CONTENT

By: Ashley Dudarenok

Updated:

China is a large market with a total population of over 1.3 billion people. As of December 2016, the number of Chinese netizens was over 730 million, almost equivalent to the total population of Europe. With the development of the Internet and widespread use of mobile technology, more and more people are using social media to connect with each other, share their achievements and feelings, obtain information and voice their opinions. Because of this, businesses are turning to it for new marketing opportunities. This is especially true in China, where there are well over 730 million active social media users and where social media is highly intertwined with e-commerce.

Chinese social media platforms are similar to their western counterparts. Although there are major platforms like Weibo, WeChat, Baidu and Taobao that have the largest volume of users, the overall landscape of Chinese social media is relatively fragmented. Platforms are either segmented by function or cater to niche interest communities.

Let’s look at the most popular social media platforms in China.

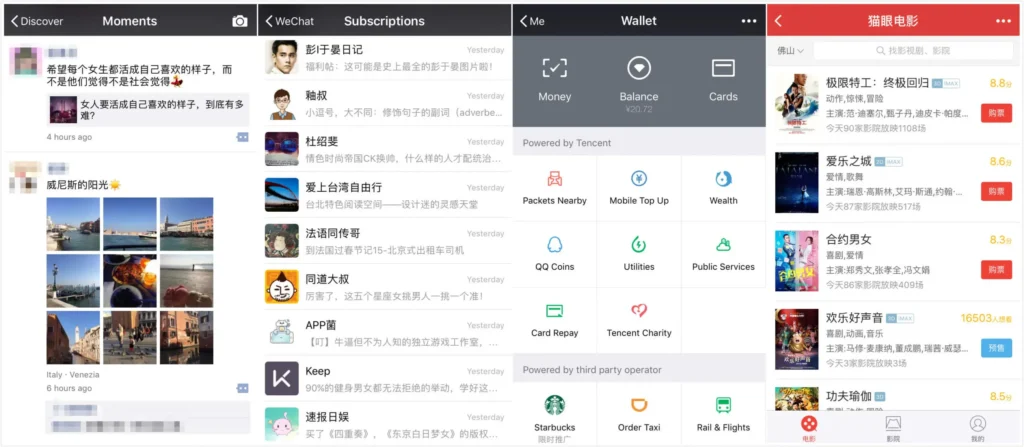

WeChat, also known as Weixin (微信) in Chinese, started as a mobile instant messaging app but has grown to include features such as a Moments page – akin to a Facebook Wall where users can update their status by posting text, photos and videos or share WeChat articles – WeChat official accounts, WeChat Pay and the newly-released Mini Program platform.

WeChat was first launched by Tencent in 2011 and has become the most used app as well as the most popular Chinese social media platform. By September 2016, the number of daily active WeChat users had reached 768 million, and 50% of them spent 90 minutes per day on WeChat checking messages, reading push articles and browsing their Moments pages and feeds.

For brands hoping to increase their Chinese exposure, opening an official WeChat account to publish brand and product information regularly and establish direct communication with customers is often the first step.

● For more detailed information about WeChat, please refer to our related blog posts.

Sina Weibo (新浪微博), is a microblogging platform. It’s a Chinese hybrid of Facebook and Twitter. Launched in 2009, Weibo had accumulated 132 million daily active users by September 2016 and is ranked as one of the top Chinese social media platforms.

On Weibo, in addition to publishing short posts or long articles with images, videos or hyperlinks, users can also comment, repost, send messages and search for trending topics.

Weibo has become a widely-used information source and trend indicator due to its speedy flow of content. You can easily find the most discussed topics on Weibo and use them in your marketing strategy. There are various advertising options and campaign ideas and formats that you can adapt to your start selling on Weibo.

● For more detailed information about Weibo, please refer to our related blog posts.

By the end of 2016, the number of Chinese netizens who watch videos online had reached over 544 million, so video platforms are a prime choice for marketing and advertising.

Founded in 2003, Youku (优酷) is now one of China’s top online video and streaming platforms. In 2012, Youku merged with Tudou (土豆), another well-known Chinese online video platform. After the merger, Youku consolidated its domination among the Chinese online video platforms.

Brands can set up their own Youku channel and upload videos related to brand and product promotion or create videos to pique interest and attract potential customers.

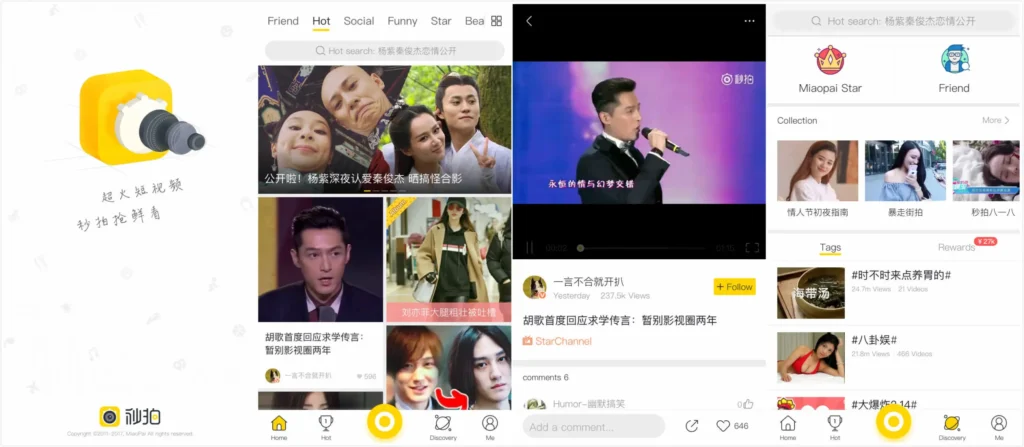

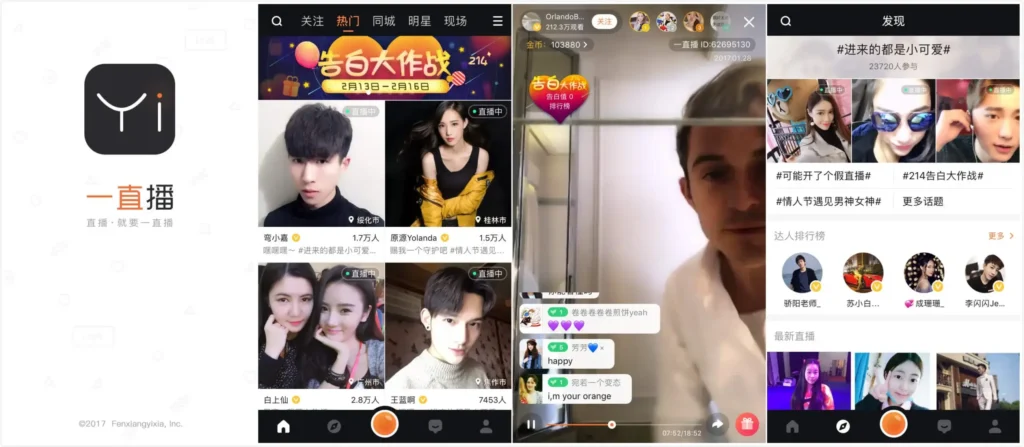

Short video sharing and live streaming have become two of the most popular trends on Chinese social media platforms. Short videos are a favourite because they allow for easy sharing without a need for huge bandwidth or memory. Live streaming witnessed unprecedented growth last year with a remarkable increase in the number of platforms and users.

Miaopai (秒拍) and Yizhibo (一直播) are two popular mobile apps for short video sharing and live streaming respectively. They are both partnered with Sina Weibo so users can view videos from these platforms directly on Weibo, which has strongly increased their exposure and popularity.

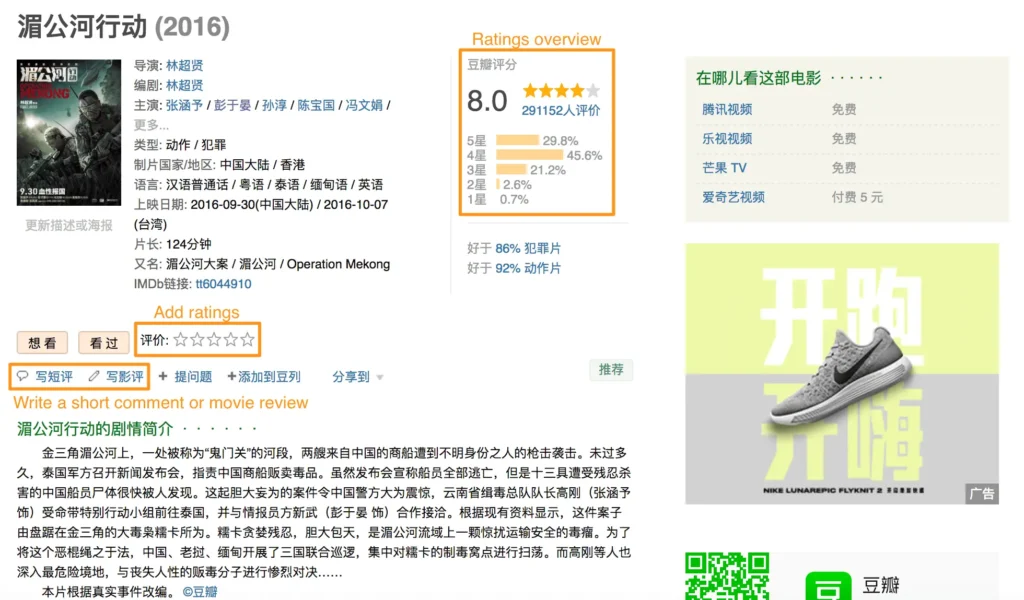

Douban (豆瓣) is an interest-oriented social networking platform in China. It’s well-known for its comprehensive information about books, movies, music and lifestyle-related content.

Douban is positioned as a creative community where user-generated content is highly encouraged. Users usually rate and write reviews on books, movies and products. Most Douban users make decisions based on the ratings and comments on the site.

Douban has been exploring new business models and trying to make the most of e-commerce trends. For example, Douban Books (豆瓣读书) allows both publishers and independent writers to promote their book while Douban Movies (豆瓣电影) supports online ticket selling and is connected to offline cinemas.

For brand promotion, a Douban station (豆瓣小站) is generally considered a brand’s official page. Brands can connect, interact and launch online campaigns.

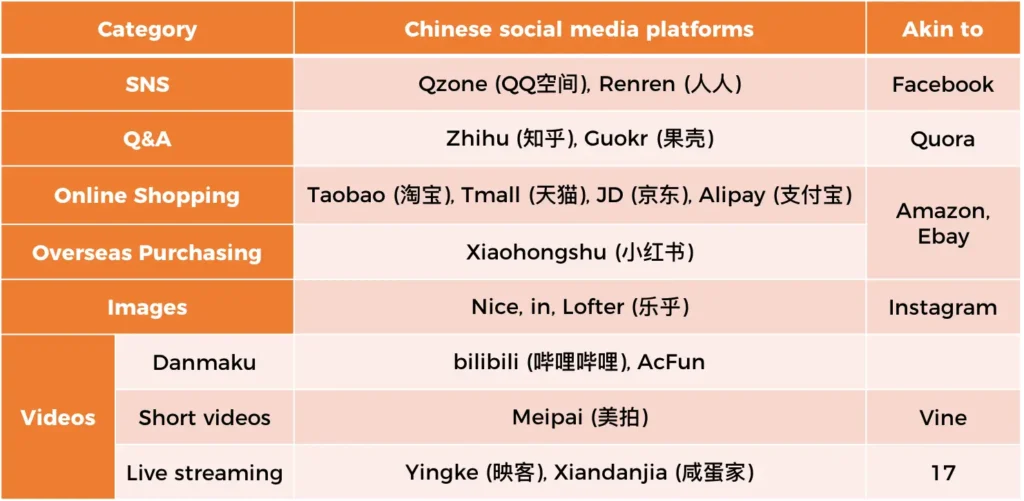

There are plenty of specialized social media platforms. Their overall user base is not as large as the ones introduced above but they usually target specific groups of users accurately. Here’s a list of some of the more popular ones listed by niche category.

We may feature some of them in future ChoZan navigators.

Which social media platform would you like to know more about besides the ones we’ve already featured? Please leave a comment below to tell us.

Maybe you can start learning about it in our next navigator!

To get deeper insights into Chinese social media marketing and utilizing it to serve your business, join ChoZan, a training and resources platform for Chinese social media marketers.

Please follow our official WeChat account to get more updates about the latest news, feature updates and case studies.

Share this article on your favourite social media

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

China Mega Projects: Biggest Infrastructure & Tech Builds

A List of 14 Major MCNs in China

Top Online B2B Chinese Channels

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.