CHINA MAIN REPORTS

CHINA REPORTS: YOUR ESSENTIAL GUIDE TO INSIGHTS AND INNOVATION

China’s market is a global powerhouse that significantly shapes industries around the world. As the second-largest economy with a GDP exceeding $18 trillion, its impact on the global business landscape is clear. In 2024, China accounted for over 50% of global e-commerce sales, and its digital economy was valued at more than $1.8 trillion. The swift adoption of mobile payments and an extensive 5G infrastructure, boasting 1.4 million base stations, positions China as the largest mobile internet market, setting trends that influence digital commerce worldwide.

To thrive in this dynamic environment, it’s essential to understand these trends. At ChoZan, we offer a wide range of reports that uncover these emerging insights, helping businesses not only succeed in China but also learn from its innovative practices. Our meticulously curated reports provide a comprehensive view of China’s economic, social, and technological shifts, complete with key data and projections to guide your strategic decisions.

From grasping the nuances of consumer behavior to leveraging China’s tech-driven transformation, our reports equip you with the tools needed to adapt and excel. Whether you’re entering the market, refining your strategies, or seeking inspiration from China’s innovations, ChoZan’s insights will give you the competitive edge to stay ahead

WHAT DO OUR REPORTS COVER?

At ChoZan, we offer a range of free expertly crafted reports that provide deep insights into China’s most critical trends, technological innovations, and evolving consumer behaviors. Our reports are designed to help businesses gain a comprehensive understanding of the complexities of the Chinese market, allowing you to stay ahead of the curve and strategically navigate the future of China’s economy.

Explore key industry trends, consumer profiles, and emerging market opportunities—all at no cost. Below, we highlight the categories of our free reports, their importance, and the actionable insights you’ll gain to drive success in one of the world’s most dynamic and rapidly evolving markets.

CHINA MEGA REPORT

The China Mega Report series stands as a leading resource for understanding the complexities of China’s evolving landscape. With over 5 years of experience in this field, we deliver comprehensive analysis of macroeconomic trends, technological innovations, and changing business practices that define the market. Our commitment to providing timely and relevant insights ensures you have the latest information for 2025, allowing you to stay ahead of the curve.

Each annual edition of the report offers an in-depth examination of the most impactful trends driving China’s growth. This includes a thorough exploration of developments within the digital economy, shifts in consumer behavior, and the country’s significant influence on the global market. By focusing on these key areas, we help you understand not only where China is today but also where it’s headed in the future.

Our reports are enriched by insights from over 50 leading experts across various sectors, including business, technology, and consumer trends. These contributions provide actionable takeaways that equip your organization with the knowledge needed to thrive in an environment characterized by rapid change and innovation.

For businesses looking to invest in or expand within China, understanding these trends is crucial for developing informed strategies. The China Mega Report serves as your essential guide, enabling you to navigate one of the world’s most dynamic markets with confidence and clarity. Trust us to provide the insights you need to make strategic decisions that drive success in this influential landscape.

KEY HIGHLIGHTS

Over 600 Pages of insights into China’s macroeconomic and digital landscape.

50+ Expert Contributions from industry leaders and trendsetters.

1000+ Charts offering data-driven insights and forecasts .

WHO IS THIS SERIES FOR?

The China Mega Report series is designed for global, regional, and local teams of companies engaged

with or looking to enter China. It is particularly valuable for:

Senior Leaders and Commercial Team Heads who need a strategic understanding of China’s evolving business landscape.

Marketing and Ecommerce Directors, who must stay ahead of China’s rapidly developing digital ecosystem.

Digital Transformation Departments and Strategists, looking to understand and apply China’s most successful business models, technology innovations, and consumer insights.

Global Brands, who seek to learn from China’s innovations and apply insights to their home markets and other regions.

CHINA MEGA REPORT 2025

The China Mega Report 2025 provides a critical outlook on China’s evolving market, examining the intersection of economic recovery, technological advancements, and shifting consumer behaviors. In 2025, businesses face the challenge of adapting to China’s post-pandemic transformation, with significant geopolitical shifts and the continued rise of the digital-first consumer. This edition explores the implications of China’s economic rebound and how technological innovations are shaping the future of global commerce.

CHINA MEGA REPORT 2023/4

The China Mega Report 2023/4 highlights China’s resilience amidst global economic challenges, offering businesses a detailed roadmap to navigate the post-pandemic recovery phase. With China’s consumer and digital platforms evolving rapidly, understanding the forces behind the 2024 transformation will help businesses plan strategically for 2025. This edition examines China’s resilience, how consumer sentiment has shifted, and the influence of new technologies on market behavior

CHINA MEGA REPORT 2021

The China Mega Report 2021 captures China’s acceleration towards becoming a digital-first market, particularly in the aftermath of the pandemic. This edition reflects on the critical changes that were implemented across industries, from e-commerce growth and livestreaming commerce to the increasing role of artificial intelligence and blockchain. This report is essential for businesses looking to understand the foundational shifts that continue to shape China’s market in 2025 and beyond.

CHINA MEGA REPORT 2020

The China Mega Report 2020 was the first in our annual series, marking a pivotal moment in China’s shift towards a digital-first economy following the outbreak of COVID-19. This edition provides a comprehensive look at how the pandemic accelerated China’s adoption of e-commerce, livestreaming, and mobile payments. It serves as an essential context for understanding how China’s early recovery in 2020 laid the groundwork for its rapid digital rise.

CHINA CONSUMER REPORTS

Our China Consumer Reports dive deep into the diverse consumer segments shaping China’s market. These reports provide detailed profiles of key groups such as Gen Z, Super Mums and Dads, Pet Lovers, and Lower-Tier Cities, offering critical insights into their purchasing behaviors, preferences, and evolving trends.

These reports are essential for businesses aiming to tailor their products, messaging, and marketing strategies to specific audiences. By understanding the complexities of China’s consumer segments, brands can make more informed, data-driven decisions that align with local preferences.

WHO IS THIS SERIES FOR?

The China Consumer Reports are designed for companies and professionals seeking to understand the intricacies of China’s diverse consumer base. Specifically, it is valuable for:

E-commerce Professionals: Those aiming to capture emerging consumer segments in China’s vast online retail market.

Brand Strategists and Marketing Teams: Companies looking to refine their messaging and product offerings based on distinct consumer profiles.

Consumer Goods Companies: Brands in industries such as fashion, beauty, food, and pet products who want to tailor their offerings to specific Chinese demographics.

Social Media and Digital Marketers: Professionals who need to navigate China’s social platforms like Douyin, WeChat, and Xiaohongshu to connect with target groups.

Retailers and Market Analysts: Those seeking to understand the shifting preferences of China’s consumer base, especially as new generations and niche segments emerge.

GEN Z UNVEILED: UNDERSTANDING CHINA’S NEXT WAVE OF CONSUMERS

The Chinese Consumers: Gen Z Report 2023 provides a detailed guide to understanding the next generation of influential shoppers in China. As digital natives, Gen Z’s preferences are fundamentally reshaping China’s e-commerce and retail landscapes. This report uncovers the driving forces behind their purchasing behavior, including their affinity for authenticity, sustainability, and individuality, which businesses must grasp to effectively engage this key demographic.

This in-depth report covers 122 pages, offering insights into their digital shopping habits, platform usage, and how Gen Z’s purchasing decisions are influenced by social commerce and livestream shopping.

SUPER MUMS AND DADS

The rise of China’s two-child policy has transformed the family market, giving birth to a new generation of Super Mums and Dads. These modern parents are tech-savvy, value-conscious, and increasingly involved in their children’s lives. This report offers a deep dive into their consumption patterns, highlighting their preference for high-quality, experience-driven products for their children, and the digital platforms they use to make informed purchasing decisions.

With 68 pages of insights, this report delves into the specific demands, preferences, and shopping behaviors of these modern parents, and how they are reshaping China’s consumer market, particularly in digital commerce.

PET LOVERS

The pet care industry in China is experiencing rapid growth, driven by younger generations like Gen Z and Millennials, who increasingly view pets as family members. This report provides valuable insights into pet ownership trends, spending habits, and the pet care products gaining popularity, allowing brands to tap into this expanding market.

With 79 pages of analysis, the report highlights the latest market trends, consumer preferences, and the platforms used by pet owners to make purchasing decisions. It helps businesses understand how to engage effectively with the growing pet-loving community in China.

LOWER-TIER CITY

Lower-tier cities in China represent a significant, yet often overlooked, growth opportunity. As these cities see economic growth, urbanization, and digital adoption, they are rapidly becoming important consumer markets. This report highlights the unique characteristics of consumers in lower-tier cities, including their preferences for value-driven products and digital-first shopping experiences.

This 69-page report offers insights into the growing demand for affordable and quality products, providing strategies for brands looking to engage with the emerging consumer base in China’s lower-tier cities.

LEARN FROM CHINA REPORTS

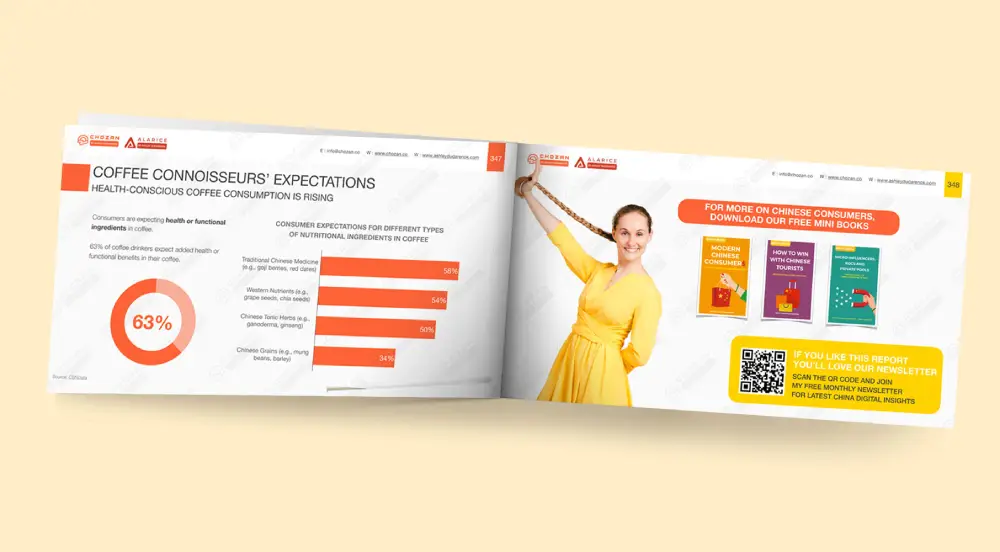

Our Learn from China reports focus on the innovative business models, processes, and technologies that have emerged from China’s market. The Fashion China report, for example, explores the digitalization of China’s fashion industry, while the Social Commerce report highlights the rise of social commerce platforms like WeChat and Douyin.

Learning from China’s innovation ecosystem can help businesses adopt cutting-edge strategies and stay ahead of global competitors. These reports provide valuable lessons from one of the most digitally advanced countries in the world.

Who Is This Book For? This book is designed for marketers, who are looking to enhance their marketing campaigns using China’s KOLs, and want to understand the impact of social media influencers on Chinese consumer behavior.

FASHION CHINA 2024

The Fashion China Report 2024 offers a comprehensive look at the dynamic Chinese fashion scene, spotlighting 35 independent Chinese fashion designers who are reshaping the industry. With 129 pages of detailed insights, this report uncovers emerging fashion trends, consumer behavior shifts, and the rise of Guochao, China’s national pride movement. It provides a deep dive into how Chinese fashion is blending cultural heritage with modern sensibilities, creating unique opportunities for global fashion brands.

SOCIAL COMMERCE: HOW TO BUILD THE FUTURE OF RETAIL

The Social Commerce Report takes an in-depth look at the evolution of China’s social commerce ecosystem, where digital platforms and e-commerce converge seamlessly. This 246-page report covers the latest trends in livestreaming commerce, private traffic management, and the integration of AI and big data in marketing strategies. It explores how brands can tap into China’s social-first commerce environment, highlighting the role of KOLs (Key Opinion Leaders) and social commerce platforms like Douyin and WeChat.

CHINA TOURISM 2023: HOW TO WIN WITH CHINESE TOURISTS

The China Tourism Report provides 158 pages of essential insights into China’s rapidly growing tourism market. It explores key consumer behaviors, preferences, and emerging travel trends as the country shifts towards domestic tourism. The report also analyzes how millennials and Gen Z are reshaping the tourism landscape, with a growing focus on experience-based travel and sustainable tourism. Learn how your brand can tap into this booming sector and attract Chinese consumers who are eager to explore both domestic and international destinations.

WHY DO THESE REPORTS MATTER IN 2025?

As China continues to evolve and influence global trends, understanding its market is increasingly essential for businesses. The next five years will be pivotal for companies seeking to enter or expand within China, marked by significant changes in digital commerce, consumer behavior, and technological advancements. Our reports deliver the timely, in-depth insights required to stay ahead of these shifts and make informed, data-driven decisions for the future. While the 2025 report provides the most current insights, revisiting earlier editions from 2020 and 2021 offers invaluable context for understanding China’s rapid evolution:

TRACKING PROGRESS

By reviewing the 2020 and 2021 editions, you can observe how China’s market has evolved and how trends from previous years have matured or shifted. This historical perspective is crucial for recognizing patterns and forecasting future developments.

UNDERSTANDING LONG-TERM TRENDS

Many changes identified in earlier reports—such as the rise of social commerce and the adoption of AI—have become even more pronounced in 2025. Understanding their origins helps businesses identify which trends have long-term staying power, allowing for more strategic planning.

LESSONS FROM EARLY STRATEGIES

The earlier reports provide valuable insights into the strategies that enabled businesses to succeed during the initial stages of digital transformation. These case studies highlight how companies adapted and innovated, offering lessons that can be applied to future challenges and opportunities.

In summary, the China Report series is not just a snapshot of the current landscape; it is a comprehensive tool for understanding the trajectory of the market. By leveraging insights from both current and past editions, businesses can position themselves for success in one of the world’s most dynamic economies.

WHAT DO WE DO

At ChoZan, we empower businesses to harness the transformative potential of China’s rapidly evolving market. Our approach is simple but powerful: Learn for China and Learn from China. We provide actionable insights, data-driven research, and tailored strategies that allow our clients to thrive in China’s complex business landscape while extracting global lessons from the Chinese market.

LEARN FOR CHINA

We specialize in helping businesses understand and navigate the Chinese market. From local consumer behavior and platform strategies to regulatory challenges and digital trends, we equip brands with the knowledge they need to succeed in one of the world’s most competitive environments.

LEARN FROM CHINA

China’s innovation-driven growth offers valuable lessons for businesses globally. Through our reports, we help companies learn from China’s pioneering business models, cutting-edge digital ecosystems, and consumer engagement strategies. These insights not only enable businesses to adapt to China’s unique dynamics but also inspire global innovations that can be applied in other markets.

ChoZan’s strength lies in its team of seasoned experts with in-depth knowledge of China’s digital transformation. Led by Ashley Dudarenok, a recognized thought leader in China’s digital space, we work closely with a network of experts across diverse industries to provide clients with unparalleled insights into the Chinese market.

We collaborate with professionals who specialize in social commerce, digital marketing, e-commerce, and consumer behavior, offering guidance from those who have first-hand experience navigating China’s business environment

ABOUT THE AUTHOR

ASHLEY DUDARENOK

Ashley Dudarenok is a recognized authority in China’s digital transformation, a serial entrepreneur, and a bestselling author. As the founder of ChoZan and Alarice, Ashley has dedicated over 15 years to helping global brands thrive in China by leveraging cutting-edge insights into digital marketing, technology, and consumer behavior.

Her accolades include being named a Thinkers50 Guru and one of the top 30 internet marketers globally by Global Gurus. Ashley has authored 11 books that delve into the rapid advancements in China’s social commerce, e-commerce, and consumer trends, providing actionable strategies for brands aiming to navigate the digital-first consumer behaviors that define the market.

Ashley’s expertise has informed strategies for renowned global brands such as Coca-Cola, Disney, and 3M. Her thought leadership has been featured in major media outlets, including BBC, Forbes, and Bloomberg. As a LinkedIn Top Voice, she shares daily insights with over 500,000 followers on topics ranging from digital innovation to the future of consumer engagement in China.

Through her leadership at ChoZan, Ashley continues to empower businesses with the tools and knowledge necessary to learn from China’s digital evolution and apply these insights to succeed in global markets. She has also played a pivotal role in creating the reports featured in this series, bringing together expert insights to provide businesses with the most current and actionable data on China’s rapidly changing landscape.

Trusted By Global Leaders

What Our Clients Say

Faq About China Main Reports

What is the China Report Series by ChoZan?

The China Report Series is a collection of comprehensive china economic reports that analyze the country’s rapidly evolving business, technology, and consumer landscapes. These China reports cover everything from digital commerce and consumer trends to innovation and market strategies, helping companies navigate China’s fast-changing economy.

Who can benefit from the China Report Series?

ChoZan’s China reports are designed for executives, strategists, marketers, and analysts across industries such as retail, e-commerce, fashion, technology, and consumer goods. Whether you want to enter the Chinese market or learn from its innovations, these reports provide valuable China business insights.

What is included in the China Mega Report?

The China Mega Report is a flagship China economic report with over 600 pages of data, 1,000 charts, and contributions from 50+ experts. It provides in-depth analysis of macroeconomic trends, digital innovation, consumer behavior, and China’s global influence. The 2025 edition is a 700-page annual resource that explores how economic recovery and technological advancements are reshaping China’s business landscape.

What consumer trends are covered in the China Consumer Reports?

The China Consumer Reports provide detailed China consumer insights into groups such as Gen Z, Super Mums and Dads, Pet Lovers, and Lower-Tier City consumers. Each report examines purchasing patterns, lifestyle preferences, and platform usage, allowing businesses to tailor strategies to China’s diverse and fast-changing consumer base.

What is the “Learn from China” report about?

The Learn from China reports showcase successful Chinese innovation cases, business models, and digital-first strategies. These China innovation reports highlight how global companies can apply lessons from China’s pioneering industries such as fashion, e-commerce, and social commerce to other international markets.

How do ChoZan’s reports help businesses succeed?

ChoZan’s china economic reports transform complex data into actionable strategies. By analyzing consumer behavior, industry shifts, and digital innovations, the reports enable companies to adapt quickly, capture new opportunities, and remain competitive in China’s dynamic market.

Can I download the reports for free?

Yes, ChoZan provides free china reports across multiple categories, including the China Mega Report, China Consumer Reports, and Learn from China reports. Each report is available for download on our website and offers rich data, expert commentary, and practical recommendations.

Why are ChoZan’s China reports unique?

Unlike generic market research, ChoZan’s china business reports are built on over 5 years of expertise, contributions from industry leaders, and direct insights into the world’s largest digital economy. They combine academic depth with practical strategies, ensuring relevance for decision-makers at all levels.

How often are the China reports updated?

ChoZan releases new China reports annually, with the flagship China Mega Report published every year. Specialized consumer and innovation reports are updated regularly to reflect the latest china market insights, digital trends, and evolving business practices.

How can I stay informed about future China reports?

You can subscribe to ChoZan’s bi-weekly China market insights newsletter, which reaches over 20,000 professionals worldwide. Subscribers receive updates on the latest China insights, consumer behavior studies, and digital innovation research.

How can I provide feedback or ask questions about the reports?

STAY CONNECTED

GET YOUR FREE CHINA REPORT

Download Expert Insights on China’s Market

Gain in-depth knowledge with ChoZan’s latest reports and books covering China’s digital trends,

consumer behavior, and tech innovation. Trusted by global brands, our publications turn

complexity into clarity.