CONTENT

By: Ashley Dudarenok

Updated:

China has quite a collection of holidays that celebrate love. There’s Western Valentine’s Day on February 14th, White Day on March 14th, Cyber Valentine’s Day on May 20th and the Qixi [pronounced “chee shee”] Festival on the seventh day of the seventh lunar month, usually in August. Sometimes it’s called the Double Seven Festival or Chinese Valentine’s Day.

While there are multiple Chinese love themed holidays, brands tend to focus marketing efforts on Qixi Festival. They use major festivals like this one as a leverage to gain a boost in sales and develop their brand image among Chinese consumers.

Qixi Festival or Chinese Valentine’s Day celebrates the love described in an ancient folktale between a cowherd and a heavenly weaver girl who can only visit each other once a year when flocks of magpies form a bridge in the sky for them to walk on.

In 2022, it will be on Thursday, August 4th.

In 2023, it will be on Tuesday, August 22nd.

What does this have to do with brands and marketing? Just as many special occasions in the West have become heavily commercialized, so it is in China and the Qixi Festival has turned into a major shopping occasion.

In 2020, just before the festival, gift-related search keywords on JD.com increased 280% with “gift”, “chocolate” and “gift girlfriend/boyfriend” among the most popular. Sales also shoot up before and during the festival. In 2020, there were sales increases of 20-30% for home and outdoor goods, and an increase of around 30% for chocolate and candy. Mid-to-high end cosmetics were popular in lower tier cities and sales of red wine and imported steak rose indicating that more people were opting for home-cooked romantic dinners. Intercity orders for flowers across the country rose 33% from 2019 levels. While most flowers were ordered by men, in an interesting trend, there was a 40% increase in the number of young women buying flowers.

Tmall and Taobao also saw sales increases of 118% YoY in the week before the festival and some brands see record-breaking sales in August.

It’s also a prime battleground for luxury brands given China’s strong recovery in this sector. In 2020, on JD.com, luxury products saw sales increases of 20-30% with jewelry and handbags among the most popular imported products. Traditional Chinese-style jadeite jewelry saw a 53% increase in sales and there was a 148% increase in the sales of investment-grade gold and silver compared to 2019.

So, what are some examples of successful Qixi Festival marketing campaigns from 2020 and 2021? Let’s take a look.

Gucci has shown a strong ability to get the right kind of attention and strong buzz during China’s love themed holidays, especially on May 20th, also known as 520 or Cyber Valentine’s Day, and during the Qixi Festival. In 2020, the brand focused on apples as a symbol of love. A smart choice given its similarity to the iconic heart shape, its presence in love myths and its use in modern expressions like “the apple of my eye”. It’s also a design that can be worn year-round without seeming out of place. They came up with a full collection of items that modified their signature pattern in clever, cute and unexpected ways to incorporate apples.

They had a three week campaign customizing the campaign for each of the most important social media platforms. It released a series of short videos with nostalgic locations for people in their 20s and 30s like CD stores, the library and school campus. The videos showcased six young idols dressed in the signature designs in stories related to love. Lucas Huang was one of the featured idols. Huang is hugely popular among young women and teens and garnered huge traffic for the brand. The videos got 16.7 million views.

On its Tmall flagship store, the brand launched exclusive items like a padlock handbag and an iPhone case.

At the end of July, Gucci announced the collection on its WeChat account with an article containing an animation showing an apple ripening from green to red and then the brand’s double G logo appearing on it. The animation was posted on its Weibo account. The WeChat article got over 300,000 views in a day and the video got 700,000 views in a week.

Chinese fans appreciated that the brand made a full collection with a pattern specifically for the holiday instead of producing a few token items. They also liked that the brand used Chinese celebrities to energize it and customized the marketing campaign so well for each different social media platform.

The brand has continued its apple theme with its 2021 campaign but has changed from nostalgia themes to a moody modern aesthetic that also seems to be hitting all the right notes.

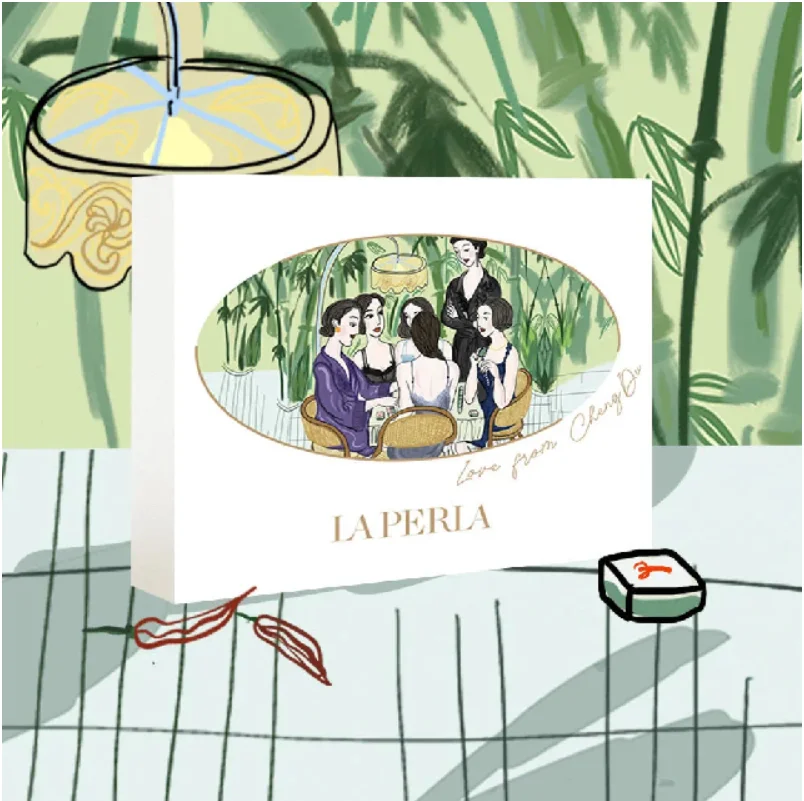

In 2020, luxury underwear brand La Perla took an unusual approach by featuring illustrations by Julia Long (龙荻 Long Di), a regular collaborator with fashion brands, and included them on cards in special edition packaging for its Chinese Valentine’s Day offerings. Miss Long’s hand crafted style and the retro scenes set in a dream-like China set the mood and heightened the brand image through a connection with art.

The brand used the artwork and a rainbow theme across its social media marketing and employed different KOLs/influencers to represent separate colours of the rainbow and showcase the limited edition holiday packaging.

周若雪Patty is a KOL on RED. Here’s some of her note translated:

“The Double Seven Festival丨A rainbow-like romance hidden in the summer?

“☀️The Double Seven Festival is coming. If summer is colorful, then Double Seven is the rainbow-like romance hidden in the summer. I like to record my life with the camera. This time I want to share the gifts I received on this special day.

“?This time, the Qixi Festival gift box was designed in collaboration with artist Julia Long Di. The degree of sophistication can be said to hit my heart.”

The brand’s subtle, soft, elevated approach resonated with consumers and built the brand’s image while using trendy, modern art created by a Chinese artist with strong fashion connections.

For 2020’s Chinese Valentine’s Day, Fendi collaborated with British artist Sam Cox, also known as Mr. Doodle, and high profile Gen Z influencers for their marketing campaign. They also launched pop-up stores to display their capsule collection. There were small cafés covered in artwork by Mr. Doodle that featured tables and plates with his artwork.

Popular singer and dancer Jackson Wang, who is from Hong Kong, based in mainland China and a member of South Korean band Got7, Liu Qingsong and Jin Taixiang, part of China’s League of Legends world championship team, collaborated with the brand on their campaign and were featured modelling items from the collection in ads and on social media.

Items from the capsule collection could be purchased on Fendi’s WeChat mini program store.

The collaboration with Mr. Doodles fit the brand and produced unique, visually striking clothing that was immediately identifiable and stood out from the crowd. The pop-up stores catered to the tech savvy with experiences, omnichannel capabilities, and social sharing opportunities. Their choice of KOLs showed their strong desire to appeal to Gen Z and to appeal to e-sports fans.

How about our honourable mentions? Let’s see.

The first honourable mention isn’t for a brand or a campaign but WeChat itself. Why? For the Qixi Festival in 2020, it rolled out gesture recognition capabilities that allowed users to make a “finger heart” gesture, like they’re about to snap their fingers, to unlock features, get stickers featuring KOLs, get discounts, go to a gift collection page, or other customized interactions. Brands like Mengniu Dairy, Tom Ford and Tiffany used the gesture in creative ways fitting for the festival.

Louis Vuitton’s flagship Shanghai store broke sales records in August 2020 with what is believed to be the highest monthly store sales in China at US$22 million. It reached these heights with the help of a menswear fashion show at the start of the month that broke live streaming records, its Qixi Festival limited edition goods and a whole lot of pent up demand and relief after Covid infections had been brought under control.

The brand’s extensive love themed Dioramour capsule collection, designed by Maria Grazia Chiuri, a colourful limited edition collection for men designed with Kenny Scharf and its deft deployment of famous influencers got the brand lots of love and attention from consumers, especially Gen Z.

But there were some brands who just couldn’t read the room. What happened? Let’s see.

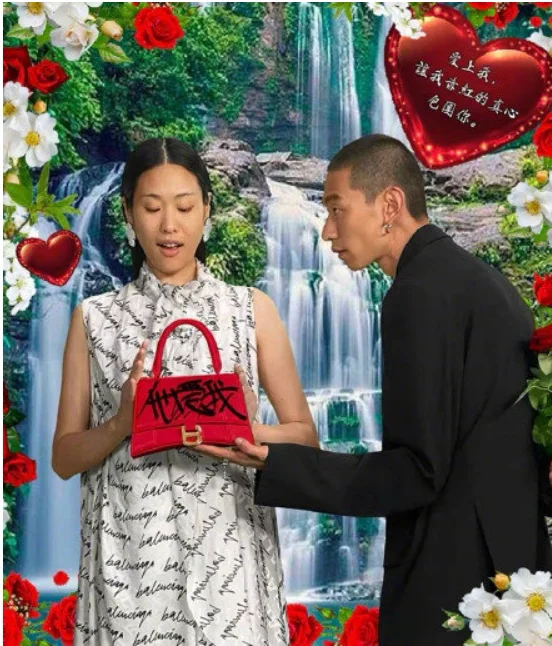

The brand seemed to be trying to be edgy, retro and local but missed the mark. Netizens started the hashtag #Balenciaga’sChineseValentinesCampaignisTacky (it’s shorter in the original Chinese) and called out the brand for what it saw as a poorly executed lacklustre concept. The hashtag was attached to over 210,000 discussions and got 170 million views on Weibo. A related hashtag, #BalenciagaInsultsChina, was attached to 6,000 discussions and got 15 million views.

While most brands came out with fully realized concepts involving multiple products and capsule collections, Balenciaga focussed on its hourglass bag in 4 colours with a few simple love related slogans drawn in a graffiti style considered trendy by some in Gen Z, while being seen as downmarket and ugly by many others. The colour scheme and style of the ads turned people off and they weren’t attracted to items that they felt they could easily create themselves.

For Chinese Valentine’s Day 2020, Cartier released a one minute video ad for its Trinity rings that rotates between different young couples. It appears to spotlight both heterosexual, gay and lesbian pairings in dreamlike scenes of them viewing a cityscape from the top of a building, riding bikes, taking a ride in a convertible and practicing music with a lovely classical them as soundtrack and the slogan “How far would you go for love” at the end. On Weibo, the brand posted the message “Trinity rings. Witnessing all sorts of love and emotions in the world.” It struck a chord and seemed subtly, tastefully inclusive.

Then on Tmall, it posted images from the ad with the words “Father and son can be brothers, enjoying life’s journey,” under the image of the two men of similar age riding bikes together and “Mutual understanding beyond words. Witness our everlasting friendship,” under the image of the two women. Netizens cried foul.

Commenters called out the brand for its lack of logic, questioning why a father and son or friends would wear a ring meant for romantic couples. They were also very disappointed as the initial ad was well-received and there was no need to add these new comments, which pushed LGBTQ people back to the margins.

It’s thought that the steps were taken to avoid being censored on Tmall, but consumers felt that given the original video, the brand needed to follow through or, at least, not insult the audience by calling 2 men so near in age a “father and son”.

Chinese consumers know how important they are to brands and expect them to do something special and surprising for big occasions like the Qixi Festival. Brands relying on celebrities and influencers in unimaginative ways won’t cut it. Consumers are shying away from tactics that pander or feel overly commercial.

With so many love holidays in China, some brands are also shifting away from marketing activities for 520/May 20th/Cyber Valentine’s Day and devoting more time and energy to the Qixi Festival. With marriage rates declining, there are also a broader range of scenarios that brands are focussing on related to love.

With pent up demand and an audience that is increasingly spending domestically due to travel restrictions, competition between brands is ramping up.

Getting important marketing campaigns like this right can generate long term benefits in terms of sales and brand loyalty. Getting them wrong can lead to short term backlash or cause damage to the brand’s reputation.

The Qixi Festival is not an occasion to be missed and if brands fumble, they need to make sure they follow it up with a hit.

Do you have urgent questions about your next festival campaign? Do you want to get a better understanding of Chinese consumer behaviour and influencers? We can help you understand the China marketing landscape through custom corporate training and our other company, Alarice, can help you with China marketing research and strategy. Contact us today.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

WeChat VS Weixin, an Essential Guide for Marketers

5 Chinese Fashion Bloggers (KOLs) You Must Know in 2025

7 Digital Lifestyles of Chinese Gen Z Consumers

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.