China Mega Report 2020

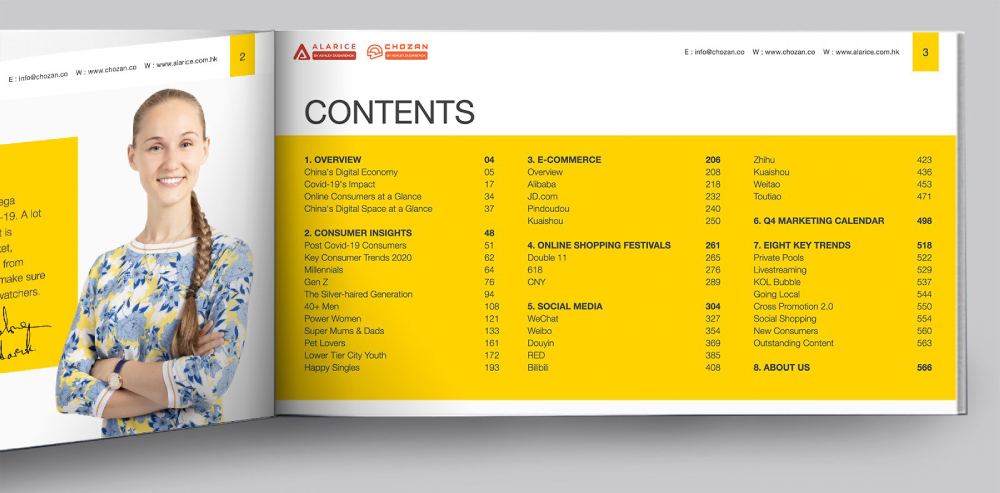

The China Mega Report 2020 kicks off ChoZan’s series of quarterly reports that delve into China’s rapidly evolving e-commerce and digital marketing landscape. In the wake of the Covid-19 pandemic, technology adoption has skyrocketed, transforming how Chinese consumers engage with digital platforms. Livestreaming, e-commerce, and new digital features have reshaped the consumer experience, propelling China into an increasingly digital-first market.

The COVID-19 outbreak has not only reshaped consumer behaviors but has also acted as a catalyst for technological development. With the rapid rise of e-commerce, livestreaming, and new digital marketing functionalities, China’s digital space has undergone a transformation, making consumers embrace a more digital-first lifestyle. New consumer groups, especially those shaped by these shifts, have emerged as key players.

This comprehensive 580+ page report combines real-time data, social listening, and deep insights from ChoZan’s surveys over the last six months. It examines nine critical consumer groups, offering a detailed analysis of their evolving shopping behaviors, preferences, and motivations. Understanding these emerging trends will equip businesses with the necessary knowledge to stay competitive and thrive in China’s rapidly evolving digital marketplace.

China Mega Report 2020?

What Will You Gain In This China Mega Report?

By downloading the 580+ page China Mega Report 2020, you will gain:

China’s Economic Recovery and Growth: The rapid recovery of China’s economy from the pandemic, along with new regulations and policies such as the Dual Circulation Strategy, which will drive sustained growth.

The Digital Economy: Insights into how the digital economy, particularly e-commerce, is outpacing overall economic growth, with a focus on government support for 5G rollout and the continued expansion of digital platforms.

Emerging Consumer Groups: Analyzing nine key consumer groups shaping China’s marketplace, including Millennials, Gen Z, Super Moms, Pet Lovers, and Lower Tier City Youth, with a focus on shifting consumer preferences and demands post-COVID-19.

Livestreaming and E-Commerce Trends: An in-depth look at how e-commerce and livestreaming are dominating the digital retail space in China, alongside major updates from leading platforms like Tmall, JD, and Pinduoduo.

Key Consumption Economies: Understanding the latest

consumption trends in sectors like FMCG, luxury goods, and F&B.

Regulatory Updates: Key updates on China’s new market regulations, focusing on data privacy, digital payments, and e-commerce functionalities.

READY FOR ACTIONABLE CHINA INSIGHTS?

Don’t miss out on the crucial China insights you need to succeed. Subscribe to Ashley Dudarenok’s free, bi-weekly China Newsletter today and stay ahead of the curve.

Key Highlights Of The China Mega Report 2020

Part 1: Exponential Growth In China’s Digital Economy

Moving forward, digital platforms are expected to further enhance their capabilities to cater to increasingly sophisticated consumer needs. Innovations in mobile commerce and the rise of AI-powered shopping experiences are set to make China’s digital space even more competitive. Brands will need to stay agile, integrating new technologies to meet consumer expectations and continue growing their digital presence in this rapidly evolving market.

PART 2: COVID CONSUMER SHIFTS AND NEW BEHAVIORS

Part 3: Dual Circulation Strategy: Shaping Domestic Growth

Part 4: Livestreaming: The Future Of Shopping In China

Part 5: Cross-border E-commerce: New Frontiers For Global Brands

Part 6: E-commerce Platforms – Key Insights And Future Outlook

About The Authors:

Ashley Dudarenok

Editorial Team

Ashley

Founder of ChoZan & Alarice

Mason

Project Director

Jacqueline

Project Director

Natalia

Marketing Director

Maureen

Executive Editor

Wendy

Head of Digital Products

Stephanie

Graphic and Videography

SYCA

Head of Research and Strategy

What Do We Do?

At ChoZan, our mission is to illuminate the intricacies of China’s digital economy, particularly through our flagship publication, the China Mega Report. This comprehensive annual report serves as an essential resource for businesses aiming to understand and navigate the rapidly changing e-commerce landscape in China.

COMPREHENSIVE MARKET ANALYSIS

We delve deeply into the dynamics shaping consumer behavior and market trends, providing data-driven insights that empower brands to make informed strategic decisions. Our research encompasses a variety of sectors, including FMCG, luxury goods, and technology, ensuring that businesses have a well-rounded understanding of the market.

TAILORED INSIGHTS FOR GLOBAL BRANDS

Through the China Mega Report, we offer tailored insights that address the unique challenges faced by global brands entering or expanding within the Chinese market. Our analysis includes emerging consumer groups and evolving shopping behaviors, equipping companies with the knowledge needed to adapt and thrive.

STRATEGIC CONSULTATION

In addition to our report, we provide expert consultations to help businesses interpret the findings and implement effective strategies based on the latest trends. Our team works closely with clients to ensure they can leverage the insights from the report for maximum impact.

About The Contributors

Ella Kidron

Global Corporate Affairs, JD

Shaun Rein

Founder of China Market Research Group

Chloe Goncalves

Senior Business Development Manager at Tmall Global - Alibaba group

Elijah Whaley

Chief Marketing Officer PARKLU

Michael Zakkour

Founder – 5 New Digital and China BrightStar

Ada Yang

Head of Social Community, Pinduoduo

Pablo Mauron

Partner & Managing Director China DLG (Digital Luxury Group)

Qimei Luo

Livestreaming Industry Marketer and PR expert

Edward Tse

Founder & CEO, Gao Feng Advisory Company

Jerry Clode

Founder, The Solution Consultancy

Edith Yeung

General Partner at Race Capital

Michael Norris

Research and Strategy Manager, AgencyChina

Clement Ledormeur

GM & Partner at 31TEN

Elena Gatti

Managing Director Europe, Azoya

Alex Duncan

Co-founder of KAWO

Folke Engholm

CEO of Viral Access

Josh Gardner

CEO KUNG FU DATA

Dr. Gang Lu

Founder of TechNode

Fabian Bern Ouwehand

CEO & Founder, MANY

Arnold Ma

Founder and CEO, Qumin

David Thomas

China Expert and Author of China Bitesc

Matthieu David-experton

CEO and President at Daxue Consulting

Thomas Graziani

Co-founder, WalktheChat

Aaron Chang

CEO and Founder, JING digital

Pascal Coppens

Partner at Nexxworks, author of China's New Normal

Olivia Plotnick

WeChat and China Marketing Specialist

Andy Mok

CGTN Tech and Geopolitics Commentator Senior Research Fellow, Center for China and Globalization

Chris Baker

FOUNDER TOTEM MEDIA

Martina Fuchs

TV Anchor & Business Journalist

Jons Slemmer

ChemLinked Market Research Analyst

Hendrik Laubscher

Founder and Chief Analyst at Blue Cape Venture

Michelle Castillo

Director of Content and Insights

Artem Zhdanov

Founder of LaowaiMe

Nishtha Mehta

Founder of CollabCentral

Jan Smejkal

Founder, YCG&C

Jimmy Robinson

Co-Founder and Director, PingPong Digital

Alberto Antinucci

Digital Innovation Strategist and China Expert

WILLIAM AUGUST

Founder, Outlandish Studio

Rachel Daydou

Partner & China General Manager, Fabernovel

Bo Ji

Assistant Dean, Chief Representative of Europe, Cheung Kong Graduate School of Business

Romain Henriot

Chief Operations Office, Splio China

Olivier Verot

Founder of GMA (Gentlemen Marketing Agency

Ben Cavender

Managing Director, China Market Research Group

William Bao Bean

General Partner SOSV MD Chinaccelerator and MOX

David Gulasi

CEO of davegulasi.com and China KOL

Sean

China Market Research, ChoZan

Beverly

Senior Digital Marketing Executive, ChoZan

Stella

Social Media Marketing Manager, ChoZan

GET YOUR FREE CHINA REPORT

Download ChoZan’s China Mega Report 2020 and gain crucial insights into the future of China’s e-commerce and digital marketing. Stay ahead of the curve with expert opinions, key consumer trends, and actionable data to help you succeed in China’s fast-evolving digital landscape.

Faq About China Mega Report 2020

What makes the China Mega Report 2020 unique?

The China Mega Report 2020 is ChoZan’s first comprehensive, forward-looking report, designed to give businesses deep insights into the rapidly evolving Chinese e-commerce and digital marketing landscape. Unlike traditional reports, this edition places a strong focus on the transformative effects of the COVID-19 pandemic on consumer behavior, technological advancements, and the rise of new consumer segments. It offers a data-driven, real-time analysis to help businesses navigate these changes and seize emerging opportunities in China’s digital space.

What are the key trends in China covered in the China Mega Report 2020?

The China Mega Report 2020 covers pivotal trends, including the boom of livestreaming commerce, the explosive growth of e-commerce platforms, and the rise of new consumer groups like Gen Z and medical beauty enthusiasts. It also explores shifts in consumer purchasing behavior due to COVID-19, such as increased demand for wellness and luxury goods. Additionally, the report highlights China’s rapid digital transformation, with increasing reliance on mobile payments and digital wallets, making digital commerce more integrated into daily life.

How can the China Mega Report 2020 benefit my business?

The China Mega Report 2020 offers businesses critical insights into consumer behavior shifts, digital trends, and emerging technologies in the Chinese market. By understanding the new consumption patterns and adapting to the ongoing changes in e-commerce and digital marketing, businesses can optimize their strategies and enhance their ability to succeed in the highly competitive Chinese market. The report also provides valuable guidance on how to navigate the evolving regulatory landscape.

How often is the China Mega Report published?

The China Mega Report is published annually, with updated insights each year to reflect the latest market trends, regulatory changes, and consumer behavior data. ChoZan also releases yearly or smaller focused reports throughout the year to keep businesses updated on specific sectors, technologies, and developments that impact the Chinese market.

What consumer trends are highlighted in the China Mega Report 2020?

The China Mega Report 2020 highlights key consumer trends such as the surge in demand for health and wellness products, the growth of medical beauty services, and the increasing consumption of luxury goods. It also covers the evolving behaviors of younger generations like Gen Z, who are shaping the future of e-commerce with their digital-first approach and preferences for personalized and immersive experiences. The rise of livestreaming commerce and increased engagement with social media platforms also plays a crucial role in consumer decision-making.

How can I stay updated with future reports and insights from ChoZan?

To stay informed about future reports and gain exclusive insights into China’s evolving market, subscribe to ChoZan’s newsletter. Subscribers will receive regular updates on China’s digital transformation, emerging consumer trends, and key industry developments, ensuring they stay ahead of the competition and can act on the latest information.

How can I provide feedback or report an error in the China Mega Report 2020?

If you find any errors or have feedback about the China Mega Report 2020, please reach out to ChoZan at info@chozan.co. We value your input and aim to ensure the highest quality and accuracy in all our reports. Your feedback helps us continuously improve and provide the most valuable insights.

Is the China Mega Report 2020 available for free?

Yes, the China Mega Report 2020 is available for free download. ChoZan provides this report at no cost to ensure businesses of all sizes can access critical insights and stay informed about the rapidly changing digital landscape in China.

How can the China Mega Report 2020 help my business in China?

The China Mega Report 2020 provides businesses with the knowledge and tools needed to succeed in the fast-evolving Chinese market. With insights into consumer behavior shifts, emerging digital trends, and market dynamics, businesses can refine their strategies, engage more effectively with Chinese consumers, and stay competitive in the ever-changing digital space. The report helps brands navigate challenges and capitalize on the opportunities created by China’s digital transformation.

GET YOUR FREE CHINA REPORT

More Reports From Chozan

FASHION CHINA:

35 INDEPENDENT DESIGNERS

SHAPING THE FUTURE

THE RISE OF SOCIAL COMMERCE:

BUILDING THE FUTURE OF RETAIL

IN CHINA

CHINA TOURISM REPORT:

HOW TO WIN WITH CHINESE

TOURISTS

LOWER-TIER CITIES:

CHINA’S NEXT CONSUMPTION

POWERHOUSE

CHINA MEGA REPORT 2024:

E-COMMERCE, MARKETING, AND

THE DIGITAL FRONTIER

GEN Z UNVEILED:

UNDERSTANDING CHINA’S NEXT

WAVE OF CONSUMERS