In 2025, e-commerce companies in China continue to set the global benchmark for innovation, scale, and digital integration. Despite regulatory adjustments and broader economic shifts, the country’s online retail sector remains robust, powered by advanced platform ecosystems, AI-driven personalization, and the seamless fusion of entertainment with shopping. With over a billion internet users and rising digital activity in lower-tier cities, China’s e-commerce growth is accelerating in depth and reach.

Platforms like Taobao Live and Douyin routinely convert real-time engagement into high-volume transactions. AI-driven product recommendations and voice-enabled shopping are raising conversion rates across the board. Whether group buying on Pinduoduo or private domain traffic on WeChat Channels, Chinese platforms turn every scroll into a sales opportunity.

Key Takeaways

Here’s a brief overview of this article:

- China’s e-commerce growth in 2025: Platforms like Alibaba, JD.com, and Pinduoduo dominate a $3.45 trillion market, with livestream shopping and social commerce driving sales.

- Platform specializations: Alibaba leads with an integrated ecosystem; JD.com focuses on logistics and product authenticity; Pinduoduo emphasizes group buying and agriculture.

- Short-video commerce leaders: Douyin and Kuaishou convert influencer content into sales, while RedNote builds trust through authentic user-generated reviews.

- Emerging trends: AI-driven personalization, rural market penetration, and cross-border trade are key drivers shaping China’s retail landscape.

- Role of Meituan and Vipshop: Meituan leads local services and instant retail, while Vipshop dominates discounted branded goods.

- Expert guidance from ChoZan: Ashley Dudarenok’s team provides tailored research, strategy, and advisory services to help brands succeed in China’s fast-changing digital market.

Contact ChoZan to build your China e-commerce strategy.

Top 8 E-Commerce Companies in China 2025

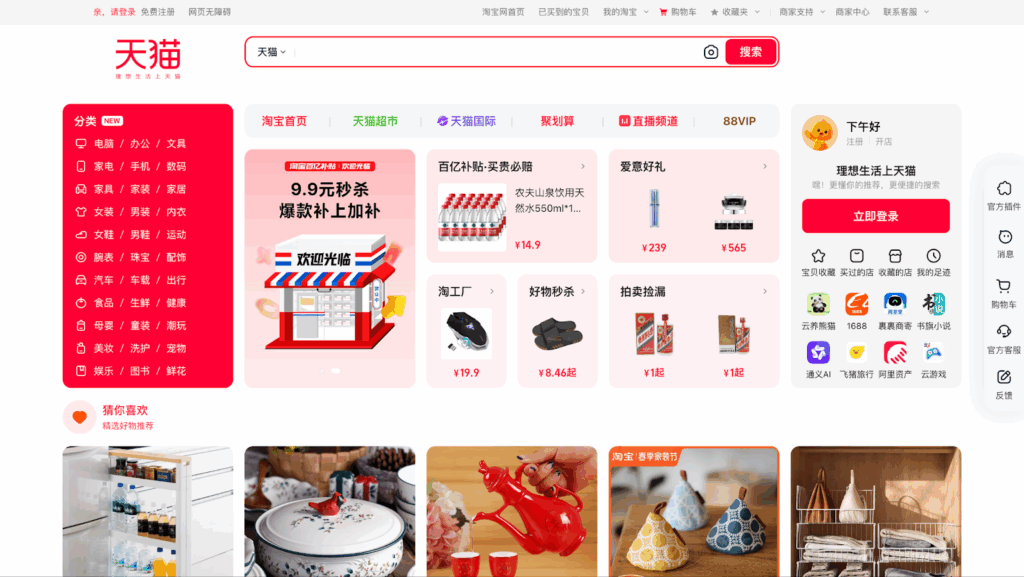

1. Taobao, Tmall, and 1688: Distinct Platforms with Shared E-Commerce Infrastructure in China

Largest E-commerce Companies in China. Photo from Tmall Official Website.

Thanks to its layered platform strategy, Alibaba remains at the center of China’s e-commerce universe in 2025.

- Taobao – A consumer-to-consumer (C2C) marketplace that also features social commerce elements. Through user reviews, short videos, and community deals, Taobao encourages interactive shopping. Its sibling app Taobao Deals and Taocaicai grocery service have gained traction in lower-tier cities. For example, Alibaba’s Taocaicai now covers about 40% of China’s townships and counties, reflecting the group’s push into rural areas.

- Tmall – A business-to-consumer (B2C) platform hosting brand storefronts. Tmall is the gateway for domestic and international brands (including Tmall Global for cross-border sales) to reach Chinese consumers, especially premium and well-known labels. Its more stringent entry requirements and reputational focus help assure quality.

- 1688.com – A domestic wholesale marketplace (B2B). Factories and suppliers list bulk goods for other businesses or individual buyers. It underpins Alibaba’s reach into China’s manufacturing belt and small retailers.

Competitive Edge of Alibaba’s E-Commerce Companies in China

Alibaba’s competitive advantage lies in its deep ecosystem and infrastructure. It owns leading services across the shopping journey. For example, Alibaba’s Affiliated payment system, Alipay, covers most digital transactions in China.

Its logistics arm, Cainiao, has built a massive delivery network domestically and globally. Cainiao now boasts a worldwide fulfillment network promising delivery anywhere on earth within about 5 days. This logistics muscle and a huge captive user base (estimated to be over a billion annual active customers) give Alibaba an unmatched scale.

Integrating services means a Taobao purchase, an Alipay payment, and delivery via Cainiao can all happen smoothly within the same corporate group. As one analyst puts it, Alibaba’s control of payments and shipping and its broad product ecosystem give it “ecosystem depth” that few rivals can match.

Strategic Shifts in 2025: AI, Personalization, and Rural Penetration

Alibaba has intensified its investment in AI across its platforms. Product recommendations, customer service chatbots, and search results now adjust in real time based on shopper intent and behavior. This has made browsing more efficient and improved conversion rates, especially in mobile shopping environments.

Meanwhile, Alibaba has pushed aggressively into rural markets and lower-tier cities, where consumer demand continues to grow. With localized logistics hubs and tailored promotional campaigns, Taobao and Tmall now serve millions of new customers who were previously underrepresented in digital commerce.

2. JD.com: Precision Retail Among Leading E-Commerce Companies in China

Largest E-commerce Companies in China. Photo from JD.com Official Website.

JD.com operates as both a retailer and a marketplace, a model that prioritizes product quality and delivery speed. In 2024, around 600 million users will engage with JD.com, which is drawn by verified goods and a dependable supply chain.

Unlike Alibaba’s marketplace model, JD primarily operates a direct retail model: it buys inventory from manufacturers, owns extensive warehouses, and handles logistics. This “inventory plus platform” approach means JD has end-to-end control, ensuring quick deliveries and guaranteed authentic products. JD also runs a marketplace for third-party sellers, but with strict vetting.

JD.com’s Strategic Focus in 2025: Automation and AI Integration in Chinese E-Commerce

In 2025, JD.com maintains its leadership in logistics innovation. Over 40 intelligent logistics hubs now feature AI-powered storage systems and autonomous robotics. The in-house forecasting model “TimeHF” has improved inventory accuracy by more than 10 percent, minimizing stockouts and excess stock. Autonomous delivery vehicles and drone pilots operate in pilot zones, setting a new standard for reach and efficiency.

Financial Strength and Marketplace Growth

The Q3 2024 earnings report highlights JD.com’s performance: RMB 260 billion in revenue—a 5 percent increase—and net margins around 5 percent. Notable growth in general merchandise (up 8 percent) indicates success beyond electronics.

JD.com continues opening its platform to third-party sellers. The “618” mid-year sales event broke records with over 2.2 billion orders, as multi-sector partnerships and rapid fulfillment reinforced omnichannel strengths.

Competitive Advantage: Trust, Speed, and Technological Depth

JD.com’s value lies in its vertical integration. Every transaction stage—from warehousing to doorstep delivery—is optimized internally, so consumers know they’ll receive authentic products quickly.

Brands gain access to advanced logistics and AI tools, smooth cross-border channels, and data-driven insights. This precision-driven ecosystem supports scalable, reliable experiences, which will remain JD.com’s advantage in 2025.

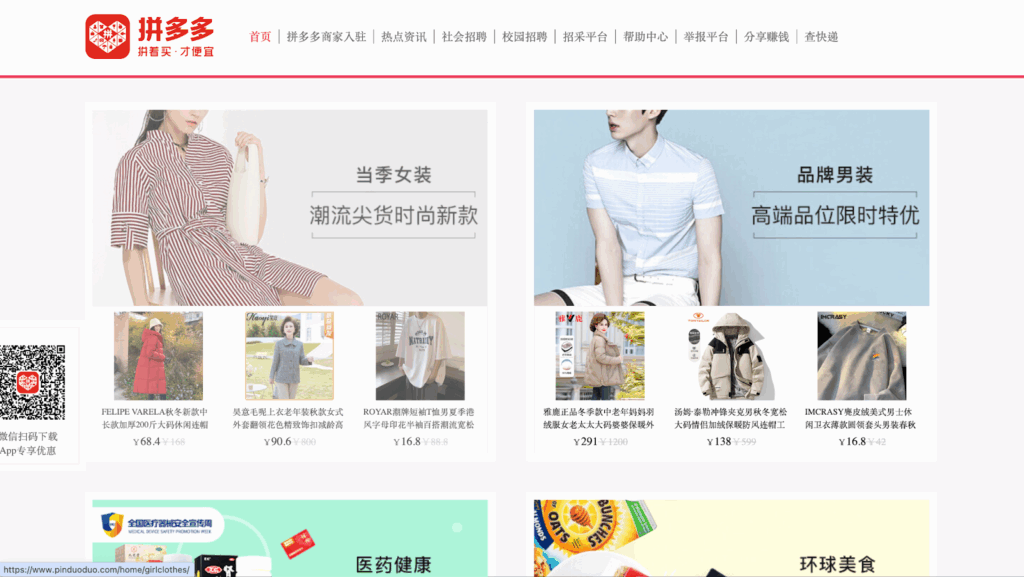

3. Pinduoduo (PDD): Social-Commerce Powerhouse in China’s E-Commerce Sector

Largest E-commerce Companies in China. Photo from Pinduoduo Official Website.

Pinduoduo’s defining feature is its group-buying approach. Users join together in teams to unlock lower prices. This model creates a viral loop that drives high-order volumes.

For example, the platform’s “team purchase” feature offers cheaper prices as more buyers join. Pinduoduo also introduced viral gamified features (like virtual farming games and price-cutting tasks) that keep users engaged.

This blend of deep discounts and social sharing allowed Pinduoduo to penetrate rural markets quickly; tens of millions of users in small cities flocked to its deals, boosting Pinduoduo into China’s top three e-commerce giants within a few years.

In Q3 2024, revenue topped RMB 99.4 billion, reflecting 44% year-over-year growth. Despite missing slightly below forecasts, net income increased by 61%, showcasing rising monetization through advertising and transaction services.

Agriculture as a Growth Driver for E-Commerce Companies in China

Based on its rural foothold, Pinduoduo has aggressively expanded into direct-to-farmer supply chains. The goal is to sell fresh produce and agricultural goods straight from farms to consumers, cutting out middlemen. In 2025, the company committed to this path with significant investments.

For example, in April 2025, Pinduoduo announced a RMB 100 billion support plan aimed at agricultural modernization:

- Funding research

- Tech adoption, and

- Farmer training.

This effort, in partnership with organizations like the UN’s FAO, will use Pinduoduo’s platform to boost yield and connect rural producers to markets.

In practice, Pinduoduo’s A2C projects include setting up local “science and technology courtyards” (smart farming stations) and integrating fresh produce sales into the app. These moves strengthen PDD’s position in the agricultural sector, turning it into a major marketplace for farm goods.

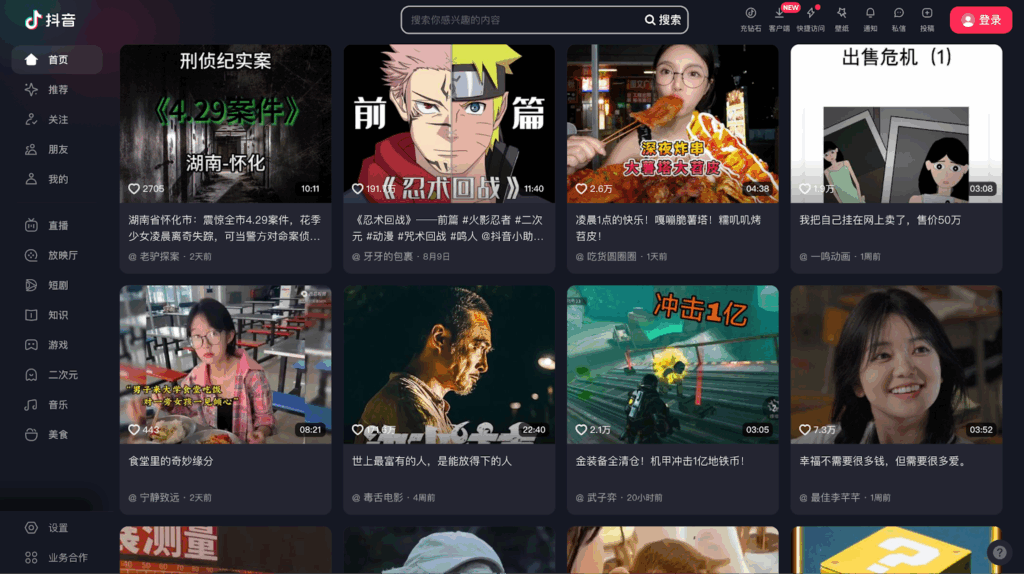

4. Douyin E-Commerce: Short Videos Turned High-Conversion Stores

Largest E-commerce Companies in China. Photo from Douyin Official Website.

Douyin is the Chinese version of TikTok, owned by ByteDance. Beyond short videos, Douyin has rapidly built a robust social commerce ecosystem. Douyin’s approach is seamless: users scroll through short videos and occasionally see product links or ads. They can click those to enter an in-app store without ever leaving Douyin.

Similarly, livestream sessions hosted by influencers allow viewers to buy featured items on the spot. All shopping (from discovery to checkout) happens natively.

- GMV Growth: Douyin’s commerce has surged. In 2024, it achieved about RMB 3.5 trillion (≈$483 billion) in gross merchandise value, jumping to the #3 spot nationally behind Alibaba’s Tmall and Pinduoduo. This rapid growth reflects how Douyin dominates categories driven by trends and spontaneity – cosmetics, fashion, gadgets, snacks, and anything “hyped.” Young consumers, in particular, discover new brands via viral videos.

- Livestream & Influencer Power: Douyin has become the go-to place for livestream shopping. By 2024, official merchant livestreams (hosted by brand-run accounts) accounted for the largest share of Douyin’s live commerce GMV. Douyin’s top KOLs (key opinion leaders) command massive followings and often sell out products in minutes.

Brand Strategy: Storefronts, Influencers, and Cross-Border Access

Global companies like P&G invest heavily in Douyin stores and influencer programs. Their Pantene live streams, featuring influencers like Ni Bi Yi, helped reverse sales declines and capture market share. Flagship brand stores and dedicated content teams reinforce credibility.

Cross-border brands can also launch via Douyin EC Global. That program supports overseas sellers through compliance, payment, and logistics, turning content into sales without needing a local presence.

By merging algorithmic targeting with rich creator content, Douyin builds trust, spreads reach, and drives measurable sales, making it the go-to platform for any brand seeking scale in China in 2025.

5. Kuaishou E-Commerce: Trust-Driven Shopping Beyond Big Cities

Kuaishou is another giant short-video app (Bytedance’s main rival) that has built a thriving commerce business. It’s often seen as the “other short-video economy,” distinguished by its grassroots vibe and deep penetration into China’s smaller cities and rural areas.

Livestream-First Commerce Model in China’s E-Commerce Market

Kuaishou’s e-commerce is heavily centered on livestream sales. Influencers (often everyday people rather than polished celebrities) regularly sell products in live broadcasts. Kuaishou pioneered this model even before Douyin scaled it up. The typical Kuaishou livestream feels personal and informal, resonating with shoppers in tier-2, tier-3, and rural communities.

Over 50% of Kuaishou’s users come from third-tier and lower areas. These users trust the Kuaishou “grassroots” hosts because they seem like neighbours or friends, which drives extremely high engagement. KOLs on Kuaishou tend to be “less polished” but build genuine relationships with followers, who often see them as relatable and trustworthy.

Content-Commerce Integration as a Core Strategy in Chinese E-Commerce

Kuaishou takes a distinct approach to e-commerce by placing everyday users—not brands—at the center of its strategy. Instead of relying on polished campaigns or celebrity endorsements, the platform builds its commerce model around short videos and live streams that feel spontaneous and relatable. These content formats are the primary purchase entry point, turning social interaction into sales.

Kuaishou’s model prioritizes authenticity. Creators build trust through real-time engagement, community storytelling, and unfiltered product showcases, making commerce feel like a natural content extension.

Expanding Merchants and Affordable Quality Products

Last year, the number of sellers in Kuaishou grew substantially—e-commerce operators increased 55%, and active merchants rose 68.5%. The platform targets price-sensitive shoppers by boosting the supply of goods under ¥50 and partnering directly with manufacturing hubs, making quality items affordable and accessible.

According to a recent industry report, during the 618 shopping festival 2024, Kuaishou’s non-livestream (shelf) sales jumped 75% year-on-year as the company pushed more catalog shopping and search.

In 2025, Kuaishou continues to leverage its tight-knit communities, making it a potent channel for brands targeting China’s vast, engaged rural and semi-urban population

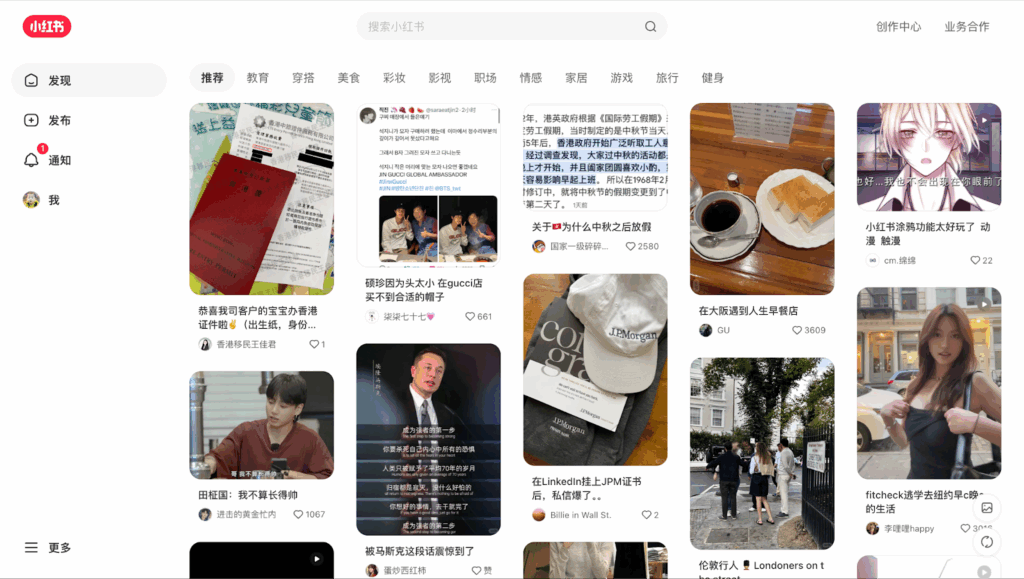

6. RedNote (RED): From Social Inspiration to Trusted E-Commerce Company in China

Largest E-commerce Companies in China. Photo from RedNote Official Website.

RedNote stands out by weaving together lifestyle content and commerce. The platform began as a space for sharing product reviews and now functions as a trusted source for beauty, fashion, and personal-care recommendations.

Categories like skincare, cosmetics, fashion, baby care, and health supplements thrive here – any item that benefits from personal testimonials and aspirational imagery.

While RedNote began as a social platform, it now has robust commerce features. The app has native “brand stores” and affiliate links. When browsing a post, readers often see a hyperlink or shopping cart icon that takes them straight to a product page or retailer (often Taobao or Tmall).

RedNote also supports its own direct-sales stores. Major brands (especially foreign labels) can set up official RED stores, allowing in-app purchases with integrated cross-border logistics.

Community-Driven Discovery in Social E-Commerce Companies in China

RedNote’s content is overwhelmingly user-generated. In 2024, it reached over 300 million monthly active users, about half of whom are Gen Z females in first- and second-tier cities. Users post detailed “Notes” with photos and reviews of products or lifestyle tips.

Other users browse these notes to find honest feedback before buying. Roughly 80 million people contribute content on RED, and over 90% of posts are UGC. This creates a strong culture of word-of-mouth and trust.

Luxury and premium brands value RedNote because it reaches affluent young consumers who want authentic peer opinions. Categories like skincare, cosmetics, fashion, baby care, and health supplements thrive here – any item that benefits from personal testimonials and aspirational imagery.

Rapid Merchant and Sales Growth

RedNote’s e-commerce arm experienced dynamic growth in 2024. New merchants increased by a factor of 8.1, while those generating over RMB 50 million in annual sales grew 4.6x.

Livestream sessions hosted by merchants surged 3.3x, and specific product categories—such as home furnishings and parent-child goods—saw GMV increases between 7x and 9x. This expansion reflects active monetization and rapid scaling in user engagement and revenue.

Livestreaming with Low-Pressure Tone

Though relatively new to live streaming, RedNote’s emphasis on conversational, low-key sales sets it apart from high-energy formats on rival apps. Influencers like Tera Feng moved over RMB 15,000 worth of luxury items and daily goods during quieter, trust-based live streams. Brands like L’Oréal and Coach are now opening official stores and partnering with influencers to blend narrative content with direct sales.

Looking Ahead: Triple-Digit GMV Growth and Global Interest

After the rise of “TikTok refugees,” the app became the most downloaded free app on Apple’s U.S. App Store. Despite censorship and moderation challenges, RedNote continues to evolve—from content-first inspiration to a credible e-commerce platform rooted in trust and depth.

7. Meituan: Local Commerce Giant Among Top E-Commerce Companies in China

Meituan is China’s dominant platform for local services, combining food delivery, in-store experiences, travel bookings, and on-demand retail. In 2024, it handled over 70 percent of China’s food delivery market and served over 650 million annual active users, showcasing scale and consumer trust.

Instant-Retail Strategy Among China’s Leading E-Commerce Companies

Meituan continues to deepen investment in instant retail, shifting focus from loss-making community group-buying units to profitable “flash buy” and “XiaoXiang Supermarket” models. In June 2025, expansion of instant-retail capabilities into tier-1 and tier-2 cities was announced — with flash-warehouse formats and optimized inventory logistics — while exits began in underperforming regions of Meituan Youxuan.

Profit Resurgence and Efficiency Gains

In Q1 2025, Meituan’s revenue climbed 18 percent year-on-year to RMB 86.6 billion, and net profit nearly doubled to RMB 10.06 billion. Core local commerce revenue rose 18 percent, while “new initiatives”—which include instant retail and cross-border delivery—grew 19 percent. Crucially, losses in those segments narrowed to RMB 2.3 billion.

Tech-Driven Expansion and Global Reach of Chinese E-Commerce Firms

Meituan invests heavily in AI, autonomous delivery drones, and data analytics. Its coupon-allocation algorithm reportedly services over 100 million users across 110 cities, generating an extra RMB 8 million annual profit. Unmanned aerial delivery and self-driving vehicles continue to roll out in major cities. Internationally, Meituan launched “Keeta” in Saudi Arabia and Hong Kong and confirmed plans to enter Brazil with a USD 1 billion investment.

Competitive Strength and 2025 Outlook

The company remains focused on operational efficiency and targeted growth, moving away from high-burn strategies toward sustainable profitability. Meituan’s agile expansion supports a “retail + tech” model that blends logistics innovation and high-frequency consumer engagement.

8. Vipshop (Vip.com): Discount E-Commerce in China with a Premium Focus

Vipshop is China’s leading discount e-commerce platform. Unlike the other giants, Vipshop’s niche is value fashion and lifestyle: it offers flash sales of branded apparel, cosmetics, home goods, and more at steep discounts. Its model is a “rolling outlet” – each day it features limited-time deals on certain brands.

Shoppers are drawn to deals in women’s and men’s apparel, beauty products, and home goods, all offered under strict time constraints to prompt purchases.

In 2024, Vipshop recorded RMB 108.4 billion (US$14.9 billion) in net revenue, a 4% decline from the previous year. Despite this dip, improved inventory turnover (16.48 in 2024 versus 14.4 in 2023) signaled better stock efficiency. Gross margins rose 23.5%, supported by a swing to higher-value apparel.

Vipshop’s target audience is the value-conscious consumer. Many shoppers on Vip.com are price-sensitive but still want branded goods. Regarding product mix, apparel (including sportswear and luxury fashion) accounts for around half of GMV. Cosmetics, skincare, and accessories are also popular. The site highlights international brands and seasonal products (e.g., cosmetics after Christmas).

Vipshop also leans on its SVIP membership program. It offers tiered discounts and early access to sales for members (and reported aiming for double-digit SVIP user growth in 2025). Loyalty programs help Vip retain customers even as margins are squeezed.

Path to Sustainable Profitability

Vipshop has taken significant steps to strengthen its core. It launched a dividend, repurchased shares, and focused on gross margin improvement in 2024.

The goal: reduce dependence on user volume by locking in high-value members and managing stock more efficiently.

In 2025, Vipshop continues to optimize this model by streamlining its mobile app, expanding private labels, and leveraging brand partnerships to keep a steady flow of clearance merchandise. Though it faces competition from fast-fashion newcomers and community group-buy platforms, Vipshop’s brand partnerships and discount focus let it maintain a solid niche among budget-minded but brand-aware consumers.

Need Expert Guidance on China’s E-Commerce Landscape?

Navigating China’s e-commerce ecosystem requires more than surface-level knowledge—it demands real expertise rooted in local platforms, consumer behaviors, and rapid market shifts. That’s where ChoZan comes in.

Founded by renowned China digital expert Ashley Dudarenok, ChoZan is a consultancy focused on helping global brands decode and succeed in China’s digital market. From livestream commerce to super app strategies, ChoZan bridges the knowledge gap for companies entering or expanding in the world’s most dynamic e-commerce environment.

With a proven track record serving top clients such as Coca-Cola, L’Oréal, Shiseido, and Johnson & Johnson, ChoZan offers high-impact research, market strategy, and advisory solutions tailored to China’s ever-changing platforms—including Douyin, Tmall, Xiaohongshu, and WeChat.

Need Expert Guidance on China’s E-Commerce Landscape?

If China’s digital ecosystem feels overwhelming, Ashley Dudarenok offers direct, actionable insights through consulting and speaking sessions designed for speed and clarity.

- Book a 30- or 60-minute strategy session with Ashley for targeted advice on your specific challenge

- Tap into custom research on platforms, trends, and consumer shifts

- Invite Ashley to speak at your next leadership offsite or event

- Access ChoZan’s China Insights Library for ongoing updates and trend reports

Ready to accelerate your China e-commerce strategy? Book a session and learn more

Largest E-Commerce Companies in China – Frequently Asked Questions (FAQs)

Alibaba, JD.com, and Pinduoduo are China’s top e-commerce players. Their platforms—like Taobao, Tmall, and JD Mall—handle billions in transactions annually and shape how consumers across urban and rural areas shop, pay, and receive goods in record time.

China leads the world in e-commerce, with a market valued at $3.45 trillion. It surpasses all other countries’ sales volume, mobile commerce penetration, and platform innovation, making it the most mature and competitive e-commerce environment globally.

JD.com and Alibaba are Amazon’s main competitors in China. JD offers an Amazon-like model with its inventory and logistics, while Alibaba runs massive marketplaces like Tmall and Taobao, connecting third-party sellers with hundreds of millions of users.

China’s e-commerce system combines marketplaces, direct retail, livestream shopping, and mobile payments. Platforms like Taobao, JD, and Douyin integrate content, logistics, and checkout in one seamless user journey, creating a fast, mobile-first shopping experience powered by data and personalization.

China’s e-commerce thrives due to mobile-first habits, fast delivery networks, digital wallets, and livestream commerce. Platforms combine entertainment and shopping, while user trust in social recommendations fuels higher engagement. This makes the buying process fast, intuitive, and deeply integrated into daily life.

Top platforms invest in AI, streamline logistics, and expand into rural areas. They partner with influencers, run flash sales, and use data to personalize experiences. These strategies help drive loyalty, improve speed, and maintain an edge in a highly saturated market.

Most consumers shop through mobile apps, discover products via short videos and livestreams, and pay with digital wallets like Alipay. They rely on social proof, reviews, and influencer content to make informed decisions and expect fast, traceable delivery with every purchase.

Technology powers every layer—from AI-based product recommendations and chatbot support to autonomous delivery and cross-border logistics. Chinese platforms use big data and automation to reduce costs, personalize shopping, and create seamless end-to-end consumer experiences.

Chozan provides comprehensive resources, including consulting, industry reports, and webinars, to help businesses understand and leverage the power of China’s largest e-commerce platforms, such as Alibaba, JD.com, and Pinduoduo.