CONTENT

By: Ashley Dudarenok

Updated:

Mainland China blocks Pinterest, so designers and influencers turn to local and global platforms for visual inspiration. In recent years, a handful of apps and websites have become go-to sources for creative imagery in China. These include lifestyle and social platforms, designer communities, and free image libraries. Each offers its spin on “pinning” ideas. The top 8 photo-sharing alternatives to Pinterest in China that we cover are:

They all serve designers and marketers by letting users discover, save, and share pictures and ideas. Below, we explain how each works and why it’s useful as a Pinterest substitute in 2025-26.

A true Pinterest alternative in China is not just a photo-sharing app. It is a platform where visual discovery connects directly to action—whether that means making a purchase, visiting a store, or planning a trip. To understand how Chinese users approach visual platforms in 2025, it helps to break down the key criteria.

Taken together, these factors demonstrate why no single app can be considered “the Chinese Pinterest.” Instead, multiple platforms replicate and extend Pinterest-like functions, each optimized for different consumer behaviors—from lifestyle discovery on RED to travel planning on Dianping.

| Platform | Main Use | Best For |

| Duitang | Hobbyist image boards | Personal inspiration |

| Douyin 图文/图集 | Image carousels + shopping | Mass reach, commerce |

| WeChat Channels | Photos + Mini Program links | E-commerce, lifestyle |

| RED (小红书) | Lifestyle + social commerce | Fashion,beauty, influencers |

| Meitu | Photo editing & filters | Content creation |

| Zhihu | Q&A + infographics | B2B, expert content |

| Visual social feed | Trends, celebs | |

| ZCOOL | Professional design hub | Creative industry |

Duitang (堆糖) is a long-running image-sharing community in China, often compared to Pinterest. It focuses on aesthetic and inspirational visuals — from wallpapers and fashion to anime fan art and design tutorials. With billions of images in its database and millions of users curating themed collections, it has become a “treasure trove of beautiful images.”

Users “collect” (pin) visuals into theme-based boards, making it a discovery hub for personal inspiration rather than professional design work.

By 2026, Duitang will be a niche product. It will remain popular among hobbyists, anime fans, and casual wallpaper collectors, but lack the commercial or professional relevance of RED, Douyin, or ZCOOL.

Duitang allows users to “collect” (收藏) and organize visuals into theme-based albums, just like Pinterest boards. Its clean grid layout and browsing experience closely resemble Pinterest’s early design. However, unlike Pinterest’s marketing-driven boards, Duitang primarily serves as a personal archive of aesthetic inspiration, making it popular with fans but less useful for commercial campaigns.

Duitang remains active with daily content updates. After over a decade of growth (including early backing from Alibaba), its extensive archive makes it valuable for casual collectors and hobbyists.

In 2024, Duitang adapted to new trends by featuring seasonal wallpapers, trending fan art, and lifestyle imagery. While it lacks the professional exposure and commercial integration of ZCOOL or RED, it maintains a dedicated user base that treats it as a visual inspiration board.

Duitang content reflects its hobbyist and fan-driven nature, including:

Duitang thrives as a casual image archive and inspiration hub, rather than a professional creative network.

Douyin, the Chinese counterpart of TikTok, is known globally for short videos. But since 2023, its 图文 (image + text) and 图集 (carousel galleries) formats have gained traction, creating a Pinterest-like layer inside the app.

As of 2025, Douyin’s users are approximately 54% male and 46% female. 65% of Douyin users are under 35, and usage is increasingly widespread across Tier 1–4 cities.

By 2026, Douyin will be not only a short-video powerhouse but also a serious competitor in visual discovery and lifestyle planning, especially in commerce and local life.

Douyin’s 图文/图集 features allow users to create swipeable carousels of images with captions, tutorials, or mood boards. These posts are easily saved, shared, and discovered through hashtags, trending topics, or Douyin’s algorithmic feed. Like Pinterest boards, they encourage users to collect ideas—from recipes and fashion to home renovation.

What makes Douyin unique is its seamless integration with commerce. A gallery about a skincare routine can include product tags, while a travel carousel can link directly to POI (point-of-interest) pages or group-buy deals. Inspiration is not just pinned—it is immediately actionable.

Douyin is no longer just a short-video platform—it is a visual commerce ecosystem. In 2024–2025, Douyin Local Life’s (抖音本地生活) growth created new opportunities for F&B, travel, and service brands. Image galleries often act as bridges to live commerce, where users first discover ideas visually and then move into livestreams for purchase.

Its dominance in Tier 1–3 cities and its strength in everyday lifestyle content make Douyin 图文/图集 a core channel for brands needing scale. Compared with RED’s niche trust-driven base, Douyin offers broad exposure and immediate commerce impact.

Douyin’s 图文/图集 format is Pinterest at Douyin scale—a mix of inspiration, swipeable discovery, and commerce hooks. For brands seeking mass reach plus transactional power, it is the strongest complement to RED in 2025.

WeChat Channels, launched in 2020, have become one of Tencent’s strongest growth engines. In 2025, it had transformed WeChat from a private messaging app into a public discovery and commerce platform.

With photo posts, short videos, and direct connections to Mini Programs, Channels now rivals Douyin in engagement while leveraging WeChat’s ecosystem advantage—its 1.3+ billion user base and integrated payments.

Pinterest is about visual inspiration leading to action. Channels achieves this through multi-image posts (up to 9 photos) arranged as galleries. Users can save posts, forward them to groups, or repost them in Moments. Crucially, every gallery can link directly to WeChat Shops or Mini Programs, creating a closed-loop flow from discovery to purchase without leaving the app.

Tencent’s 2024–2025 earnings report shows rapid ad revenue growth from Channels as advertisers shift spend from Weibo and Baidu into WeChat’s ecosystem. Channels’ biggest advantage is that they are native to user routines—people don’t need to install another app. Instead, they discover inspiration while browsing WeChat and then purchase through official stores.

For brands, Channels is a high-trust environment with a conversion-friendly design. Unlike RED, which is discovery-first, Channels is retention-first, linking inspiration to CRM funnels (WeChat groups, OAs, loyalty programs).

In essence, WeChat Channels is Pinterest with payments built in. It blends visual inspiration with WeChat’s unmatched commerce rails, making it one of the most powerful discovery-to-purchase platforms in China today.

RedNote, or Xiaohongshu (小红书) or RED, is China’s fastest-growing lifestyle and social commerce platform. Blending user-generated content with e-commerce has become a destination for product inspiration and shopping.

By 2024, RED counted over 339 million monthly active users, with a young demographic (80% under 30), 70% female, with more than half under 30, and concentrated in Tier 1–2 cities

RED is more than “China’s Pinterest.” It is a Pinterest, Instagram, and Yelp hybrid, optimized for searchable inspiration and direct action. For any brand looking to build a Pinterest-style strategy in China, RED is the first and most essential stop.

Users publish “notes” (笔记), often image sets with text, similar to Pinterest pins. These can be saved, tagged, and collected into inspiration boards. The 收藏 (save) feature works like Pinterest’s boards, letting users curate fashion, beauty, home décor, food, and travel ideas.

Unlike Pinterest, RED layers in e-commerce and POI connections, allowing users to move directly from inspiration to purchase or local experiences

RedNote has become a cornerstone of influencer marketing and visual inspiration in China. In 2024, its daily engagement surged, with 56% of active users logging in multiple times per day.

RED’s trends ripple across China’s fashion, beauty, and design industries. Designers often upload portfolios or mood boards to build visibility, while brands — including global players — maintain official accounts to connect with young Chinese consumers.

Its unique content-commerce fusion sets it apart from platforms like Pinterest or Instagram: users can move seamlessly from discovering a look to purchasing the products featured in it.

Content on RED is aspirational and lifestyle-focused, including:

Meitu is China’s leading photo-editing and beautification app ecosystem, powering much of the polished visual content shared across RED, Weibo, and Douyin. In Q1 2025, Meitu reported 3.34 billion CNY in revenue and a 59% YoY increase in net profit, confirming its strength as both a tech and cultural platform.

Pinterest is about curating and sharing visual inspiration. Meitu plays a different role — it creates that inspiration. With AI-powered editing, beautification, and AR filters, Meitu shapes the visual styles that later go viral on platforms like RED or Weibo. While Pinterest is a discovery board, Meitu is the toolkit that feeds those boards.

Meitu continues to expand beyond filters into AI and design. Its “MiracleVision 4.0” AI model represents its latest push into creative AI. In late 2023, it co-hosted an AI design conference with ZCOOL, underscoring its role in professional design and consumer creativity.

Content on Meitu centers on personal images and stylized edits, including:

Although Meitu is not structured like Pinterest, its influence lies in fueling the content pipeline. The highly stylized photos created on Meitu often go viral once shared on other Chinese platforms, making it a behind-the-scenes driver of visual culture.

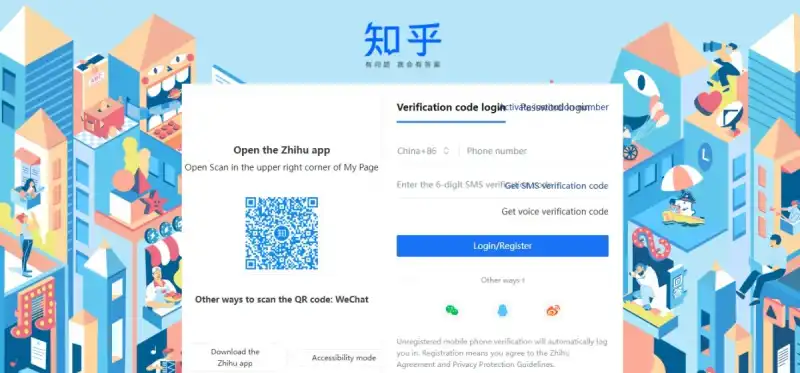

Zhihu is China’s largest knowledge-sharing platform, comparable to Quora. Its core function is Q&A, where experts and enthusiasts exchange insights through detailed answers and long-form articles. While text dominates, the platform also supports images, charts, and videos, making it valuable for visual case studies.

In 2024, Zhihu remained a central platform with over 102 million monthly active users and 13.2M paying users (mid-2025). Most of those users are well-educated (over 80% have college degrees). Under-35 users comprise approximately 71% of that base. Zhihu’s tone is serious and professional, attracting programmers, entrepreneurs, academics, and specialists.

Pinterest is a consumer-oriented platform, built around moodboards and lifestyle ideas. Zhihu is expertise-oriented, where visuals (infographics, case studies, annotated photos) reinforce authority. Both rely on search and long-tail discovery, but Zhihu focuses on credibility rather than inspiration.

Zhihu continues to grow steadily, reporting a 13% year-over-year increase in content creators as of late 2023. It remains the go-to space for educated users seeking credible, professional content.

For visual media, Zhihu is not a design showcase. Instead, it excels in visual-rich explanations: diagrams, case studies, and photo-based guides that deepen understanding. For instance, popular posts in design or photography often use annotated screenshots or infographics to break down processes.

Brands and influencers increasingly use Zhihu to publish curated, image-heavy articles (e.g., marketing case studies with infographics). Although the platform offers some e-commerce features (e-books, paid courses), its primary function is knowledge sharing, not commercial transactions.

Visual content often appears in answers and articles on Zhihu. You will find infographics, charts, and step-by-step design guides embedded in Q&A. Popular topics include

Unlike Pinterest or Huaban, Zhihu does not have standalone galleries. Content is organized by question or topic, with visuals anchoredto expert commentary.

Weibo (literally “microblog”) is China’s largest Twitter-like platform. It is a hybrid social media that supports text posts, images, videos, and livestreams. As of 2024, Weibo boasts over 588 million active users, roughly half of whom are male and half female, with the most significant segments comprising the post-90s and post-00s generations.

Users spend, on average, about 50 minutes per day on Weibo. While its roots lie in real-time news and updates, Weibo has evolved into a highly visual platform, with photos, short videos, and GIFs dominating timelines. It offers broad exposure and a direct link to trending conversations for designers, influencers, and brands.

Like Pinterest, Weibo offers visual discovery—users explore fashion, events, and creative content via trending topics and hashtags. But unlike Pinterest’s evergreen nature, Weibo’s content thrives on real-time virality, making it a platform for rapid inspiration rather than long-term curation.

Weibo remains a central hub for China’s social conversation. Its algorithm updates in early 2024 improved content filtering and recommendations, helping quality posts gain traction. Travel and fashion brands, in particular, report strong visual engagement.

For creatives, Weibo is often where design content—posters, concept art, or promotional visuals—first gains public exposure. Design schools, gaming firms, and studios use official accounts to showcase work and connect with audiences. The platform also experiments with short-form video and mini-programs, signaling its push to stay relevant against Douyin and Xiaohongshu.

Weibo hosts a broad spectrum of visual material, including:

Brands often post polished promotional campaigns, while creatives share mood boards, illustrations, and finished projects. This mix makes Weibo both a newsfeed and a creative stage.

ZCOOL (站酷) is China’s premier online design community. Often described as the local equivalent of Behance or DeviantArt, it is a hub for creative professionals to showcase portfolios, connect with peers, and participate in competitions. Founded in 2006 by designer Liang Yaoming, it has grown into the largest design-focused platform in China with over 17 million users.

Like Pinterest, ZCOOL is a visual inspiration hub, but it focuses on professional-grade portfolios, not casual mood boards. Users curate and share high-quality projects, engage in creative contests, and explore design trends via image galleries and case studies. It parallels Pinterest in concept but caters to a B2B and professional creative ecosystem.

ZCOOL continues to define China’s creative industry. In 2024, it remains a leading showcase platform for online and offline exhibitions. In December 2023, the company partnered with Meitu to launch an “Emerging AI Designer” program, reflecting its commitment to AI-driven design.

ZCOOL is the best place for Chinese creatives to gain professional exposure and connect with clients. For international marketers, it offers a window into China’s design trends, an opportunity to source local talent, and a platform to collaborate on creative campaigns.

Recent updates include improved mobile browsing (with app version 1.0.28) and expanded support for NFTs and AI-generated art.

The platform emphasizes polished, professional-grade projects rather than casual uploads. Content includes:

ZCOOL is, above all, a portfolio and inspiration hub. It represents the cutting edge of China’s design culture and serves as a launchpad for creative professionals.

The first step is to discover the Duitang, Douyin, RED, Meitu, Zhihu, Weibo, and ZCOOL platforms. The real challenge lies in understanding how Chinese consumers use these platforms, which content trends drive engagement, and how global brands can adapt without missteps. This is where ChoZan comes in.

If you want to move beyond browsing and start turning inspiration into impact across China’s photo-sharing platforms, ChoZan is your partner in making that leap.

Contact ChoZan to learn how your brand can harness China’s visual platforms for design inspiration, influencer marketing, and measurable growth.

China’s most popular Pinterest alternatives include Duitang, Douyin, RED (Xiaohongshu), Meitu, ZCOOL, Zhihu, Weibo, and WeChat Channels. Each serves different needs—Douyin and RED for commerce, ZCOOL for design, WeChat for ecosystem integration, and Zhihu for professional knowledge.

Pinterest is blocked in China due to internet regulations and the Great Firewall. Local platforms like RED, Douyin, and WeChat Channels filled the gap, offering similar image-sharing features but with deeper e-commerce and social integrations.

Yes. RED integrates UGC, e-commerce, and influencer marketing, directly driving sales. Duitang is now a niche, more suitable for personal collections or fan content. For marketers, RED is far more impactful.

ZCOOL serves fashion, graphic design, product design, advertising, and architecture. It’s where brands scout talent, launch design contests, and showcase creative campaigns.

No. Meitu is also a trendsetting tool. Its AI-powered features fuel visual culture across RED, Weibo, and Douyin. Many brands collaborate with influencers using Meitu edits for product promotion.

Douyin offers scale and immediacy—mass reach and fast commerce. RED is more niche, high-trust, and search-driven. Many marketers use RED for targeted seeding campaigns, and Douyin for mass amplification.

Yes, but it varies. RED, Weibo, Douyin, and WeChat Channels provide structured ad tools and influencer collaborations. Meitu is more creator-driven. ZCOOL is best for design-focused campaigns. Local partners are often essential.

ChoZan helps brands localize strategy across RED, Douyin, ZCOOL, and others by explaining user behavior, campaign mechanics, and influencer ecosystems.

Yes. ChoZan offers masterclasses and workshops on platform mechanics, trend analysis, and campaign design across RED, ZCOOL, Douyin, and more.

Because platform complexity, regulations, and cultural nuances can derail campaigns. ChoZan provides research, training, and expert calls to help brands launch with confidence and achieve measurable results.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

KOL Marketing: An Essential Chinese Social Media Tool

WeChat VS Weixin, an Essential Guide for Marketers

5 Chinese Fashion Bloggers (KOLs) You Must Know in 2025

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.