CONTENT

By: Ashley Dudarenok

Updated:

Live streaming in China has transformed from a trendy marketing tactic into a full-fledged retail and entertainment infrastructure. Platforms like Douyin, Taobao Live, and WeChat Channels have evolved into end-to-end commerce ecosystems, while category specialists like Bilibili and Huya dominate gaming and fandom niches.

In 2025, the sector is defined by AI-driven personalization, store-led broadcasts, and strict regulatory oversight, making it both more sophisticated and more competitive than ever.

China’s live commerce GMV is projected to grow at 20%+ annually, driven by short video penetration, improved logistics, and social-first shopping experiences.

Platforms are no longer just video apps—they now integrate payments, fulfillment, and CRM, offering a “closed-loop” journey that Western markets still struggle to replicate.

This article breaks down 5 platforms shaping live streaming in 2025-26:

China’s live-streaming sector has moved beyond novelty and become a backbone of e-commerce. By 2024, more than 1.1 billion users—nearly the entire online population—will have engaged with video content. Livestream shopping GMV surpassed ¥5 trillion (about USD 688 billion) and is forecast to grow by 20–25% annually through 2026.

Short-video giants like Douyin and Kuaishou have evolved into commerce ecosystems that integrate payments, logistics, and AI-driven recommendations, creating a seamless journey from content to checkout.

Influencer-led live commerce is being replaced by professional brand studios. Taobao Live reports that over half its GMV now comes from store-run live rooms. This shift favors brands willing to invest in in-house hosts, creative teams, and integrated customer-service systems.

Platforms are leaning on AI for scale and efficiency. Virtual anchors, automated scripts, and predictive pricing models have become common. Platforms like Douyin and WeChat Channels now segment audiences in real time, improving ROI on ad spend and boosting conversions.

Douyin’s local-life business has also turned live commerce into an O2O growth engine by connecting streams to offline retailers, restaurants, and tourism services.

The dominance of short-video giants has not stopped niche players from growing. Xiaohongshu is carving out a space in lifestyle and premium product discovery, while Bilibili Live and Huya Live lead in gaming and fandom-based communities. This diversity gives brands opportunities to create campaigns tailored to highly engaged audiences.

Douyin has evolved from a short-video platform into the backbone of China’s livestreaming economy. By late 2024, it had become a commerce infrastructure platform that merges entertainment, marketing, and sales in one ecosystem.

Key metrics:

The platform has moved beyond influencer-led campaigns. In 2024, brand-led streams overtook influencer sessions, accounting for 41% of GMV. By mid-2025, over 162,000 merchants had surpassed ¥1 million in livestream sales, marking a 113% year-over-year increase.

Store-led livestreaming now drives the majority of Douyin’s growth, enabling brands to exert greater control over content and audience engagement. Companies are also diversifying traffic sources, relying on Qianchuan ads, organic reach, and search-driven campaigns to reduce dependence on high-profile influencers.

Douyin leads in livestream technology, blending AI automation with immersive shopping experiences. AI anchors now handle 90% of standardized product explanations, enabling 24/7 coverage. Hybrid models—utilizing AI overnight and human hosts during peak hours—boost engagement by 40% and reduce returns by 18%.

The launch of Douyin XR in November 2024 introduced:

While hardware adoption is still limited, XR signals Douyin’s push to make immersive livestream commerce mainstream.

In January 2025, Douyin introduced nine merchant support policies aimed at reducing operational costs and enhancing profitability. These included commission reductions, freight insurance, and upgraded traffic allocation. This approach positions Douyin not just as a marketplace but as a brand incubation platform.

While influencer-driven livestreams still thrive, Douyin is prioritizing store-led live rooms to ensure consistent brand representation. This shift has led to higher conversion rates for complex or premium categories, such as electronics, skincare, and luxury fashion, where trust and consistent messaging are crucial.

AI-powered digital humans are redefining efficiency:

AI hosting is now standard for off-peak hours, with human hosts reserved for storytelling and high-stakes campaigns.

Douyin is no longer just a sales channel—it is China’s core livestream commerce infrastructure. The platform’s mix of scale, AI-driven automation, immersive tech, and deep merchant support makes it the benchmark for livestreaming globally. Brands that thrive here focus on lifetime value, investing in hybrid hosting, advanced content ecosystems, and trust-building strategies.

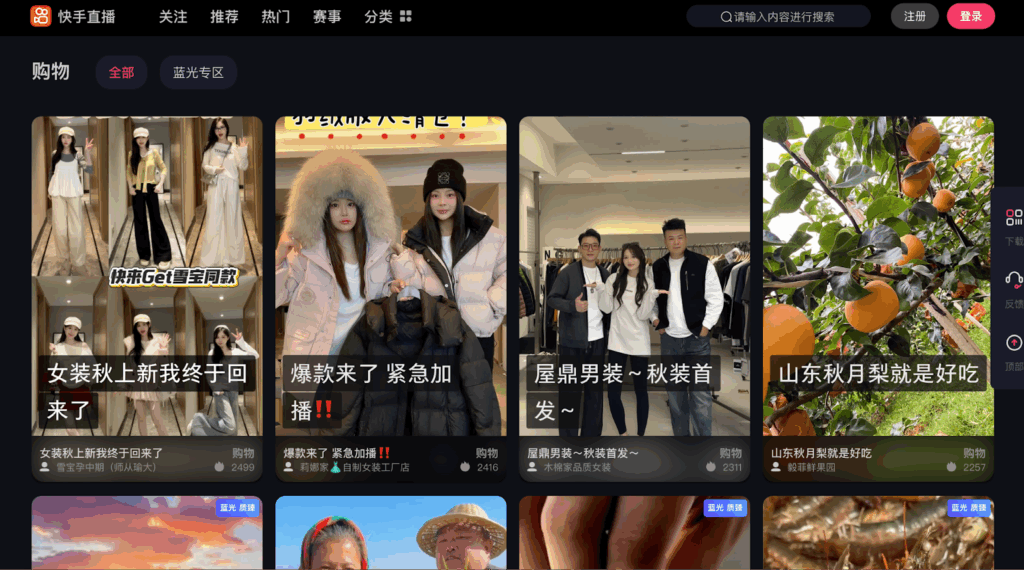

Kuaishou has established a strong presence in China’s third-, fourth-, and fifth-tier cities, providing a deeply community-driven experience. The platform blends entertainment-first livestreams with affordable e-commerce, making it popular among users in northern regions.

Its authentic, grassroots culture gives Kuaishou a loyal user base that values connection over polished production. This position makes the platform a natural fit for regional merchants and industrial belt sellers, who can market directly to niche audiences without heavy ad spending.

In the first quarter of 2025, Kuaishou Live revenue grew 14.4% year-over-year, reaching ¥9.8 billion. This growth reflects the platform’s refined operations and strategic investments in content. The supply side has expanded significantly:

Kuaishou’s ecosystem rewards persistence. While creator growth is slower compared to Douyin, its emphasis on loyalty, localized engagement, and grassroots events makes growth more sustainable over time.

Kuaishou’s Summer Festival is a cornerstone of its livestreaming strategy, designed to reward creators of all levels. The 2025 festival featured over 24 major events and 1,400 competition tracks, providing growth opportunities for top anchors, regional creators, and long-tail streamers.

Highlights include:

The event system positions Kuaishou as a platform that actively invests in creator loyalty and growth rather than relying solely on algorithmic distribution.

Kuaishou has built a reputation for cultural innovation and local engagement. Its Big Stage (大舞台) format combines offline performances with livestreaming, drawing over 160 million views from more than 900 rural and regional shows. This model promotes tourism, rural revitalization, and community culture while expanding the livestreaming market.

Gaming is another key pillar. Partnerships with over 40 game studios and Spring Festival promotions featuring titles like Honor of Kings attracted more than 100 professional players and top streamers. This mix of rural entertainment and gaming content reinforces Kuaishou’s dual strength in localized community building and mainstream entertainment.

Kuaishou livestreams often operate like mini production studios. A single session typically involves:

This structured approach allows even small creators to scale professionally, offering a lower barrier to high-quality production.

In 2025, Kuaishou adopted Smart AI Third-Generation Livestreaming to overcome traffic saturation and algorithm throttling. The technology combines data-driven recommendations, real-time feedback loops, and VR/AR features to enhance personalization and monetization.

AI also offers creators audience insights, brand partnership recommendations, and performance reports, helping smaller creators monetize effectively and compete with established talent.

Kuaishou differentiates itself by leaning into community loyalty, rural penetration, and creator-first growth systems. Its combination of grassroots content formats, major festivals, and AI-powered monetization creates an ecosystem where creators of all sizes can succeed. Kuaishou’s strategy emphasizes authenticity, localized commerce, and sustainable creator growth.

Taobao Live is positioning itself as China’s premium livestream commerce platform, leveraging Alibaba’s vast ecosystem of over one billion buyers. In March 2025, it announced a ¥11 billion investment over two years to double both its user base and transaction volume by 2027. This marks a shift away from discount-driven competition to a model centered on quality, trust, and polished sales campaigns.

Despite industry slowdowns in 2024, Taobao Live posted impressive growth, underscoring the effectiveness of its quality-first approach:

These numbers demonstrate Taobao Live’s increasing appeal to major brands and established creators, who seek a brand-safe and high-conversion environment.

Taobao Live’s 2025 vision prioritizes long-term loyalty and premium positioning over raw traffic numbers. The platform is introducing:

This strategy strengthens consumer trust, making Taobao Live the go-to platform for quality-driven brands like Xiaomi, Balabala, and Ubras, alongside star creators such as Li Jiaqi and Chen Jie Kiki.

SheTao E-commerce’s work with brands illustrates how Taobao Live has evolved into a platform that prioritizes conversions. Brands succeed by meeting users at every touchpoint, combining search optimization, short-form video seeding, and shelf placement coordination.

Educational and narrative campaigns deliver standout results: Kryolan doubled its conversion rates with tutorials on medical-grade color correction. At the same time, pet food companies utilized ingredient traceability streams to earn trust and achieve rapid sales growth.

Scarcity-driven launches, such as limited-edition pre-sales, have achieved conversion rates exceeding 30%, demonstrating that users are willing to pay premiums for transparency and high-quality storytelling.

Taobao Live integrates AI-powered automation to help merchants scale effectively. AI-driven product selection tools, real-time diagnostics, and one-click livestream room optimization have cut bounce rates by 40% and lifted average transaction volumes by 58%.

This data-driven infrastructure integrates livestream channels, product shelves, and search placement into a closed-loop conversion engine, reducing reliance on ad spend and enhancing ROI for high-quality campaigns.

Taobao Live’s advantage is its deep integration with Alibaba’s retail ecosystem:

This full-stack ecosystem makes Taobao Live an essential platform for premium and global brands, enabling them to scale livestream commerce without worrying about fragmented infrastructure.

Taobao Live is emerging as the benchmark for brand-driven livestreaming in China. While Douyin emphasizes entertainment and Kuaishou focuses on grassroots engagement, Taobao is building an ecosystem rooted in premium branding, storytelling, and AI-powered infrastructure.

The platform is well-positioned for a future where livestreaming is computation-driven rather than labor-intensive, offering brands a stable, trustworthy space to reach discerning consumers.

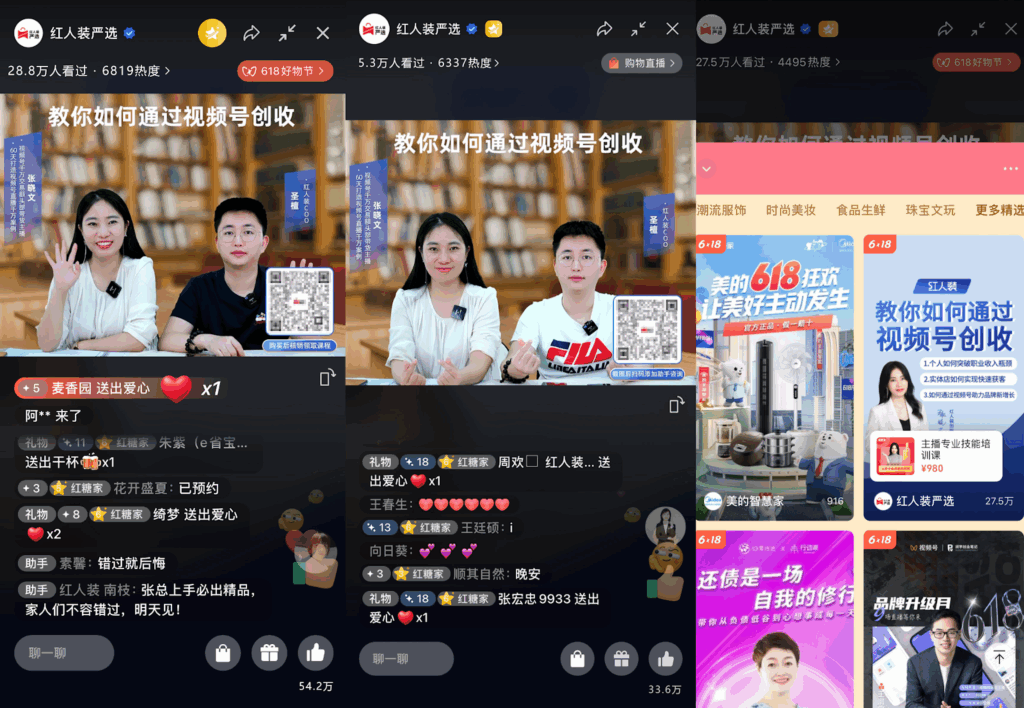

WeChat Channels (视频号) have quickly evolved from an experimental content platform into one of Tencent’s most strategic initiatives.

Unlike Douyin or Kuaishou, which thrive on algorithmic discovery, Channels leverages WeChat’s private-domain ecosystem—comprising Official Accounts, Mini Programs, WeChat Work (WeCom), and Groups—to create a unique, socially driven commerce model. This makes it especially powerful for brands seeking direct CRM integration and long-term customer relationships.

In 2024, WeChat Channels and their associated WeChat Shop (微信小店) saw explosive growth. Tencent reports that GMV increased by approximately 1.92 times year-over-year, while order volumes rose by over 2.2 times.

Channels have also become a significant advertising channel for Tencent, with ad revenue growth closely tied to high engagement rates and integrated targeting tools. Its user base now skews toward high-income, urban consumers, making it an attractive option for premium brands.

WeChat Channels is not just another livestream platform; it’s a private-domain powerhouse. Brands can use:

This model ensures brands own customer data, unlike other platforms where traffic remains platform-controlled.

The channels’ focus on social connections has made them a leader in gifting-driven commerce. Features like “送礼物” (Send Gifts) have become a conversion engine for food, health, and premium consumer goods, allowing users to purchase products for friends without leaving the app.

Tencent has tightened merchant verification and introduced stricter ad approval to align with China’s live-commerce regulations. The platform also invests heavily in content moderation, making it one of the safest environments for brands concerned about compliance or reputational risk.

WeChat Channels is a strong choice for:

For brands investing in relationship-based sales and long-term retention, WeChat Channels is an indispensable complement to Douyin and Taobao Live.

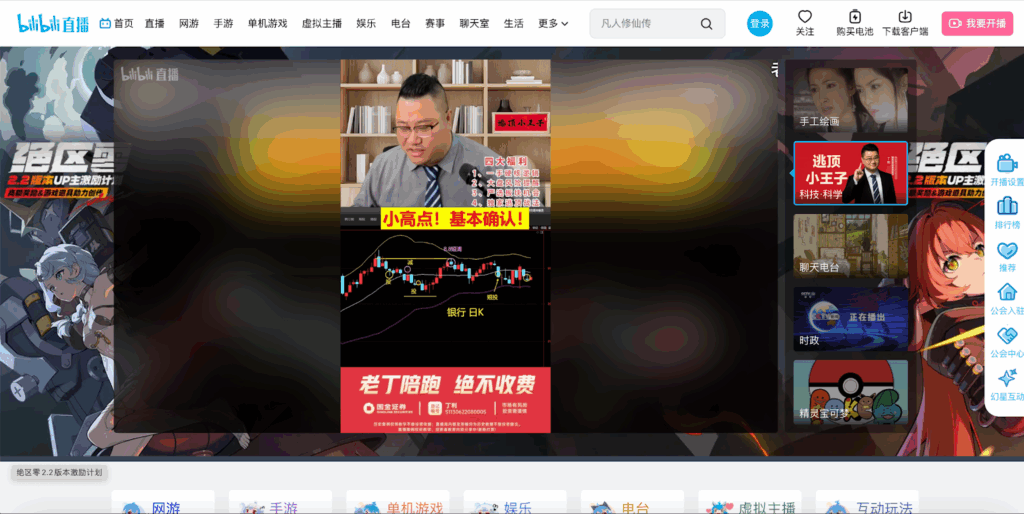

Bilibili Live has evolved beyond its roots in anime and gaming to become a major destination for fandom-driven livestreaming and long-form content.

In 2025, it attracted 368 million monthly active users and over 32 million paying subscribers, with users spending an average of 108 minutes per day on the platform. Its community-first culture and strong Gen Z base make it one of China’s most trusted spaces for interactive content.

Initially known for its focus on anime, gaming, and subculture, Bilibili has expanded its ecosystem to include livestream commerce, premium memberships, sponsorships, and advanced creator monetization tools. Creator income grew by 40% year-over-year in early 2025, supported by revenue-sharing incentives and improved content tools.

The platform’s growth strategy emphasizes:

Bilibili excels in niche, high-engagement campaigns rather than mass-market product drops. Its audience is passionate, tech-savvy, and culturally invested, making it ideal for:

Brands often use Bilibili Live for exclusive debuts and events before scaling campaigns to Taobao, Douyin, or Kuaishou.

Bilibili has invested heavily in R&D, positioning itself as a technical leader in livestream engineering. The 2025 Spring Festival Gala broadcast demonstrated the platform’s ability to deliver 4K HDR streaming, millisecond-level latency, and synchronized danmu-based effects to tens of millions of viewers.

Key innovations include:

This engineering strength makes Bilibili attractive for large-scale events, esports tournaments, and immersive virtual concerts.

Bilibili is a pioneer in virtual idol livestreaming, leveraging animated avatars to expand content while reducing costs and risks.

The platform entered livestream e-commerce in 2021 with the “Little Yellow Car” feature, aiming to diversify revenue as gaming slowed. While trust-driven commerce performs well, scaling remains challenging because many creators excel at scripted content rather than live selling. Over-commercialization also risks alienating users, making the balance between monetization and culture critical.

Bilibili Live is not competing directly with Douyin or Taobao for raw GMV but has carved a defensible niche as the platform of choice for authenticity, subculture campaigns, and fandom commerce.

Best use cases include:

With heavy R&D investment, cultural credibility, and a loyal Gen Z base, Bilibili is positioned as a strategic channel for immersive experiences, event-level campaigns, and trust-driven sales in China’s livestreaming market.

Measuring success in China’s livestreaming ecosystem requires a platform-specific approach combined with a unified brand-side data strategy. Unlike traditional e-commerce, livestream performance can fluctuate based on the host’s quality, timing, and promotional events, making real-time tracking and incremental analysis essential.

Every livestream campaign should begin with baseline engagement and conversion metrics, then expand to profitability and retention indicators. The most important KPIs include:

Platforms like Douyin and Taobao Live provide detailed dashboards with these metrics; however, brands should consolidate data across all channels to identify the proper performance drivers.

With multiple platforms running campaigns simultaneously, attribution can become a complex process. Brands should adopt incrementality testing, where control and test campaigns measure the direct impact of livestreaming on revenue beyond baseline sales. This helps determine whether spikes are organic or campaign-driven, guiding more intelligent allocation of ad spend and influencer budgets.

Each platform operates as a closed ecosystem, so external attribution tools have limited access to it. Brands often rely on:

For long-term growth, brands need a robust data pipeline that consolidates:

The best-performing brands in China treat livestreaming as a data-driven channel, not a gamble. Platforms’ native dashboards provide strong insights, but proper optimization requires blending those numbers with internal analytics and predictive modeling.

Launching and scaling livestreaming in China requires a significant upfront investment in both budget and operational resources. While smaller brands can start lean with creator collaborations, serious growth demands dedicated teams, ad spend, and optimized production setups.

Costs vary widely depending on category, target audience, and campaign scale. The most common cost factors include:

Brands typically allocate 20–30% of revenue from livestream sales toward traffic acquisition, and another 10–15% for influencer or host fees.

A high-performing livestream operation requires a cross-functional team:

For brands running multiple sessions per week, dedicated teams are a non-negotiable requirement. Larger companies often operate full studios or partner with MCNs (multi-channel networks) to maintain daily livestream schedules.

Douyin, Taobao Live, and WeChat Channels tend to have higher entry costs due to competitive ad auctions and production requirements. Kuaishou offers a lower-cost entry point for brands targeting lower-tier markets. At the same time, Xiaohongshu, Bilibili, and Huya require specialized investments to appeal to niche audiences but deliver higher engagement and loyalty.

Brands often underestimate operational costs when scaling their livestreaming operations. Those who succeed build profitability models early, tracking Contribution Margin 3 (CM3) after refunds and aligning campaign goals with product margins. By combining aggressive ad buying during festivals with year-round low-cost community engagement, companies strike a balance between scale and sustainability.

China’s livestreaming market is heavily regulated, and compliance is now a competitive advantage. Platforms and merchants are expected to maintain strict quality standards, transparent pricing, and responsible advertising practices. For brands entering in 2025, governance is not optional—it’s the foundation of long-term trust and operational security.

Several policies form the backbone of livestreaming governance:

These regulations require brands to verify all claims, disclose prices transparently, and ensure refund processes meet national standards.

Brands must adopt formal workflows to avoid penalties and reputational damage:

Platforms like Taobao Live and Douyin have implemented AI-based risk detection and real-time moderation to prevent violations before streams go live.

With livestreaming’s scale, brand missteps can spread quickly. Successful brands:

Brands that invest in governance early often gain a competitive edge. Consumers reward brands that handle refunds quickly, maintain transparent pricing, and provide reliable after-sales service. Platforms also prioritize compliant brands in their algorithmic traffic allocation, which reduces ad costs over time.

China’s livestreaming industry is no longer experimental. Platforms like Douyin, Taobao Live, Kuaishou, and Bilibili are now driving billions in GMV, shaping global e-commerce trends, and rewriting brand playbooks.

ChoZan helps you decode this transformation and act on it immediately through services and innovation teams navigating China’s market.

With Taobao investing ¥11 billion in “quality-first” livestreaming, Douyin advancing its AI-driven commerce tools, and Kuaishou scaling rural and niche-market penetration, livestreaming has become the frontline of Chinese e-commerce strategy. ChoZan turns this complexity into a competitive advantage, equipping you to invest, execute, and scale confidently.

Book a livestream strategy briefing or China Expedition to experience these dynamics firsthand and future-proof your 2025–2026 growth plans.

China's regulators have drafted new e-commerce livestreaming rules that ban misleading tactics, including inflated view counts, deceptive claims, and the generation of ghost traffic. Brands must update influencer contracts to include compliance clauses, educate hosts on content standards, and center strategy on legal clarity and audience trust.

Platforms like Douyin still block AI avatars, but some virtual hosts (e.g., Taobao) are legally permitted if clearly labeled as AI and comply with IP and content laws. Brands using AI personalities must disclose them and validate performance after glitches.

Livestreaming is shifting from entertainment to regulated retail. Governments now require platforms to enforce real-name verification, product authenticity, and no exaggerated claims. Continuous compliance training and approval pipelines are a must.

As of mid-2025, livestream-commerce GMV in China is pushing toward 6.5 trillion RMB, fueled by growth of platforms like Xiaohongshu and integration of livestreaming into every category.

Livestreaming now blends live performance, commerce, and algorithms. Platforms offer real-time buying buttons, vertical feed recommendations, and KPI-embedded dashboards—making livestreams part of daily shopping routines.

Micros, education streams, and subculture verticals like anime or pet care now drive 20% of livestream commerce—providing deep engagement even when macro categories are saturated.

MCNs like Xinxuan, Qianxun, and Ruthnn manage livestreamers, negotiate deals, and operate studios. Their founder-led models (e.g., Viya from Qianxun) provide brands with access to tight-knit, high-trust influencer networks.

RedNote uses long-form, lifestyle storytelling by aspirational creators rather than hard-pitch livestreams. This attracts urban, higher-income shoppers and drives performance through organic, conversational selling.

On platforms like WeChat Channels, gifting actions (such as sending virtual gifts during streams) now serve as micro-conversions—they build emotional connections and funnel into sales, especially for food, health, or relationship-first categories.

Chinese platforms function like broadcast systems. For Bilibili’s 2025 Spring Festival Gala, they deployed HDR streaming, latency dashboards, SEI timestamp triggers, and multi-source encoding—all of which enabled synchronized, large-scale live engagement.

Danmu is no longer just edge content—it’s a signal channel. Platforms utilize SEI timestamps embedded in video streams to trigger synchronized animations, effects, or chat overlays, enabling precise synchronization for millions of viewers.

China’s platforms now host 4,000+ virtual idol livestreams monthly. They offer scalable, low-risk entertainment, particularly for youth communities, frequenting platforms like Bilibili where virtual avatars like Nanako dominate charts.

Chinese livestreaming breaks into entertainment, e-commerce, gaming, and education. E-commerce accounts for 80% of value, but entertainment and niche streams continue to drive loyalty, subscriptions, and brand discovery.

Live commerce originated as Mogu’s premium live content, but Alibaba recognized real-time engagement as a key growth lever. They integrated livestreaming into Singles Day, making it part of inventory testing, brand storytelling, and real-time demand shaping.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.