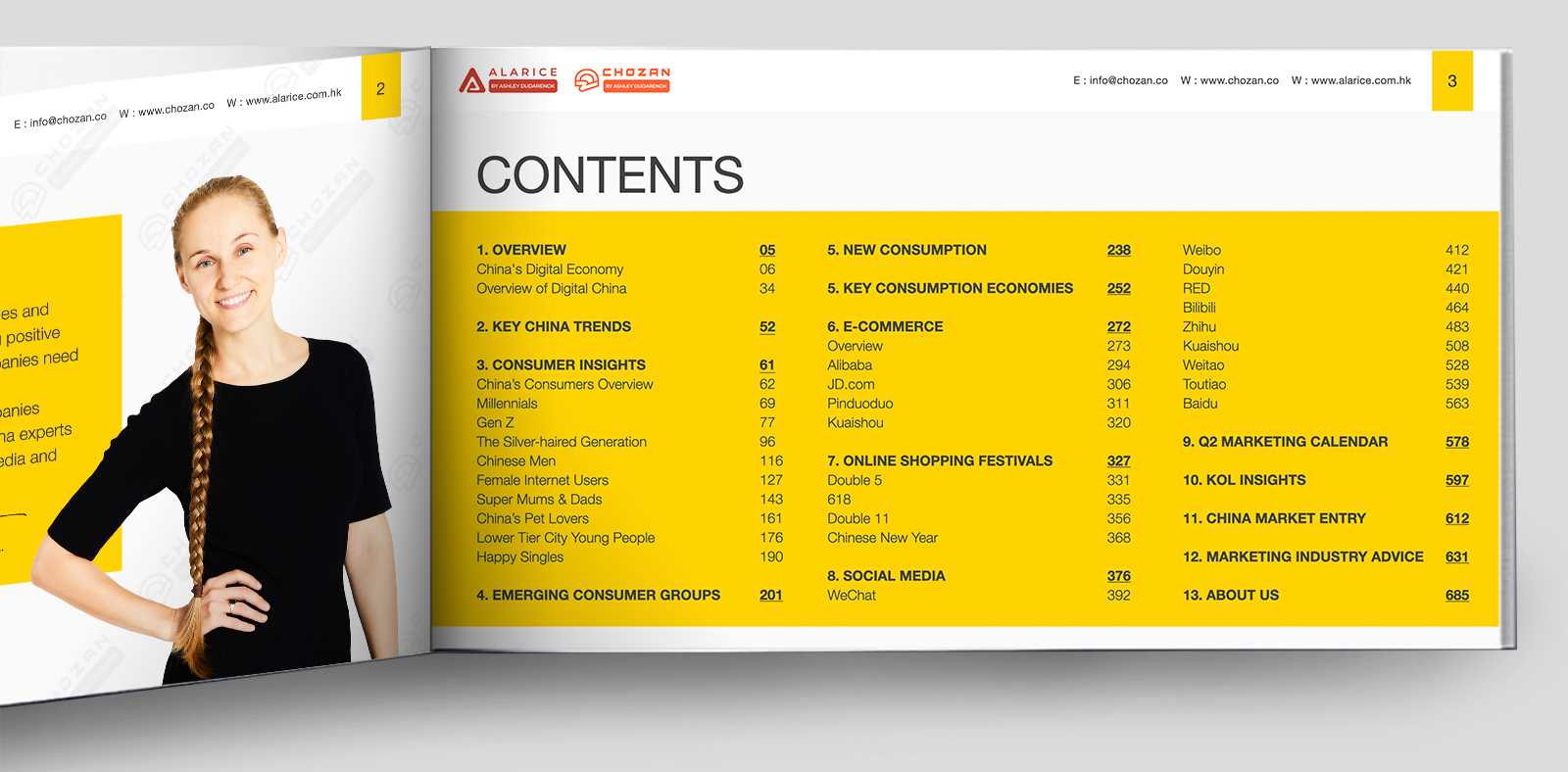

THE MEGA GUIDE: CHINA E-COMMERCE AND DIGITAL MARKETING, Q3 2021

This 690+ page report will provide you with the latest insights about China’s digital space, covering major consumer groups and the most popular social media and ecommerce platforms. You will also find up-to-date, actionable advice on China marketing strategies and latest industry updates from 50+ China experts and the ChoZan marketing team.

DOWNLOAD THE CHINA REPORT

Thank You! Here's Your Download!

WHAT'S INSIDE THE CHINA REPORT

- An overview of China’s economy in Q3 2021

- Latest trends affecting China’s development

- Insights on China’s major consumption powers by Gen Z, Super moms. Pet owners, Lower-tier city dwellers, Seniors etc

- 15 key consumption economies in China in 2021

- Emerging consumer groups such as Gen Z moms, delicate man, night owls etc

- New Consumption trends

- E-commerce and livestreaming ecommerce in 2021

- Insights on major ecommerce platforms

- Latest results of 618 2021 and other ecommerce shopping festivals

- Major Chinese social media updates in 2021

- Your marketing calendar for Q3 2021

- China’s KOL landscape

- Industry overview: FMCG, Luxury, F&B, Automobile, Travel

- More than 50 top China experts’ opinions on the Chinese digital trends you need to pay attention to in Q2 2021

- And actionable tips for market entry

ABOUT THE CHINA REPORT

ChoZan team prepared another China Mega Guide: E-commerce and Digital Marketing, Q3 2021 to help marketers and China watchers get latest insights on China’s economic development, in addition to ecommerce and digital marketing trends. In Q3 of 2021 China’s digital space was re-transformed by new regulations, rules and consumer demands. While China’s major economic indicators keep showing positive growth, Covid-19 caused shifts in consumers’ behaviour, to which companies need to keep close attention. We collected the latest insights and developed detailed profiles of major consumer groups in China, such as:

- Millennials: China’s 400+ million millennials represent a huge and emerging consumer group with a large impact on the economy. Most millennials own smartphones that are constantly in use and used in more versatile ways than their counterparts in the West. Millennials enjoy luxury brands. Forecasts expect them to make up 40% of global luxury goods sales by 2024, with around 58% of that group aged 18 to 30. It’s key for brands to understand the consumer behaviours of millennials.

- Gen Z: Post-95s, Gen Z, or Dotcom kids. They go by many names and are a truly global generation, shaped by the technology of the 21st century. Gen Z will make up 27% of the population by 2025. About half will earn an university degree They’ll have an average of 18 jobs across 6 careers and 15 homes. Around 2,000,000,000 Gen Zs globally

- The Silver-Haired Generation: Chinese seniors are eager to benefit from China’s fast-growing mobile technology. Accounting for 13% of the population in 2015 and with 255 million in 2020, the senior group is expected to account for 25% by 2050. WIth such eagerness to adopt new technology and tools, brands should look to meet the needs of the older generations, who desire experiences, social connections and learning opportunities.

- Female Internet Users: Chinese women with higher education and greater participation in the workforce have more financial autonomy and personal freedom. 56% of the female population completed secondary school and enrolled in tertiary education, while only 46% of men do so. Women are spending more on themselves. Cosmetics sales rose 13% in 2019, while aesthetic medical services have grown 24% in five years. Not only are women spending on themselves, but they’re also responsible for three quarters of household purchasing decisions. Women represent a significant power in China’s market.

- Chinese men: Chinese men are starting to care more about their appearance and this trend will continue in 2021. In 2020, about 30% of cosmetic medicine consumers in China were male.

- Super Moms and Dads: The replacement of China’s one child policy with the two child policy in 2015 has created an organic push for the maternity and baby products market. The sector is expected to maintain an annual growth rate of 20-30% for the next ten years. Post-90s super moms account for 70% of related product categories, according to JD platform data. They have become a major market force, preferring trendy products while being less price-sensitive.

- Pet Lovers: China’s pet lovers share overlaps with millennials and happy singles. The pet industry is growing but there’s still lots of untapped potential. Pet lovers are creating unique lifesyles and communities that include socializing and accessorising. Additionally, pet owners are willing to pay for quality products.

- Lower Tier City Youths: 930 million Chinese people live in cities designated third tier or lower and in rural areas, but this previously overlooked group has had significant growth in recent years with consumption expected to reach US$8.4 trillion by 2030. Lower tier city young people in what the Chinese call “sinking cities” aren’t sinking at all. They’re spearheading this growth.

- Happy Singles: The 260 million single adults in China generally have more disposable income and are spending on shopping, socializing and travelling. Chinese singles are looking for experiences, enjoyment, and fulfilment. Men account for the majority of the single population.

In this report you will also find emerging consumer groups gaining more power in H2 2021:

- Gen Z moms

- Delicate men

- Medical Beauty Devotees

- Night Owls

In order to help companies navigate market entry we also collect latest industry insights and best practices for ecommerce and social media platforms:

- WeChat, Weibo, Red, Douyin, Zhihu and others

- Tmall, JD and Pinduoduo

In this report ChoZan team monitors latest insights in Q3 of 2021 to help companies identify new opportunities and act on it for the following industries:

- FMCG

- F&B

- Luxury

- Travel

- Automobile

- Education

Our founder Ashley Dudarenok has also interviewed more than 50 China experts to get their take on the recent developments in the Chinese economy, consumer landscape, digital marketing and ecommerce space.

Download ChoZan’s Mega Guide: China E-commerce and Digital Marketing Q3 2021 to get not only insights and trends, but also your marketing calendar. Or contact the ChoZan team to get answers for your China marketing strategy planning.

CHINA Q3 2021 KEY HIGHLIGHTS

- China’s e-commerce market is projected to reach USD 1,260,359 in revenue during 2021, this would put them way over other major players such as the US and Japan.

- China’s economy has been rapidly recovering since the first quarter of 2021, with China’s GDP expected to grow 8% in the same year.

- The number of Chinese monthly internet users has increased in the first half of 2021 but this number has not exceeded the highest traffic of 116 million active users in 2020 Q2.

- The medical beauty industry in China is growing. The market size is expected to reach 311 billion RMB in 2023.

- Douyin has held their Double 5 festival this year from April 30th to May 9th. Due to the event period marking the beginning of summer, summer apparel items became best sellers during 2021 Double 5 on Douyin.

- Cross-platform KOLs are now the trend. More than 67% of cross-platform KOLs operate on 2 platforms with the most popular combination being Douyin and Kuaishou.

ABOUT THE AUTHORS

Ashley Dudarenok is a China marketing expert, serial entrepreneur, global keynote speaker, 3 time bestselling author, vlogger, podcaster, media contributor and female leadership spokesperson. She was recognized as a LinkedIn Top Voice in Marketing in 2019 and chosen as an Asia Pacific Top 25 Innovator by the Holmes Report. She is the Founder of China-focused social media agency Alarice and China insights and training company ChoZan. Ashley is an active supporter of women in leadership and business and is the creator of the self-development and mentorship program FIRE

Jacqueline Chan is Project Director at Alarice and ChoZan. She has hands-on experience in account management for multinational brands in the FMCG, luxury and hospitality sectors. She knows how to develop and execute in-depth digital marketing strategies on the most popular Chinese social media platforms, like WeChat and Weibo, and run creative campaigns on platforms such as Douyin, RED, Zhihu and more.

Wendy Chen is the Head of Digital Products at ChoZan. She’s one of the leading experts on KOL campaigns and China’s fan economy. As a marketing manager at Alarice, Wendy leads account management projects on niche social media platforms and helps brands to launch creative campaigns on Bilibili, RED, Douyin and other Chinese social media platforms.

Natalia Drachuk is Marketing Director at Alarice and ChoZan. For the last 5 years at Alarice Natalia has guided clients and developed global marketing strategies and social media plans.

Maureen Lea is a writer, editor, copywriter and educator who has worked in many genres and formats. She specializes in research, finding patterns and making data understandable.

Ashley

Founder of ChoZan & Alarice

MASON

Project Director

Jacqueline

Project Director

NATALIA

Marketing Director

WHAT DO WE DO?

ChoZan’s training and resources will increase your expertise about the Chinese market, Chinese consumers, Chinese social media, KOL/influencer marketing and China’s technology landscape. This includes:

- China Market Research and Strategy Development to help you identify your consumers and the most effective ways to communicate with them.

- Custom Corporate Training to increase your Chinese social media marketing expertise and get your team members up to a consistent skill level.

- Expert Calls for your urgent China marketing questions.

- ChoZan’s Online Course with 8 modules that you can take online to get a practical handle on China’s market, its modern consumers and Chinese social media marketing and selling.

- Keynote Speeches about modern Chinese consumers, Chinese social media marketing or China’s New Retail deliver in dynamic style.

The China Marketing Circle is an exclusive membership group for China watchers with weekly insights, trends, strategies and case studies related to consumers and marketing in China.

GET IN TOUCH

ABOUT THE CONTRIBUTORS

Saw Gin Toh

Head of Strategy Consulting for Dentsu Creative, China

Michelle Lau

Co-Managing Director of Alibaba Group France

Aurelien Rigart

Co-Founder and VP, IT Consultis

Simon Zagaynov

CEO at ExpoPromoter

Chris Baker

FOUNDER TOTEM MEDIA

Tait Lawton

Founder, Nanjing Marketing Group

George Godula

Chairman of Web2Asia

Michael Zakkour

Founder – 5 New Digital and China BrightStar

Mark Tanner

Founder & Managing Director at China Skinny

David Thomas

China Expert and Author of China Bites

David Gulasi

CEO of davegulasi.com and China KOL

Alberto Antinucci

Digital Innovation Strategist and China Expert

Chenyu Zheng

Founder of Apple Sister Creative Consultancy

Kristina Koehler-Coluccia

Head of Business Advisory at Woodburn Accountants & Advisors

Ron Wardle

Incredible Media, Founder and Yooma Wellness Inc, CEO

Michel Tjoeng

SVP Sales & Marketing, ChatLabs

Miro Li

Founder of Double V Consulting & CHINAble Academy

Josh Gardner

CEO KUNG FU DATA

Jerry Clode

Founder, The Solution Consultancy

Arnold Ma

Founder and CEO, Qumin

Martina Fuchs

TV Anchor & Business Journalist

Elena Gatti

Managing Director Europe, Azoya

Pablo Mauron

Partner & Managing Director China DLG (Digital Luxury Group)

Olivia Plotnick

WeChat and China Marketing Specialist

Jimmy Robinson

Co-Founder and Director, PingPong Digital

Pascal Coppens

Partner at Nexxworks, author of China's New Normal

Sharon Gai

Director of Global Key Accounts, Alibaba Group

Tomas Kucera

Business Development Manager at FSG

Shameen Prashantham

Associate Dean & Professor of CEIBS

Sander Kole

Sander Kole

Albert Krisskoy

Old China Hand, known online as “papahuhu”

Clement LEDORMEUR

GM & Partner at 31TEN

Meha Verghese

Growth and Innovation Lead, MediaCom China

Shine Hu

ChemLinked Market Research Analyst

Jasmine Zhu

Founder & Head of Brand of CI Brand Management

Kejie Yi

Content manager at China Marketing Insights

Elijah Whaley

Chief Marketing Officer PARKLU

William August

Founder, Outlandish Studio

Artem Zhdanov

Founder of LaowaiMe

Aaron Chang

CEO and Founder, JING digital

Marcus Pentzek

Chief SEO Consultant Searchmetrics Digital Strategies Group

Andrei Prokhorovich

Founder and CEO Eurasia Development Ltd.

Kristina Knut

Marketing Director at KAWO

Michael Norris

Research and Strategy Manager, AgencyChina