CONTENT

By: Ashley Dudarenok

Updated:

China’s digital commerce is surging ahead of the rest of the world. In 2024, online retail sales surpassed US$3 trillion, driven by over 1.1 billion internet users. Mobile payments have become an integral part of daily life, with more than 600 million consumers now shopping directly through live streams.

This shift has created a “shoppertainment” economy, where discovery, entertainment, and instant purchases blend seamlessly. The social media landscape is evolving into an entertainment–commerce hybrid; 71% of people watching short-video livestreams make purchases, and the audience for micro-dramas (mini-series produced for short-video apps) has reached 662 million viewers.

These figures illustrate why mobile apps are the primary channels for shopping, beauty, and entertainment in China. The following six apps represent the platforms every marketer and consumer should know in 2025-26.

China’s selfie‑obsessed culture and rapid adoption of augmented reality have created a lucrative market for beauty camera apps. A global industry report estimates that the market was valued at about US $2.1 billion in 2023 and could exceed US $4.5 billion by 2032, reflecting a compound annual growth rate of about 8 %.

Asia‑Pacific is the largest contributor because of the region’s high smartphone penetration and obsession with curated social profiles. Chinese developers dominate this space with sophisticated AI algorithms that smooth skin, apply virtual makeup, and even swap outfits.

These features make beauty apps more than vanity tools; they provide e‑commerce gateways where brands can sell cosmetics and clothing through virtual try‑ons.

Overview. BeautyCam (美颜相机) is the flagship selfie editor from Meitu Inc., a publicly listed company that also offers the broader Meitu app. Both apps use deep learning models to detect facial landmarks and apply real-time beautification.

Their latest versions go beyond simple filters: users can apply digital makeup, reshape facial contours, remove blemishes, and even generate professional headshots or “yearbook” photos with a single tap.

In 2024, the company launched AI Hairstyle and AI Wardrobe features. AI Hairstyle maps the user’s hair and virtually applies different cuts or colors. AI Wardrobe segments the body and overlays 3D clothing models, turning the app into a virtual fitting room. Meitu’s generative tools also include AI Art (convert photos into stylized portraits) and AI Clothes Colors for designers.

Meitu’s financial reporting offers rare transparency into the scale of beauty camera use. The company’s 2024 annual results (released March 18, 2025) show that Meitu’s ecosystem had 266 million monthly active users (MAUs), up 6.7 % year‑over‑year. 94.51 million of these MAUs were outside mainland China, reflecting a strong international footprint and a year-over-year growth rate of 21.7%.

Paid subscriptions are a significant revenue stream: By December 2024, Meitu recorded 12.61 million paying subscribers, representing a 38% increase from the previous year.

In the first half of 2025, Meitu reported that its global MAUs reached 280 million, with 98 million outside mainland China, and it had 15.4 million paying subscribers. The company notes that BeautyCam and Meitu have consistently led China’s photo-beautification category.

BeautyCam and the Meitu app rely on a proprietary AI imaging engine. After detecting facial landmarks, the software applies real-time smoothing, eye enlargement, teeth whitening, and other retouching techniques. Advanced functions include:

Subscription packages unlock HD exports, ad‑free usage, exclusive filters, and the full range of AI tools. For brands, Meitu offers beauty industry solutions that enable cosmetics companies to host virtual makeup counters within the app.

Meitu’s results demonstrate how AI-driven imaging can serve both as a consumer service and a profitable business. In 2024, the company’s imaging and design products segment generated 2.09 billion CNY, accounting for 62.4 % of total revenue.

The explosion of AI Wardrobe demonstrates that digital fashion has transitioned from novelty to mainstream; top Google and Baidu search queries include “BeautyCam AI Wardrobe” and “Meitu AI Hairstyle,” as users seek to preview looks before purchasing clothes or visiting a salon.

For marketers, collaborating on branded filters or virtual garments can expose their work to millions of beauty enthusiasts.

Overview. Taobao is Alibaba’s flagship shopping app built around content-led discovery, live shopping, and increasingly, short-form drama that links directly to product pages. The app has leaned hard into “watch, chat, buy” journeys and faster fulfillment, while rolling out AI to improve search, pricing, and merchant content.

Alibaba has more closely tied Taobao to creator content and instant retail. Two key moves stand out: a formal content partnership with RedNote (Xiaohongshu) that directs “inspiration-to-purchase” traffic to Taobao, and a push into one-hour delivery via Ele.me and “instant retail” channels for everyday categories. Both are aimed at winning low-price and speed-of-delivery battles without sacrificing engagement.

Overview. CapCut is ByteDance’s AI-powered video and graphic editing platform, available on mobile devices, desktops, and browsers. First released in China as JianYing (剪映) in 2019 and rebranded internationally in 2020, CapCut has expanded to include iOS, Android, Windows, Mac, and web browsers.

Updated versions launched after 2024 feature smart tools such as script-to-video, auto captions, video upscaling, and interactive long-to-short conversions, making creation both fast and polished. It caters to creators of all levels, offering seamless export to TikTok, Instagram, YouTube, and more.

In January 2025, CapCut crossed 1 billion downloads on the Google Play Store. The app ranked among the most popular on both Google Play and the App Store in 2025. Tech media ranks CapCut as the best free video editing app for social media creators in 2025, praising its AI-powered features, such as background removal and auto-captioning.

Since 2024, CapCut’s AI toolkit has expanded significantly:

For creators and marketers, CapCut is a one-stop content creation powerhouse that combines ease of use with sophistication. Its AI tools save time and deliver high-impact visuals, while built-in platform compatibility streamlines the workflow from editing to social posting. This makes it not just a tool but a launchpad for viral storytelling.

Douyin, known internationally as TikTok’s Chinese counterpart, has rapidly evolved from a short-video app into an integrated e-commerce ecosystem. The platform launched in September 2016 and quickly filled a market gap.

The demographics skew young: approximately 65% of Douyin users are under 35, and 54%are male. Douyin’s reach is also expanding beyond China’s biggest cities; the app now attracts users from tier 2 and tier 3 cities, diversifying the types of content and influencers on the platform.

These users are not just browsing; they are shopping. The same report states that approximately 480 million Chinese consumers actively purchased through Douyin’s e‑commerce features during the Double 11 shopping festival.

This purchasing base helped Douyin’s gross merchandise value (GMV) surge 33.5% in 2024 to US$509 billion, making it the third-largest marketplace worldwide after Amazon and Pinduoduo. Douyin’s success contrasts with the slowing growth of traditional platforms—Taobao, JD.com, and Tmall saw less than 1 % GMV growth in 2024

Notably, it’s not just the youth; senior influencers are gaining millions of followers, demonstrating the app’s broad cultural appeal.

Beauty brands can no longer ignore Douyin. It alone hosts around 600 million daily active users who watch livestreams and short videos featuring product demonstrations and tutorials. Many global beauty brands run livestream events and maintain in‑app flagship stores to tap into this massive user base.

Douyin has become central to beauty marketing because it makes shopping entertaining and friction‑free.

Key features include:

These features create a seamless “watch, want, buy” loop. Instead of actively searching for a product, users discover it while watching short videos. This content-driven shopping model is particularly effective for beauty items, as consumers can view real-time demonstrations and read honest reviews before making a purchase.

For beauty consumers, shopping on Douyin is intuitive:

However, brands should budget carefully because high ad costs can erode profits. For shoppers, this means that deals and promotions are abundant, but they should still compare prices across platforms before making a purchase.

Douyin demonstrates how a content platform can evolve into an e-commerce titan. Its short‑video format keeps users engaged (average daily usage exceeds 2 hours), while the recommendation engine ensures product promotions reach relevant audiences.

Overview. Launched in 2015 by former Google engineer Colin Huang, Pinduoduo pioneered social group buying in China. Users form teams with friends or other shoppers to buy products at discounted prices, with deeper discounts unlocked as more participants join.

The platform also operates a C2M (consumer‑to‑manufacturer) model, connecting factories directly with consumers to reduce middleman costs. Another distinctive feature is its focus on agricultural products; Pinduoduo invests heavily in connecting farmers with urban buyers.

Data shows that Pinduoduo’s monthly active users reached about 720 million in November 2024. Pinduoduo’s user base skews toward price‑sensitive consumers in lower‑tier cities.

Although precise spending numbers for 2024‑2025 are scarce, Pinduoduo’s GMV is large enough to place it among the top two marketplaces globally, and it remains the largest platform for agricultural products.

Pinduoduo challenges the assumption that e‑commerce growth must come from big cities. By tapping into social networks and group psychology, it attracts price‑sensitive consumers who might otherwise shop offline.

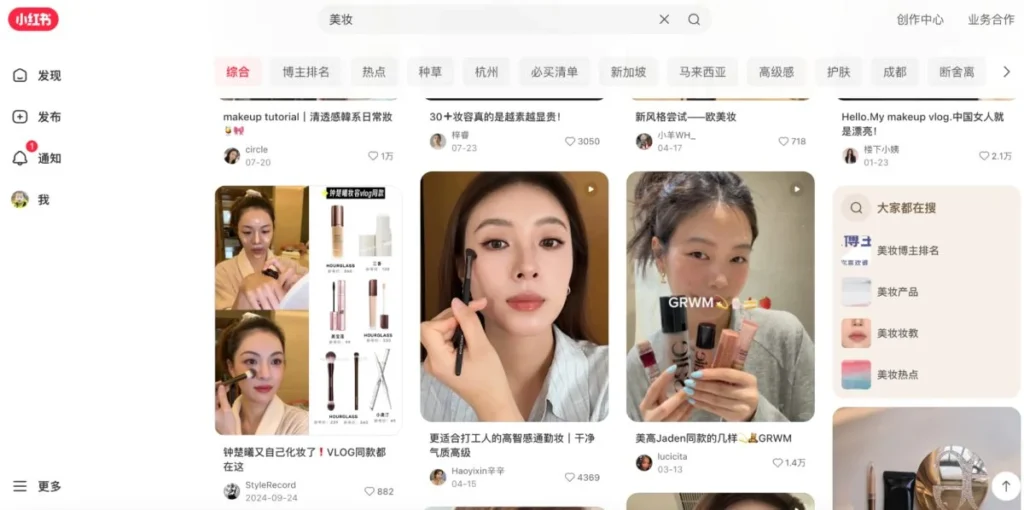

Overview. RedNote—literally “Little Red Book,” often branded internationally as RED—is a hybrid of Instagram, Pinterest, and Amazon. Users (called “notes writers”) post pictures, videos, and product reviews in categories like beauty, fashion, travel, and food.

Each post can include product tags that lead directly to purchase pages. The platform positions itself as a lifestyle community first and a marketplace second, curating high‑quality brands and user‑generated advice.

A January report notes that RedNote had roughly 300 million monthly active users, with about 79 % of the user base being women. The same report states that the company raised approximately US $917 million in venture funding and was valued at around US $17 billion following a secondary share sale in 2024. Xiaohongshu is profitable, with the article projecting over US$1 billion in profit for 2024.

TMO Group’s 2025 e‑commerce ranking adds that as of mid‑2024, RedNote’s MAU reached 320 million, and daily active users were around 120 million, indicating rapid growth.

The platform appeals to Chinese millennials and Gen Z who seek authentic recommendations over hard sells. Its predominantly female user base gives it disproportionate influence in the beauty and fashion sectors.

China’s app ecosystem is where AI try-ons, livestream commerce, and social group-buying set global benchmarks. To capture growth on platforms like BeautyCam, YouCam, Douyin, Pinduoduo, and RedNote, you need more than translations—you need strategic, data-backed execution.

ChoZan provides exactly that:

If your goal is to turn AI-powered beauty apps and shoppertainment platforms into growth channels, ChoZan is the partner that can provide you with insights, foresight, and access to the people shaping these apps today.

Chinese shopping apps merge entertainment with commerce. Instead of searching for a product, users discover it through live shows, gamified tasks, or influencer tutorials.

Checkout is built into the content, making purchases instant. This integration of discovery, trust-building, and payment sets them apart from platforms like Amazon, which still separate browsing from buying.

Trust comes from transparency and community. Shoppers rely on authentic reviews, before-and-after photos, and real-time influencer demonstrations.

Counterfeit prevention systems, community guidelines, and strict seller vetting reinforce credibility. The personal feel of live interaction gives buyers more confidence than reading static product descriptions on traditional e-commerce sites.

Short videos let consumers see how products look in real life, not just in professional marketing photos. When peers or influencers demonstrate beauty items, skincare routines, and fashion outfits, they become tangible.

The quick, snackable format keeps attention high, while embedded purchase links let viewers act immediately without switching apps.

KOCs are everyday shoppers who share personal product experiences online. Unlike celebrity influencers, they typically have small followings but stronger credibility. Their reviews feel authentic, which makes them powerful in converting undecided buyers.

Many beauty brands actively seed products to KOCs, knowing their grassroots influence drives higher trust than polished ad campaigns.

Impulse buying is often driven by feelings of urgency and scarcity. Flash deals, countdown timers, limited-time coupons, and exclusive livestream discounts push users to act quickly.

Many apps also gamify shopping with rewards, coins, or points for every action. This combination of entertainment and urgency creates a powerful psychological trigger to make an instant purchase.

Yes, but success depends on compliance. China’s regulators closely monitor advertising, product labeling, and cross-border sales. International brands must ensure their products meet local standards.

Partnering with licensed distributors, securing logistics through bonded warehouses, and adopting local payment methods help brands avoid legal risks while earning consumer confidence.

Alipay and WeChat Pay remain the top digital wallets, covering nearly all online purchases. Douyin Pay and Pinduoduo Pay are growing as in-app solutions. These systems enable one-tap payments linked to bank cards or wallets, making checkout frictionless.

For cross-border shopping, bonded warehouse systems simplify customs and payment processing for international users.

Hosts mix entertainment with expertise. They demonstrate products, compare shades, answer live questions, and create a sense of urgency with time-limited discounts.

The interactive nature mimics a personal consultation, but on a larger scale. Popular hosts often sell out products within minutes, which is why brands invest heavily in livestream partnerships to reach their target buyers.

Yes. Rural users often prioritize affordability and practicality above all else. Platforms like Pinduoduo thrive here, particularly through group buying and the sale of agricultural products.

Promotions and bundles usually influence beauty purchases. Unlike urban consumers who chase luxury trends, rural buyers lean toward essentials with high perceived value and competitive pricing.

The Personal Information Protection Law (PIPL) governs how apps collect, store, and use personal data. Companies must obtain consent before tracking or using biometric data, such as facial scans.

Beauty apps that utilize AI for skin analysis must clearly disclose their methods. Non-compliance can lead to fines or removal from app stores.

In China, word of mouth has been amplified by digital platforms. Shoppers trust peer experiences because they feel unbiased and relatable.

Online communities like RedNote thrive because users value social proof over corporate messaging. A single well-written product review can influence thousands, showing how community trust outweighs traditional brand advertising.

Gamification keeps users engaged between purchases. Apps reward participation with points, badges, or virtual goods redeemable for discounts.

For example, daily check-ins or fruit-tree games keep buyers active. This constant interaction builds habits, ensuring users return frequently. It transforms shopping from a task into a daily digital ritual.

Platforms have implemented strict merchant verification, AI-powered product recognition, and consumer complaint systems. RedNote, for example, vets merchants before allowing them to list. Douyin and Pinduoduo ban sellers caught distributing fakes.

Compensation policies guarantee refunds when counterfeit goods slip through. This accountability reassures users that the marketplace values quality and authenticity.

Gen Z shoppers seek self-expression. Instead of buying based solely on function, they value products that align with their identity, aesthetics, and social image.

They are early adopters of AR try-ons, experimental cosmetics, and trendy packaging. They are also vocal online, sharing opinions that influence broader communities and brand reputations.

Many executives join China learning programs that take them into live studios, app headquarters, and retail labs. These immersive trips reveal how Chinese platforms integrate AI, content, and commerce.

Beyond reading reports, meeting the product managers and creators firsthand provides unmatched insights that brands can adapt globally with confidence.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

WeChat VS Weixin, an Essential Guide for Marketers

5 Chinese Fashion Bloggers (KOLs) You Must Know in 2025

7 Digital Lifestyles of Chinese Gen Z Consumers

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.