CONTENT

By: Ashley Dudarenok

Updated:

Pop Mart isn’t just a toy brand anymore—it’s a cultural signal for China’s Gen Z. With characters like Labubu and Molly, it transformed collectible toys into lifestyle essentials, tapping into a desire for self-expression, nostalgia, and aesthetic identity.

By 2024, Pop Mart’s revenue had reached RMB 13.04 billion, a 107% increase from the previous year. Its breakout IP, The Monsters (featuring Labubu), brought in RMB 3.04 billion, accounting for approximately 23% of total sales.

In the first half of 2025 alone, Pop Mart reported a 396.5% jump in net profit and a 204.4% increase in revenue year-on-year. Overseas markets now account for nearly 40% of its total income. Meanwhile, China’s collectible toy market is expected to reach RMB 110.1 billion by 2026, indicating ample room for new challengers.

So the big question is: with Gen Z calling the shots, who will be the next Pop Mart?

China’s Gen Z (generally those born in the mid-1990s through 2000s) have emerged as the core consumers of the new wave of collectible toys. Unlike older generations who viewed toys as mere children’s items, Gen Z sees designer toys – also called 潮玩 (chao wan) – as extensions of their identity, fashion statements, and even emotional companions.

Surveys show that Gen Z and millennial adults form the majority of China’s “trendy toy” buyers, with 25– to 45–year–olds accounting for 75% of purchasers, and the post-1995 cohort alone making up over 40%.

Notably, spending by young buyers on blind boxes has skyrocketed; for example, on one major platform, their blind-box purchases rose 580% year-over-year at one point. This generation’s strong purchasing power is fueling the market’s expansion at an unprecedented pace.

Gen Z’s interest in trendy toys goes far beyond “cute” appeal. For many collectors, these toys deliver emotional satisfaction, stress relief, and social value that traditional goods lack. A New Economy Observer report notes that practicality is secondary—what makes you happy will find a market. Students or office workers may save on daily expenses but still spend ¥69 on a blind box for the joy it brings.

Collecting also enables self-expression and community. In China, unboxing videos, display photos, and toy-themed shoots are common on social media. Pop Mart’s Labubu, an “ugly-cute” character, became a national craze in 2023–2024, reaching over 1.3 billion views on RED.

Fans carry keychains, dress plush dolls, and bond with fellow collectors. One observer referred to Labubu as “social currency,” noting that sharing it online facilitates interaction.

Importantly, this craze is not about speculation. Surveys show more than 85% of blind-box buyers purchase for the surprise, the IP itself, or shared experiences, while fewer than 2% cite resale as a motive. Genuine passion drives this behavior.

Gen Z has elevated designer toys into a lifestyle category that blends fashion, pop culture, and emotional fulfillment, creating a fast-growing market where demand is defined by attitude rather than age.

Pop Mart’s rise is the result of three powerful forces: the creation of original IP, hype-driven sales models, and deep emotional branding. The company has mastered the art of building characters that resonate on a personal level and rolling them out in a way that keeps fans constantly engaged.

Its IPs aren’t just toys—they’re style icons. Molly, Skullpanda, Labubu, and the Monsters series all cater to slightly different subcultures within China’s Gen Z, ranging from artsy to street to quirky. This segmentation has allowed Pop Mart to expand its fan base across tiers and cities.

The blind box model adds an element of gamification and scarcity. This has not only driven repeat purchases but also birthed a thriving secondary market for rare editions, further boosting hype and social sharing.

Offline, its flagship stores in premium malls create immersive, Instagrammable experiences. Online, Pop Mart drives traffic through Xiaohongshu, Douyin, and Bilibili, where influencers and fans unbox, rate, and trade. It’s omnichannel done right.

Despite strong numbers, Pop Mart faces real challenges in 2025:

What still works in Pop Mart’s favor is its storytelling, IP pipeline, and community building. It invests in artist collaborations, runs annual conventions, and nurtures fan communities across platforms. Its success is not just in selling toys, but in making people care about the characters.

China’s collectible toy market has grown from a niche hobby into a multibillion-yuan industry, driven by young consumers seeking products that provide happiness and emotional value. This growth reflects a broader shift toward “emotional consumption,” where buyers prioritize comfort and enjoyment over purely functional spending.

Industry figures illustrate this sharp rise:

Designer toys fit perfectly into this emotional economy. They deliver cultural resonance and personal comfort that resonate with urban professionals. A Guangzhou buyer described her routine of squeezing a plush toy after work as an affordable form of stress relief, capturing why “if it makes you happy, it sells” has become a mantra for Gen Z consumers.

The market’s long-term potential is evident in spending comparisons. Americans spend about $2,000 per person annually on hobbies, while Japanese consumers spend around $588, and Chinese consumers spend around $51.

This gap signals significant growth opportunities as Chinese youth increase hobby-based purchases. Even during economic slowdowns, securities analysts note the sector’s “certain toughness,” as passion-driven spending continues to outpace demand for purely practical goods.

Looking ahead, industry experts in China have identified several key trends and “tracks” that are expected to propel the toy market (and produce the next big winners) in the coming years.

At a 2025 Taobao/Tmall toy industry summit, the head of Alibaba’s toy division highlighted four “super tracks” for the next five years, all of which align with Gen Z’s influence:

Emotional Value & “Healing” Toys

The continued rise of “情绪价值” – products that deliver emotional comfort, stress relief, or joy. Toys with cute, humorous, or nostalgic elements tap into this need. Young consumers explicitly say “I buy it for the emotional boost”, and companies will keep emphasizing surprise, fun, and “therapy” in toy design.

The massive success of mood-lifting toys like Pop Mart’s crying baby figurines (CRYBABY) or squeezable plushies illustrates that a toy that can cheer you up will thrive.

Analysts expect “self-care” through collectibles to remain a strong motive, especially as societal pressures persist.

Turning popular intellectual properties into merchandise, known as “IP实体化,” is a cornerstone of China’s toy industry. Virtually every major film, game, or web comic now has related merchandise available on Tmall.

Brands like Pop Mart built empires by creating characters like Molly and Skullpanda, each with dedicated fan bases. The next wave of growth may come from domestic Chinese IPs, such as Black Myth: Wukong, which are attracting global attention and expanding merchandise opportunities.

Male collectors are becoming a dominant force, particularly in mecha models, building kits, trading cards, and gadgets. This demographic is driving high-value purchases in categories once dominated by female buyers.

China’s Gundam and Transformers fan communities are also fueling growth, signaling that toys are no longer just for kids or female collectors. Brands that target this market with a focus on nostalgia and craftsmanship are well-positioned to thrive.

Technology is reshaping the toy industry, with AI and gamification creating a new “Toy 3.0” era. Startups and established brands alike are investing heavily in digital integration.

Yuanqi Mart, a Shenzhen-based company, combines collectible toys with metaverse gaming and AI-generated content. Buyers receive a digital avatar of each toy to use in an online world, where they can socialize, customize, and co-create content. The company’s rapid growth has attracted major venture capital, showing how blending physical and virtual experiences can redefine the market.

Established leaders like Pop Mart are also experimenting with AI-powered vending machines and virtual characters. These innovations point toward a future where interactive, tech-enabled toys become mainstream, creating deeper engagement and higher brand loyalty.

Together, these four trends—emotional value, IP merchandising, male-focused niches, and AI integration—are shaping a broader and more tech-driven toy industry. Companies that excel in one or more of these areas stand the best chance of becoming “the next Pop Mart.”

Pop Mart (泡泡玛特) is the company most closely associated with China’s潮玩 (trendy toy) craze. Founded in 2010 by Wang Ning as a small shop in Beijing, it has grown into China’s largest designer toy brand and a global industry leader. Its turning point came with the blind box model—collectible figurines sold in sealed, random packages and often tied to collaborations with independent artists.

Characters like Molly and Dimoo became instant hits, helping the brand ignite a nationwide craze from 2017 to 2019. Fans queued for new releases, and rare editions sold for high prices, firmly placing Pop Mart at the heart of China’s toy market boom.

Pop Mart’s growth over the last five years has been extraordinary:

These numbers prove how Pop Mart turned trendy toys into a lucrative global business.

A broad portfolio of original IPs drives Pop Mart’s success. By 2025, it had collaborated with over 200 artists, creating characters with unique appeal.

This constant innovation keeps fans engaged and prevents Pop Mart from being a one-hit wonder. Its dominance is so strong that “Pop Mart” is now synonymous with “blind boxes,” earning the 品牌即品类 (“brand equals category”) status coveted by marketers.

Pop Mart operates a vast physical and digital network, comprising more than 530 stores worldwide and over 1,800 vending machine kiosks by the end of 2024. Flagship stores, such as its location in Shenzhen, serve as tourist attractions and gathering spots for fans.

Online, Pop Mart has millions of followers across Weibo, RED, and Bilibili. The company invests heavily in fan conventions, toy expos, and membership programs, strengthening its community and brand loyalty.

Pop Mart is a dominant force on Alibaba’s platforms, where trendy toys are now a major category. Limited-edition releases often sell out within minutes. A Nezha-themed blind box in 2023 earned ¥10 million in just eight days, showcasing its ability to merge online buzz with offline experiences—a strategy competitors now try to emulate.

Pop Mart’s international expansion is key to its strategy. Since 2018, it has opened flagship stores in Seoul, Tokyo, London, and Los Angeles. Overseas revenue in Q1 2025 increased by nearly 480% year-over-year, and by mid-2025, global sales were projected to surpass domestic sales. Collaborations with brands like Marvel, Disney, and anime franchises give Pop Mart global appeal while boosting its reputation at home.

Pop Mart’s rapid rise is built on five pillars: strong original IP, gamified blind box sales, a vibrant fan community, a powerful retail ecosystem, and aggressive global expansion. Its transformation from a Beijing startup into a ¥130 billion revenue giant proves that trendy toys are no longer a niche market but a global cultural movement. Competitors now race to find new angles to capture Gen Z’s attention and become “the next Pop Mart.”

As Pop Mart matures, several players are emerging with the potential to capture the next wave of toy-fashion fusion in China. Some are building original IPs; others are leveraging scale, retail presence, or cultural positioning. Here’s a look at the brands that could take the crown.

Top Toy, founded in 2020 as a subsidiary of MINISO, is one of Pop Mart’s strongest competitors. Built to capture the growing designer toy market, it has scaled quickly with MINISO’s retail network and supply chain. By the end of 2024, Top Toy operated 276 stores, including a 700m² flagship on Shanghai’s Nanjing Road.

The brand’s “big box” model sets it apart. Stores resemble toy department outlets, stocking blind boxes, anime figurines, plushies, model kits, and building block sets. Locations feature licensed IP displays, such as Sanrio and Pokémon, photo areas, and cafes, attracting collectors and casual shoppers.

Top Toy reported ¥9.8 billion in revenue for 2024 (+44.7% YoY) and ¥7.4 billion in the first half of 2025 (+73% YoY). A 2025 funding round valued the company at HK$100 billion ahead of a planned IPO. MINISO founder Ye Guofu highlights the rise of “interest consumption” (兴趣消费), where buyers prioritize hobbies and emotional value over functional spending.

The company is also targeting lower-tier cities. One prefecture-level franchisee expects to recover a ¥1.8 million investment in 18 months, showing strong demand outside major urban centers. This strategy enables Top Toy to grow faster and reach previously underserved markets.

Top Toy focuses on licensed IP rather than original characters. In 2024, it offered 11,000 SKUs, with original IP making up a single-digit percentage. Many of its bestsellers are “second creation” (二创) toys featuring Hello Kitty, Marvel, or Disney characters. This strategy drives sales but increases costs; MINISO spent ¥421 million on IP royalties in 2023 (+136% YoY). Analysts warn that without exclusive IP, Top Toy has weaker margins and loyalty compared to Pop Mart.

The company plans to have 1,000 stores across 100 cities in 40 countries by 2027, aiming for international sales to account for more than 50% of its revenue. It has already tested pop-ups in Jakarta and Bangkok and plans permanent stores in Europe and the Americas. CEO Sun Yuanwen admits building an original breakout IP is challenging, but says the company will experiment while scaling globally.

Top Toy’s execution, reach, and pricing position it as Pop Mart’s closest competitor. Success now depends on its ability to develop proprietary IP to reduce licensing costs and secure long-term growth.

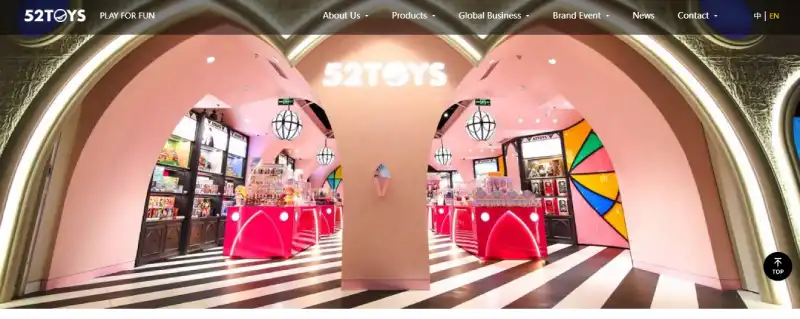

homepage

52TOYS, founded in Beijing in 2015, has grown into one of China’s top toy companies by focusing on collectibles, models, and licensed IP collaborations. Though smaller than Pop Mart or Top Toy, it has carved out a loyal following among hobbyists. In May 2025, the company filed for a Hong Kong IPO to fuel its next growth stage.

Financially, 52TOYS is improving. Revenue increased from ¥4.82 billion in 2023 to ¥6.30 billion in 2024, and the company posted a small adjusted profit of ¥32 million after years of operating at a loss. Over 60% of revenue comes from licensed IPs, with Crayon Shin-chan figurines generating ¥380M GMV in 2024. The company also licenses anime titles, such as One Piece and Naruto, as well as Hollywood franchises and Chinese classics, appealing to a diverse fan base.

While it develops original products, such as the “BOX” transforming toy series, none have matched the success of Pop Mart’s hit characters. Instead, 52TOYS has built a reputation as a curator of high-quality collectibles. It targets serious collectors with detailed figures, blind boxes, and premium model kits costing hundreds or thousands of yuan. This positioning differentiates it from brands targeting casual buyers.

52TOYS is finding momentum abroad. From 2022 to 2024, overseas revenue increased from ¥35 million to ¥147 million, now accounting for 23% of total sales. This growth outpaced domestic performance, showing traction among international anime and manga fans. The company plans to utilize IPO funding to expand further, open physical stores, and invest in marketing efforts.

However, heavy reliance on external IP is a risk. One partnership, Crayon Shin-chan, accounts for a significant share of revenue, making the brand vulnerable if licensors change their terms or the franchise’s popularity fades. Analysts note that creating a signature IP is critical to compete with Pop Mart’s cultural dominance.

For now, 52TOYS is viewed as a second-tier contender, boasting solid growth and international appeal. Its next challenge is breaking beyond its collector niche. A viral product or blockbuster IP could push it closer to Pop Mart’s scale, making its post-IPO strategy one to watch.

KaYu (卡游) has become a major player in China’s collectibles market by focusing on trading cards rather than figurines. Founded to capitalize on Gen Z’s growing interest in collectibles, KaYu produces animation- and game-themed cards, augmented reality cards, and blind-packed sets.

Its breakthrough moment came in early 2023 with the release of Nezha Reborn 2. Licensed KaYu cards tied to the film—some of which were autographed by the director—caused a frenzy, with a rare card reportedly reselling for ¥95,000.

The buzz translated into explosive sales. In 2024, KaYu reported ¥100.57B in revenue, up 278% year over year, instantly making it one of the largest players in China’s toy and collectibles industry. The company is now preparing for a Hong Kong IPO to secure capital and cement its place in the market.

KaYu’s success highlights the breadth of China’s collectibles market. Its cards appeal to fans of anime, films, and games who grew up with Japanese franchises like Yu-Gi-Oh! and now embrace Chinese fantasy IP.

Cards function as both a game and a collectible, often sold in blind packs, creating the same “surprise treasure” effect as Pop Mart’s blind boxes. KaYu has built a strong following through fan communities, tournaments, and trading events, blending fandom and social interaction.

KaYu’s rise demonstrates that “trendy toys” extend beyond vinyl figurines. However, its rapid growth was driven by a perfect storm of hype, a blockbuster film IP, and speculation driving card prices. Analysts caution that sustaining triple-digit growth will be challenging, and KaYu must diversify beyond one-off hits.

If its IPO succeeds, KaYu plans to expand its IP portfolio and invest in technologies such as AR cards and mobile games. Its revenue already rivals Pop Mart’s 2024 numbers, positioning it as a parallel empire in the collectibles industry. While its products cater more to gaming-oriented audiences, crossover with figurine collectors is common.

With Chinese mythology and original content providing rich material, KaYu’s prospects look strong. Its ability to develop evergreen franchises and avoid overreliance on hype will determine whether it can achieve Pop Mart–level influence and stability in China’s collectibles market.

Beyond Pop Mart, Top Toy, 52TOYS, and KaYu, a growing network of niche players is shaping China’s collectibles scene. Traditional retailers are entering the market, specialty stores are building fan communities, and IP studios are moving into physical merchandise.

MINISO is leading this retail crossover. Its “名创优品萌宠” plush line (WAKUKU dolls) became a hit, driving CEO Ye Guofu to reposition the brand as “the world’s No.1 IP design retail group.” Lifestyle retailers like MUJI now stock blind boxes at checkout counters, highlighting their impulse-buy appeal. Chains like ToyCity and KK Group’s KKV experiment with boutique toy lines and artist collaborations, sometimes incubating creators who later work with Pop Mart.

Content-first studios such as 12Dong Culture (十二栋) are also monetizing digital fame. Known for viral WeChat sticker characters, they now release toys and plush merchandise to capitalize on fan loyalty. With the right breakout character, these IP creators could rival larger players.

Traditional manufacturers are upgrading, too. Guangdong and Yiwu-based OEMs are launching branded toy lines. BANBAO and Keeppley compete with Lego using cultural themes, while Blueark (布鲁可) became the first Chinese block brand to IPO in Hong Kong (January 2025). Its “Brick-Men” figures—developed in collaboration with Tmall—created a new category, demonstrating how innovation in sub-genres attracts investors.

Startups are fusing tech with collectibles. Yuanqi Mart and similar brands mix metaverse features with blind boxes, while robotics companies create AI-driven pets and interactive figures, marketed as “Tamagotchi for the AI era.” Guangdong officials predict over ¥100B in toy-tech output as AI integration accelerates.

The toy market in 2025 is an ecosystem rather than a winner-takes-all race. Pop Mart dominates the art toy market, KaYu leads in cards, and Blueark is redefining block toys; however, the diverse interests of Gen Z create space for multiple leaders. Collectors often mix vinyl figures, cards, plushies, and tech-based toys, driving overall growth and innovation in the sector.

By the end of 2025, Gen Z’s buying power is expected to have transformed toys into a major consumer category in China. Spending once dismissed as frivolous has proven resilient, emotional, and largely unaffected by economic slowdowns. Young buyers unapologetically “pay for passion,” fueling Pop Mart’s rise and inspiring others to chase its success.

Pop Mart remains the clear market leader, targeting ¥300 billion in annual revenue and expanding aggressively overseas. Any challenger must compete with both its legacy and its current innovation. Top Toy is the most direct rival, rapidly scaling stores nationwide and abroad, but its long-term success hinges on developing proprietary IP to complement its licensed products.

Meanwhile, 52TOYS and KaYu thrive in niche segments—figurines for dedicated collectors and trading cards for gamers. KaYu’s revenue already rivals Pop Mart’s, but through a different product strategy.

The “next Pop Mart” may not be a direct competitor but a category leader in a new sub-sector. AI-interactive toys, metaverse-linked collectibles, or everyday carry (EDC) gadgets could define the next wave. Blueark is attempting this with block figures, showing that brands can rise by making themselves synonymous with a category (“品牌即品类”).

China’s toy industry has evolved from a utilitarian market to one centered on emotional value, creating opportunities for innovation and growth. With the core collectible toy consumer base set to exceed 100 million by 2025 and a projected market value of ¥100–150 billion, the stakes are high.

Pop Mart’s dominance shows the potential of passion-driven spending, but its success also sets a blueprint for new entrants. Whether a scaled rival, a global expansion play, or a tech-focused newcomer claims the spotlight, the race is on—and Gen Z’s tastes will determine the winner.

China’s collectibles market is moving fast, driven by Gen Z’s emotional spending power and love for IP-driven products. Pop Mart’s rise proves that cultural insights, innovative retail models, and community engagement are the keys to dominating this space. That’s where ChoZan comes in.

Our team specializes in helping global brands decode China’s Gen Z market and uncover opportunities in emerging industries like collectibles, entertainment-driven retail, and toy-tech innovation. With 15+ years of hands-on experience, we’ve guided Fortune 500 companies, leading retailers, and top tech brands through China’s complex consumer ecosystem.

Here’s how ChoZan can help your brand lead the next wave:

If you’re serious about entering China’s ¥110B+ collectibles market or taking inspiration from its fastest-growing consumer sector, ChoZan is your insider advantage.

Contact us to unlock cultural insights, consumer intelligence, and strategies that can position your brand as the next big name in China’s trend economy.

Artist collaborations help toy brands stand out in a crowded market by offering exclusivity and unique creative perspectives. Limited-edition drops tied to well-known illustrators or independent artists create hype and deepen fan engagement. These collaborations also strengthen brand identity, attract global collectors, and allow companies to charge premium prices for signature designs.

Chinese toy brands face global counterfeiting challenges, particularly for popular characters like Labubu or Molly.

In 2025, leading companies invest in advanced anti-counterfeit packaging, blockchain-based authentication, and legal teams for cross-border trademark enforcement.

Partnerships with e-commerce platforms like Tmall also help remove knockoffs quickly, safeguarding brand value and consumer trust worldwide.

Fan conventions are a critical marketing tool. Events like Pop Mart’s PTS (Pop Toy Show) or Wonder Festival Shanghai provide immersive experiences for collectors, strengthen loyalty, and drive buzz for new releases. These conventions often feature exclusive figurines, artist meet-and-greets, and workshops, turning brands into cultural ecosystems rather than just retailers.

Toy companies employ a data-driven approach to store placement, often selecting high-traffic malls in first- and second-tier cities. Location selection takes into account local collector demographics, social media trends, and regional spending power. Flagship stores also double as photo-worthy attractions, driving organic promotion when fans share their experiences online.

Yes, subscription boxes are experiencing rapid growth. Companies now offer quarterly or monthly blind-box subscriptions, guaranteeing early access to exclusive characters. This model generates recurring revenue, streamlines inventory planning, and fosters long-term relationships with collectors. It also helps smaller brands compete by offering novelty without needing physical store expansion.

AI vending machines are revolutionizing convenience retail. These machines can recommend products based on purchase history, display real-time inventory, and even gamify the buying process with interactive screens. Pop Mart and startups use AI vending for both urban convenience and overseas expansion, reducing staffing costs while maintaining strong brand engagement.

Scaling internationally involves localizing packaging, character design, and marketing to fit cultural preferences. Pop Mart, for instance, adjusts color palettes and character styling for Japan and the US. Partnering with local artists, retailers, and licensing agencies also helps Chinese brands navigate foreign regulations and avoid cultural missteps while growing revenue abroad.

Although most buyers purchase for passion, resale value still impacts brand perception. Limited editions with strong secondary-market demand reinforce exclusivity and status. Some collectors fund future purchases by trading rare pieces, creating a vibrant economy. Brands benefit as resale buzz generates organic marketing and elevates their cultural relevance.

Brands rely on social media analytics, e-commerce trends, and fan surveys to assess character success. Metrics include hashtag reach, engagement rates, and repeat purchase behavior. Some companies run closed beta tests for new IP designs to gauge interest before mass production, reducing financial risk and ensuring product-market fit.

Chinese art and design schools are key talent pipelines. Toy companies collaborate with top universities, such as the China Academy of Art, to incubate new characters and hire emerging designers. Graduates bring fresh aesthetics and storytelling approaches, helping brands continually innovate and appeal to Gen Z’s evolving cultural tastes.

Licensing partnerships are shifting toward equal collaborations. Instead of simply acquiring rights, toy companies co-create merchandise with film studios, gaming companies, and artists. This approach allows deeper storytelling, strengthens fan attachment, and maximizes revenue. Deals now include co-marketing campaigns, NFTs, and digital experiences alongside physical products for richer engagement.

As Gen Z consumers push for eco-consciousness, Chinese toy makers are experimenting with biodegradable plastics, recyclable packaging, and modular toys that reduce waste. Companies like Blueark promote reusable block systems, while Pop Mart has pledged to phase out non-recyclable packaging. These initiatives align with government policies and consumer values.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

WeChat VS Weixin, an Essential Guide for Marketers

5 Chinese Fashion Bloggers (KOLs) You Must Know in 2025

7 Digital Lifestyles of Chinese Gen Z Consumers

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.