CONTENT

By: Ashley Dudarenok

Updated:

China’s influencer economy is bigger, faster, and more competitive than ever. In 2024 alone, MCNs — multi-channel networks — were behind many of the country’s record-breaking livestream sales and viral content trends. They’re the engines connecting brands with top creators, building campaigns across Douyin, Kuaishou, Bilibili, and RedNote, and turning social buzz into measurable sales.

From e-commerce giants managing thousands of livestream hosts to boutique agencies producing high-concept micro-dramas, MCNs are shaping the industry.

Understanding these networks isn’t optional for brands inside and outside China — it’s essential for making the right partnerships and entering the market with impact.

Thinking about working with a Chinese MCN?

Choosing the right partner depends on your category, audience, and campaign goals. Platform strengths, influencer network quality, and track record all matter.

At ChoZan, we research and track China’s top MCNs in Douyin, Kuaishou, Bilibili, and RedNote. Our insights help brands understand which agencies best suit their needs before any collaboration begins.

In China’s creator economy, MCN (Multi-Channel Network) agencies sit at the center of content, commerce, and culture. They manage influencers, plan content strategies, and link creators with brands and platforms.

Unlike Western MCNs that mainly provide ad monetization, Chinese MCNs integrate full-stack services — from livestream training and supply-chain operations to compliance and IP development.

As of mid-2025, China hosts around 29,000 registered MCN-type organizations, up from fewer than 5,000 in 2017. According to research, the market value surpassed ¥63.6 billion (approximately US $8.9 billion) in 2024 and is projected to exceed ¥70 billion (roughly $9.8 billion) in 2025.

This steady expansion reflects the growing sophistication of China’s digital economy, where platforms such as Douyin, Kuaishou, Bilibili, and RedNote rely on MCNs to professionalize creators and power livestream commerce.

China’s MCN ecosystem is diverse, but most agencies can be categorized into three main groups. Each type operates with different goals, revenue models, and platform strengths, so knowing the differences can help you identify the right fit for your brand.

| MCN Type | Primary Role | Key Services Provided |

| E-commerce MCN | Drive sales via livestreaming and shop ops | Supply chain, logistics, shop management, livestream support |

| Content MCN | Produce engaging, high-quality content | Video production, talent incubation, creative services |

| Marketing MCN | Deliver end-to-end influencer marketing campaigns | Influencer matchmaking, campaign strategy, analytics |

Founded in 2016, Joy Media is the largest MCN on Douyin in terms of scale. Based in Beijing and Hangzhou, it operates in livestreaming, short video, and e-commerce. The agency manages an enormous creator network and holds a dominant share of Douyin’s influencer market.

Key details:

With its massive talent pool, broad reach, and proven ability to turn traffic into sales, Joy Media remains the top MCN on Douyin and a major player in China’s social commerce industry.

Yowant, officially Hangzhou Yaowang Technology, is one of China’s largest publicly listed MCNs. Founded in 2010 and acquired by Saturday Co. in 2018, it specializes in livestream e-commerce, influencer marketing, and brand partnerships across Douyin, Kuaishou, and other platforms.

Yowant Network is also one of the earlier organizations to train celebrity artists. With more than 30 collaborating artists, such as Wang Zulan and Cecilia Cheung, the combined fan base exceeds 500 million.

Key details:

Despite recent losses, Yowant remains a major force in China’s MCN industry. Its scale, diversified portfolio, and push into global livestreaming signal its ambition to be a cross-border leader in influencer-driven commerce.

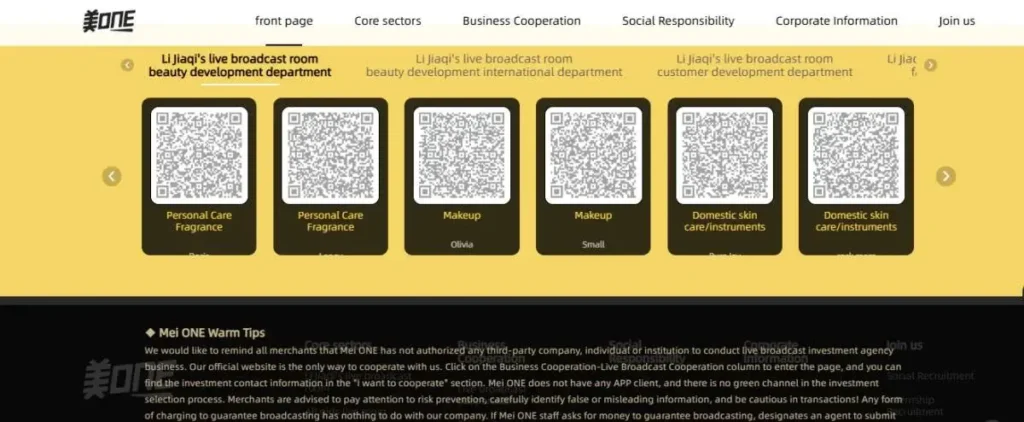

MeiONE, founded in 2017, is best known as the agency behind Li Jiaqi, China’s “Lipstick King.” Headquartered in Shanghai, the MCN focuses on beauty, skincare, and lifestyle e-commerce, operating high-impact livestream channels and co-developing products with leading brands.

Key details:

With its star anchor, strong focus on the beauty category, and proven sales records, MeiONE continues to shape consumer trends in China. Its blend of content, brand partnerships, and high-profile campaigns cements its role as a top-tier e-commerce MCN.

Qianxun, founded in 2019 in Hangzhou, gained prominence through its flagship anchor, Viya, one of China’s most successful livestreamers. The MCN built a strong reputation in multi-category sales and brand collaborations.

Qianxun was categorized as a “stability-focused institution”, balancing content, traffic, and operational efficiency. It actively enhances consumer trust through IP creation and explores new e-commerce models while adapting to rapid market shifts.

Key details:

Despite losing its star host, Qianxun remains competitive by developing a diversified streamer lineup and strengthening brand partnerships. Its multi-platform presence and long-term merchant relationships keep it relevant in China’s live e-commerce sector.

Founded in 2017 by Xin Youzhi, known as “Xinba,” Xinxuan is the leading MCN on Kuaishou and a major force in China’s livestream e-commerce sector. The company is known for its large-scale sales events, diversified product categories, and a network of high-performing hosts.

Key details:

With unmatched sales capacity on Kuaishou and a proven track record in brand promotion, Xinxuan continues to dominate China’s northern and lower-tier city e-commerce markets. Its combination of supply chain strength and influencer-driven sales makes it a benchmark in large-scale live commerce.

ErGeng, founded in 2015 in Hangzhou, is a media and video content MCN excelling in culture, travel, and food storytelling. Its focus is on high-quality production and narrative-driven influencer content across major Chinese platforms.

Key details:

ErGeng’s strength lies in merging polished production with subtle brand storytelling, ideal for heritage, travel, and premium lifestyle campaigns seeking engagement through narrative.

Formerly known as Make a Friend, Be Friends Holding was founded in 2019 and quickly became one of Douyin’s leading e-commerce MCNs. Built around Luo Yonghao’s livestreaming presence, the company has since expanded into multi-platform operations and achieved a listing on the Hong Kong Stock Exchange.

Key details:

By blending influencer-driven sales with corporate-scale operations, Be Friends has positioned itself as a rare publicly traded MCN. Its cross-platform strategy and capital backing give it both stability and growth potential in China’s competitive livestreaming sector.

Launched in 2016 by internet personality Papi Jiang in partnership with Taiyang Chuanhe, Papitube is one of China’s first major content-focused MCNs. It specializes in creative short videos, influencer incubation, and cross-platform storytelling rather than purely e-commerce-driven sales. Its roster encompasses diverse genres, ranging from comedy and lifestyle to beauty and food.

Key details:

Papitube remains a leader in the creative MCN space, proving that strong storytelling and multi-genre content can rival pure sales channels in influence. By elevating creators into multi-platform personalities, it has built a sustainable model centered on high-quality, shareable video content.

Founded in 2014, Dayu Network (Suzhou Dayu Digital Culture) is a diversified MCN that combines influencer management, ACG (anime, comics, games) content production, and branded consumer products. Its model integrates person IP, digital IP, and physical IP, allowing it to operate in entertainment and e-commerce. By 2025, Dayu had built a complete ecosystem encompassing content production, distribution, brand marketing, and product sales

Key details:

By combining content creation with consumer products, Dayu Network has carved out a unique space in China’s MCN industry. Its fusion of ACG storytelling, influencer marketing, and branded merchandise offers a multi-revenue model that appeals to both fans and commercial partners.

Established in 2016, Erka Media is a large-scale MCN with strong capabilities in short video production, influencer incubation, and cross-platform marketing. Known for its creative storytelling and multi-vertical content, it operates across China’s major platforms and extends to global social networks.

Key details:

With a strong cross-platform strategy and a diverse creator roster, Erka Media bridges domestic and overseas markets. Its adaptability across categories and ability to execute multi-platform campaigns make it a preferred partner for both local and global brands.

Founded in 2014 and based in Shenzhen, Fengqun Culture is a full-service MCN specializing in multi-platform KOL marketing. Known for its ability to run synchronized campaigns across China’s major social channels, it manages a wide range of influencers, from mainstream celebrities to niche content creators.

Key details:

Fengqun Culture’s ability to tailor content for different platforms while maintaining a unified brand message makes it a go-to agency for integrated influencer marketing. Its combination of mainstream appeal and subculture expertise ensures reach across diverse consumer segments.

Founded in 2016 and based in Qingdao, Gumai Jiahe is a creative-driven MCN specializing in short-video storytelling and influencer incubation. Known for producing plot-based micro-dramas, it blends narrative entertainment with subtle brand integration to drive audience engagement and product awareness.

Key details:

By combining storytelling with influencer marketing, Gumai Jiahe provides brands with a way to engage audiences without resorting to aggressive selling. Its creative-first approach has helped it stand out in a market dominated by sales-focused MCNs.

Ruhnn, listed on Nasdaq and based in Hangzhou, is a prominent KOL-focused MCN that cultivates influencers and monetizes through e-commerce. One of their star talents is Zhang Dayi (Eve Zhang), a powerful influencer known for fashion and beauty content.

Key details:

Ruhnn combines celebrity talent with institutional backing to deliver a potent mix of influencer credibility and reach, making it a go-to MCN for fashion and beauty verticals.

Onion Video, founded in 2016 in Chengdu, is a creative MCN with a “pan-life” lifestyle focus. It specializes in trend-forward, high-impact short video production that appeals to younger, urban Chinese consumers.

Key details:

Onion’s ability to generate culturally resonant lifestyle content at scale positions it as a powerful MCN for brands seeking authenticity and storytelling in China’s short video ecosystem.

Working with an MCN in China means making decisions based on real-world operations, verified performance data, and a precise alignment with your goals. ChoZan gives brands the insight to do this with confidence.

We help by:

Every insight is drawn from up-to-date market intelligence and on-the-ground experience, so your MCN partnerships in China are built on facts, not guesswork.

Ready to partner with the right MCN?

Contact us to discuss your goals, review case studies, and start building a China strategy that works.

An MCN (Multi‑Channel Network) in China is an agency that manages influencers (KOLs) and oversees content strategy, production, monetization, and brand partnerships. Unlike Western models, Chinese MCNs play a central role in facilitating livestream commerce, influencer growth, and platform integration.

The number of MCNs in China has exploded—from around 5,000 in 2017 to over 30,000 by 2024. This surge reflects the rapidly expanding influencer economy and brands’ reliance on MCN-driven marketing.

MCNs act as one-stop partners—helping brands discover talent, create content, and run livestream e-commerce campaigns. They streamline brand strategies across platforms like Douyin, RedNote, and Bilibili, saving brands from navigating a fragmented ecosystem alone.

In early 2025, the Cyberspace Administration of China (CAC) introduced new draft regulations requiring MCNs to register and adhere to guidance on politics and ethics. Restrictions aim to prevent the spread of rumors, protect minors, and enforce compliance through platform-linked registration.

Studies highlight that MCNs can help creators optimize algorithmic reach and monetize effectively—but they may also exploit creators or limit their autonomy, with contractual terms often favoring the agency rather than individual talent.

Chinese MCNs manage talent across major platforms, including Douyin, Kuaishou, RedNote (RED), Bilibili, and Weibo. Many are closely tied to platform ecosystems, enabling seamless content distribution and livestream commerce.

MCNs professionalize influencer development through training, production support, and cross-platform planning. They help creators scale quickly, maximizing follower growth and campaign efficiency in a fragmented media environment.

Live commerce—a blend of livestreaming and instant retail—is massive in China. With over $500 billion in sales in 2023, it is expected to grow further in 2024. MCNs serve as enablers, managing the execution and logistics of livestreaming campaigns.

MCNs have shifted cultural production by influencing content formats and storytelling styles. They amplify creators and shape trends, acting as intermediaries between platforms, creators, and audiences.

Yes. MCNs increasingly support Chinese influencers in entering global markets through platforms like TikTok, YouTube, and Instagram, helping brands launch cross-border campaigns.

Many MCNs now use AI and analytics to match brands with influencers based on engagement, sentiment, and audience demographics—boosting campaign effectiveness and ROI over traditional vanity metrics.

MCNs accelerate all stages of influencer campaigns—from talent scouting and content creation to compliance and sales performance. They reduce complexity, scale quickly, and offer platform expertise that brands rarely have in-house.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

A List of 14 Major MCNs in China

Top Online B2B Chinese Channels

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.