Gen Z includes all those who were born after 1995 and 2000. They’re different from previous generations in that they’re digital natives. They were exposed to smartphones and the internet from an early age and China’s Gen Z is unique in that many of them are the only child in their family. They were raised during prosperous times in China, enjoying better living standards and better resources.

Characteristics of Gen Z, Gen Y, and Gen X

Gen X (1965 – 1980)

Attitude: Labour is the highest virtue, Loyal, Patriotic

Communication mode: Phone calls, SMS

Devices used: Desktop

Gen Y (1981 – 1995)

Attitude: Work-Life Balance, Angry Youth, Non-mainstream, Slash lifestyle

Communication mode: Internet, Mobile Network

Devices used: Laptop, Smartphones

Gen Z (1996 – 2010)

Attitude: Free, Flexible work life, Indoorsy, Buddha-like

Communication mode: Phone calls, SMS

Devices used: Smartphones, 5G phones

Why targeting Gen Z needs to be a factor for brands in China

Gen Z is the major consumption force: There are around 260 million Gen Z individuals in China, and will make up to 27% of the country’s total population by 2025. Gen Z will likely account for 40% of overall consumption by 2020.

Gen Z is highly-educated: About 50% of Gen Z in China will be university degree holders. By now, the first batch of Gen Z has just joined the labour force, while the majority of Gen Z are still students. Internship experiences help them to have a first grasp of how society works.

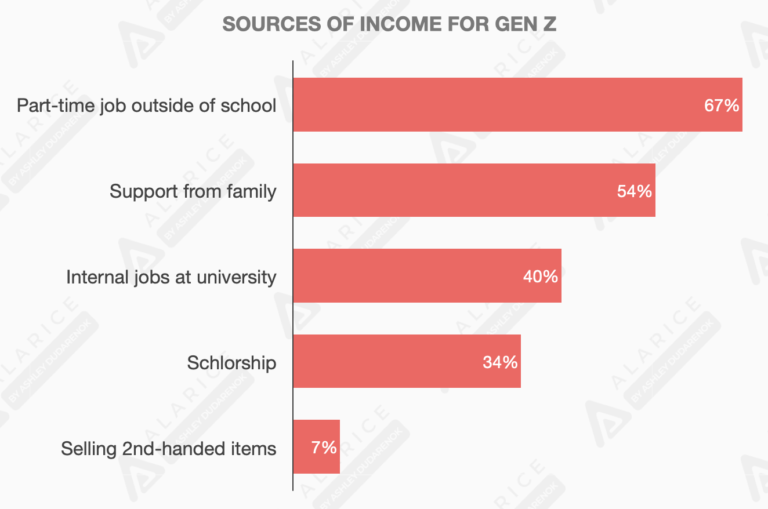

Gen Z is the “invisible rich”: Survey Data shows that the monthly disposable income of Gen Z can reach up to 3,501 RMB. There are high expectations in the Gen Z lifestyle, as they are a high-income group with no pressure to pay for expenses like rent as they are often living at home with their parents. Over 35% of undergraduates have multiple sources of income – scholarships, part-time jobs and internal job opportunities in university are popular ways of earning money.

Gen Z is the top consumer: They are more than willing to pay for their diversified interests, like Esports and Erciyuan. They make up over 60% of the esports players and 32% of the esports contest revenue. They are also responsible for almost 40% of the sales revenue of Erciyuan cosplay costumes and over 300% increase in Hanfu sales for more than 2 years.

The key digital behaviours of China’s Gen Z

1. Health conservation economy

Gen Z in China has high expectations for health, but their self-rated satisfaction to their health conditions are significantly lower than those of other generations. They are also the group that is the most anxious about their own health. Gen Z began to purchase healthcare products more frequently in the non-promotion period. In addition to self-use, Gen Z will also popularize healthcare products among friends and family, and healthy gift boxes have become a popular gift choice for them.

2. Fun and fresh economy

Trendy life is no longer just a lifestyle of following general trends out there, but has become a positive attitude to life. 50% of Gen Z expresses that they want to have the latest or untried experience. The two most popular trend categories for young people today are apparel and sneakers, accounting for 21.68% and 19.86% respectively.

3. Fans’ economy

Fans’ economy is becoming increasingly prominent in recent years. It is characterized by buying celebrities’ merchandise and endorsed products to boost the reputation of celebrities. Fans pursue individuality, establish their own social circle, and seek identity through social media.

4. Guochao (国潮) economy

Guochao is not only a fashion trend, but also reflects the new generation of young people’s recognition and pride in Chinese culture. Marketing campaigns formed on collaborations between apparel or sneaker brands become the most effective touchpoint to reach young consumers, accounting for over 60% total spending. In addition to product design, the diversification and the convenience of information acquisition channels, marketing operations are becoming one of the important driving forces affecting the rapid growth of Guochao brands.

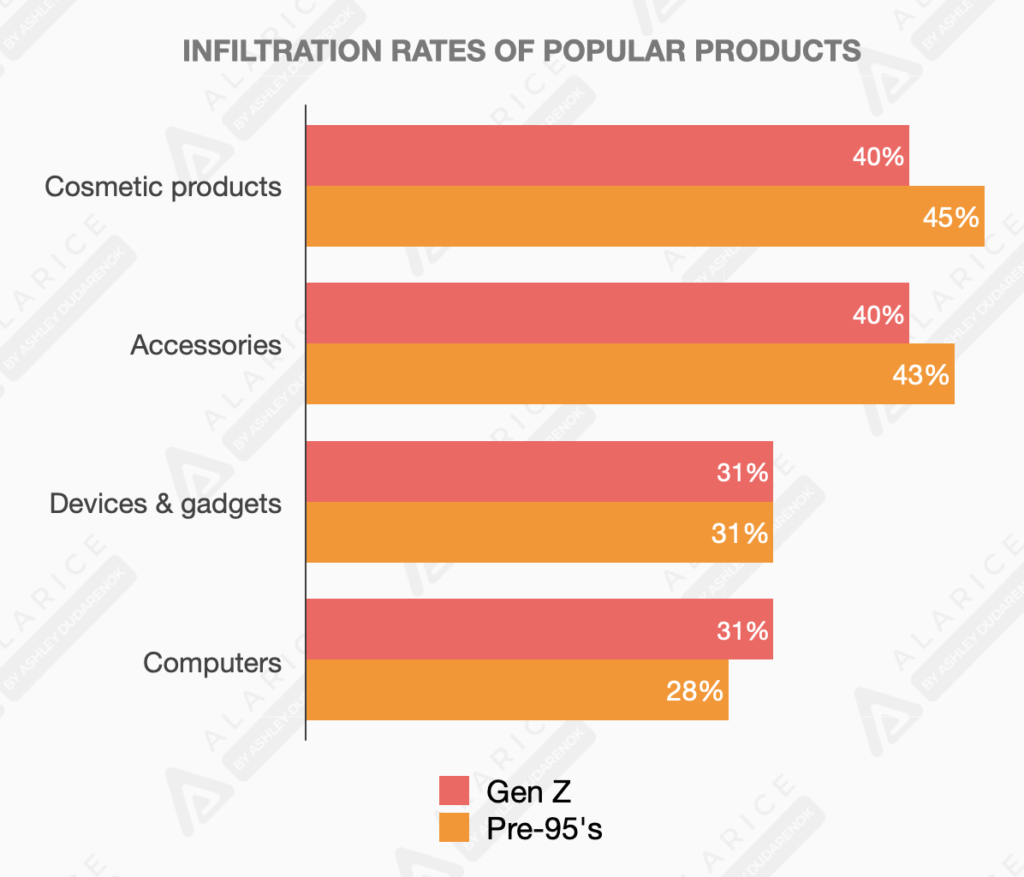

5. Appearance economy

Categories closely related to appearance, such as clothing, beauty, and shoes, make up for nearly 50% of the consumption of Gen Z in e-commerce. Skincare consumption has moved forward by almost 10 years. Nearly 40% of Gen Z started buying skincare at 16-18 years old, versus 23-25 years old in post-90’s and after 25 years old in post-85’s. At the same time, Gen Z’s spending on skincare products has been rising year on year, and the growth has only accelerated.

6. Pet economy

Pets bring an irreplaceable sense of companionship to Gen Z in China. They are not only friends, but also family members. In recent years, the number of Gen Z pet owners and their spending on pet-related products have increased year on year. Chinese pet owners, especially Gen Z, not only maintain their own well-being, but also pay special attention to the health conditions of their pets. Pet medical care (23%) has become the second largest expenditure on the overall pet consumption following pet food (34%).

7. Lazy economy

The consumption of lazy products on Taobao increased by 82% year-on-year in 2020. Most Gen Z are too lazy to cook, so fast food became the best alternative for them. However, ordinary instant noodles are no longer enough to meet the needs of the increasingly sophisticated Gen Z and their pursuit of quality life. For instance, self-heating hot pot brand, Zihaiguo, was officially launched in 2018 and targeted Gen Z as their key customers. The brand achieved over 100 million RMB in GMV after 9 months and over 500 million RMB in GMV in 2019.

Gen Z gradually dominates the consumer market, and the fight for Gen Z has become an important battle for brand development today.

Our 690+ page ChoZan mega report has a dedicated section on more insights about Gen Z consumers along with other very promising modern Chinese consumer groups such as millennials, the silver-haired generation, Chinese men aged 40+, power women, super mums and dads, pet lovers, lower-tier city youth and happy singles. Our team at ChoZan and Alarice will also publish more reports about these consumer groups in the near future, stay tuned!