings new challenges—language, trust, and brand loyalty.

Still, China’s model shows what’s possible when commerce and tech collaborate. It’s not about copying features; it’s about rethinking the system.

Turn Insights Into Action With ChoZan and Ashley Dudarenok

China’s rise in e-commerce was no accident. It came from orchestrated strategy, technological leapfrogging, and deep consumer insight. For global companies, the key isn’t copying China—it’s learning which parts of the model apply to your context.

That’s precisely what ChoZan, the digital consultancy founded by Ashley Dudarenok, helps companies do.

Why ChoZan?

ChoZan works with multinationals, global tech firms, and forward-thinking brands to translate China’s digital transformation into custom strategies, training programs, and actionable insights.

ChoZan collaborates with:

- Global brands entering or expanding in China

- Multinationals building digital commerce arms

- Retailers adapting to livestream and social commerce

- Executives navigating rapid digital transformation

Whether you’re a marketing lead or C-suite operator, ChoZan helps align your team with China’s digital realities—before they become global expectations.

What ChoZan Offers

- Strategic Consulting: Turn China’s digital playbook into a clear, context-relevant strategy. From platform entry to localization models, ChoZan helps you adapt—not imitate—what works. Explore our China Consulting services to see how we support brands at every stage of market entry and growth.

- Expert Sessions: Need fast answers? Book focused calls with China specialists to decode local platforms, consumer behavior, tech trends, or regulatory shifts.

- Team Capability Building: Upskill internal teams through structured training modules. Topics range from WeChat commerce and influencer marketing to platform mechanics and trend localization.

- Foresight & Trend Mapping: Stay ahead with ongoing insights into emerging behaviors, technologies, and social shifts inside China’s ecosystem.

- China Innovation Tours: Go beyond the desk. ChoZan’s Tech Trek program offers immersive learning journeys for senior leaders and strategy teams. These in-market expeditions include company visits, hands-on demos, and expert dialogues—designed to turn observation into insight and insight into action.

Why Ashley Dudarenok?

Ashley is one of the world’s top voices on China’s digital economy. She’s a LinkedIn Top Voice in Marketing, a bestselling author, and a keynote speaker with over 15 years of experience in Greater China. Through her deep ties to Alibaba, JD.com, Tencent, and other platform leaders, she offers real-time insight, not theory.

Her focus areas include:

- China’s e-commerce ecosystem and growth levers

- Livestream and influencer commerce

- New Retail and online-to-offline (O2O) integration

- Brand positioning in China’s mobile-first markets

Discover what your company can learn from China.

Whether you’re launching in China, exploring livestream commerce, or adapting global strategy, ChoZan provides expert guidance to move faster and smarter. Explore consulting, training, and resources, or book a direct expert session with Ashley Dudarenok to start today.

Frequently Asked Questions about China Became The World’s E-Commerce King

Why is China the world’s e-commerce leader?

China leads due to its mobile-first infrastructure, nationwide logistics, and platforms that combine shopping with entertainment. Strong government backing and consumer willingness to adopt new formats like live streaming accelerated its rise. Together, these factors built the most advanced digital retail ecosystem globally.

What role did the Chinese government play in e-commerce growth?

The government created national strategies like Internet Plus and “Rural Vitalization,” subsidizing infrastructure, digital literacy, and last-mile logistics. This top-down support helped platforms expand rapidly—even in remote regions—fueling inclusive and sustained e-commerce growth.

What is “New Retail” in China?

New Retail merges online data with offline stores to create a unified shopping experience. Using tools like facial recognition, AI recommendations, and app-linked inventory, brands personalize every step—from browsing to checkout—both online and in-store.

How did rural areas contribute to China’s e-commerce boom?

Rural regions became a significant growth engine through upgraded internet, local delivery networks, and seller training programs. Platforms like Pinduoduo and Alibaba tailored tools for low-bandwidth users, bringing millions of first-time buyers and sellers online.

What made Shein and Temu succeed internationally?

They combine China’s supply chain agility with app-based user engagement and deep discount pricing. Shein uses data to launch fast-fashion trends quickly. Temu drives installs with gamified interfaces and social sharing, outpacing many traditional Western retailers.

How is China influencing global e-commerce practices?

From one-click checkout to AI-powered personalization, Chinese platforms are setting the standard. Western brands now emulate these tactics—like embedded payments and livestream selling—to compete with rising consumer expectations.

How have technological advancements helped China become the world’s e-commerce king?

The rapid adoption of cutting-edge technologies in China, such as mobile payment systems, AI-driven recommendations, and virtual reality shopping experiences, has transformed the e-commerce landscape.

These innovations have made shopping more convenient, personalized, and engaging for consumers, which is crucial in how China became the world’s e-commerce king and drove the sector’s growth.

Why are QR codes so important to China’s digital commerce?

QR codes bridge online and offline shopping in China. QR codes offer instant connectivity, whether buying at a store, paying for services, or accessing promotions. Their ubiquity allows seamless transitions between digital content, mobile payments, and product discovery, reinforcing China’s mobile-first, hyper-efficient e-commerce model.

Why does livestreaming matter in Chinese e-commerce?

Livestreaming allows real-time product demos, creator interactions, and instant checkout—all inside one app. It builds trust and urgency, especially in fashion, beauty, and home goods. This format drives over 50% of sales in some product categories.

How do platforms like Douyin and Kuaishou drive e-commerce sales?

They turn content into commerce. With personalized video feeds, in-app stores, and influencer-led livestreams, users discover and buy products without leaving the app. Their recommendation engines maximize conversion by targeting the right product at the right time.

Why is China’s consumer base ideal for testing new e-commerce models?

Chinese consumers are quick to adopt new technologies and retail formats. They actively engage with live streams, AI tools, and gamified experiences, which creates a fertile environment for platforms to test, refine, and scale innovations before introducing them to global markets.

Join Thousands Of Professionals

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

Latest posts

SOCIAL MEDIA

Faq About Blog

About The Author

Ashley Dudarenok

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.