CONTENT

By: Ashley Dudarenok

Updated:

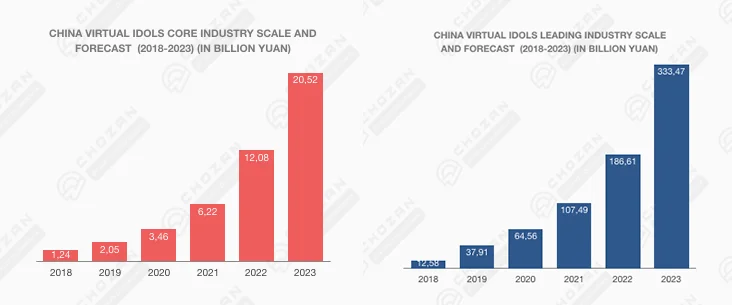

It was 2007 when Japan’s Hatsune Miku, one of the world’s first-generation virtual idols, made its debut attracting millions of cheerful fans worldwide and endorsing hundreds of brands over the years. Since then, the popularity of virtual idols has exploded, to the extent that many mainstream American entertainment industry’s think tanks predict that by 2025, virtual idols will occupy half of the entire entertainment industry. The future prospects of virtual internet celebrities are particularly promising also in China, with a core market value expected to reach 20.52 billion yuan in 2023.

On these premises, should brands invest in Virtual KOLs or simply stick to flesh-and-bone influencers? In this article, we are going to discuss the pros and cons of using Virtual KOLs in digital marketing campaigns.

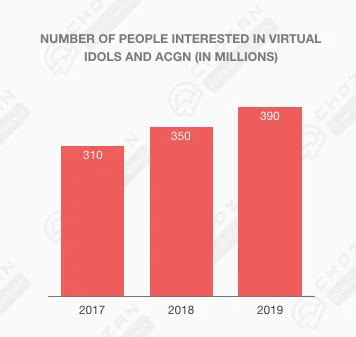

According to iQiyi’s “2019 Virtual Idol Observation Report” (2019 年虚拟偶像观察报告) in 2019 there were more than 390 million consumers interested in virtual idols in China. This was 80 million more than in 2017 and the audience is still expanding.

Due to a further boost to the digitalisation process and the increase of online interactions and events brought about by the Covid-19 pandemic, 2020 can be considered the year in which virtual idols finally took off. Their appearance on live streaming platforms during that time contributed greatly to the growing interest in virtual celebrities.

Research from iiMedia Consulting indicates that in 2020 the core market value of China’s virtual idols was around 3.46 billion yuan, and it is expected to reach 6.22 billion yuan by the end of 2021. The value of the peripheral market driven by virtual idols is expected to grow from 64.56 billion yuan in 2020 to 107.49 billion yuan in 2021.

Leading domestic online platforms, such as Tencent, NetEase, Bilibili, iQiyi, Alibaba and Douyin, have also increased their investments in the field, promoting the entertainment industry built around virtual idols. Bilibili in particular has been leading the trend, being the first to hold live concerts starring solely virtual performers such as the BML-VR 2020 Concert. They are among the largest ACG-themed events in China: in the previous year, around 8,000 people attended the six-hour-long concert held in the Mercedes-Benz Arena in Shanghai. When sales opened two months before the event, tickets sold out after only two hours. Data shows that there are more than 4,000 virtual influencers streaming on Bilibili every month, some of which are produced by the platform itself. Yousa “泠鸢yousa”, for example, is a VOCALOID that counts over 3 million followers.

In May 2020, Tmall’s Youth Lab organised a special Taobao Live that brought together five top virtual stars to interact with fans and promote global brands’ products. The livestream reached 2.7 million views at its peak, with almost 2 million participants trying to win prizes and giving cash as tips for the idols. iQiyi also launched a reality show called Dimension Nova跨次元新星, featuring 30 anime avatars competing against each other. The virtual idols are judged based on their singing and dancing skills by three human social media celebrities.

Luo Tianyi洛天依, Noonoouri努努, Aimee, Ling翎, Ayayi – these are just a few of the famous Virtual Influencers or “Key Opinion Leaders (KOLs)” as they often referred to in China. They can present different faces and features, but what they all have in common is that they are virtual characters created artificially using computer technology. Their personal “life” is very rich: from singing at concerts, hosting shows and modeling, to socialising, live streaming and collaborating with brands. Their influence is sometimes comparable to that of real celebrities and their online activity can generate millions of interactions.

By looking at some of their posts on social media, like the ones from the first meta-human virtual influencer Aiayi, you may not realise that this person does not actually exist.

The phenomenon gained popularity especially among the Chinese youth: according to an iiMedia Report (2021中国虚拟偶像行业发展及网民调查研究报告) 92.3% of virtual idols’ enthusiasts are between the ages of 19 and 30. The majority come from middle and high-income groups, with 75% of them having an average monthly income of more than 5,000 RMB.

Through their online presence, virtual celebrities can convey values and life attitudes in line with Post-90s and Post-00s, providing new entertainment experiences at the same time. It is precisely the emergence of the spending power of Chinese Gen Zs (born between 1995 and 2010) that has led to an increase in the commercial value of virtual idols. For many Gen Zs in fact, idol consumption is considered as a hobby. In order to support their favourite idol, fans will spend significant amounts buying themed merchandising and even purchasing multiple items of the same product and gifting them to family and friends. Some even start considering the idol as their boyfriend or dream lover.

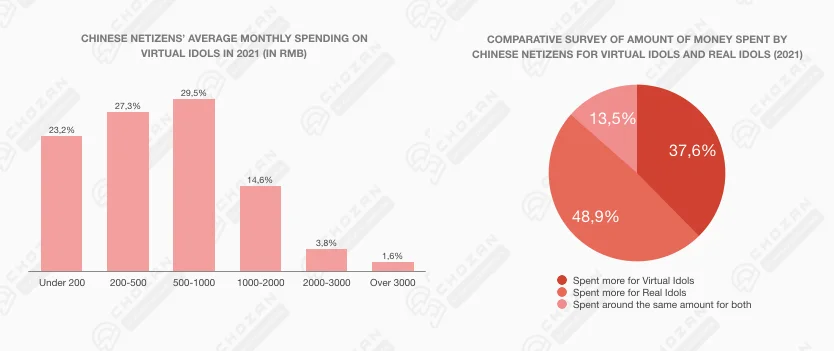

When it comes to virtual idols, although the willingness to pay is lower, as the market continues to grow in China, consumers will increasingly spend more for their adored virtual internet stars. iiMedia Research reports that 63.6% of netizens would support virtual idols. Among them, nearly 30% would spend 500-1,000 RMB a month, 27.3% around 200-500 RMB and 5.4% said their average monthly virtual idols consumption has reached more than 2,000 yuan.

Data also shows that 70% of fans express their support for virtual idols by purchasing endorsed products or merchandising, by giving gifts during live streams, engaging in fan communities and voting on rankings. From this point of view, China’s Virtual KOL economy falls within the broader “Fan economy” (粉丝经济), described as a business operation model based on the relationship between idols and followers, in which fans spend money in order to show support and appreciation for their favourite idol. According to a report released by iResearch and IMS Digital (中国红人经济商业模式及趋势研究报告), the market size of fan economy-related industries was valued at more than 3.5 trillion yuan in 2019 (a year-on-year increase of 24.3%) and it is expected to exceed 6 trillion yuan in 2023.

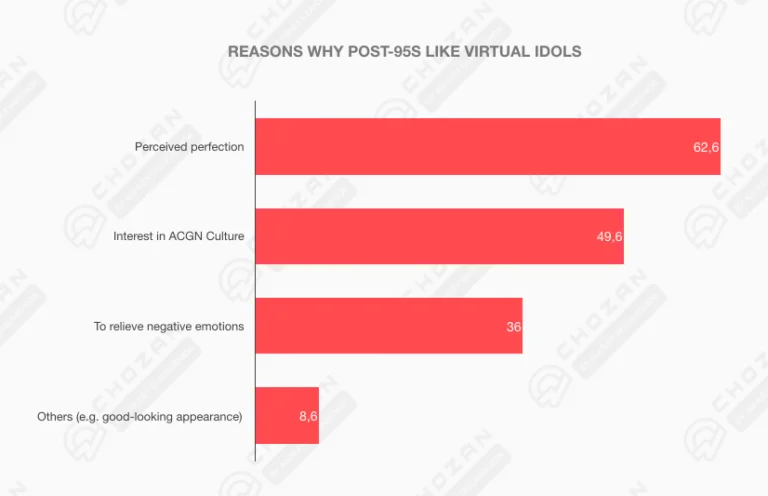

LeadLeo’s data shows that 62.7% of users said they liked virtual influencers because they will never be involved in negative news and will always remain perfect, 49.6% linked it to their interest in ACGN culture and 36% indicated they use this type of entertainment to relieve negative emotions such as anxiety and loneliness.

Virtual idols can give their fans a sense of emotional connection and identification, winning their hearts by showcasing their cool appearances, unique personalities and talents: some will share their life attitudes, travel habits, fashion perspectives and even their favourite food and snacks. This new popular culture trend created a blurred line between fantasy and reality, fueling fans’ imagination and satisfying their psychological needs.

The application of virtual KOLs in China covers many different fields such as Chinese e-commerce, advertising, education, tourism promotion, fashion, gaming, brand endorsements and other commercial activities. Brands can choose to either start a cooperation with an existing virtual KOL or to create their own from scratch. In the first case, a virtual idol can be selected to appear as the brand spokesperson or ambassador, carry out product endorsement or even engage in the co-creation of new products.

An example is Qeelia, the Chinese virtual fashionista created by Blue Wildebeest Technology. She has more than 400,000 fans on Weibo and has worked with brands such as Fenty Beauty, Zadig & Voltaire, Gentle Monster, Christian Louboutin and Uniqlo to participate in virtual events and promote new products.

In the case of newly created idol IPs, the brand can invest in the production of a virtual influencer that perfectly matches the brand values and personality.

Mr Ou (picture below) is L’Oréal’s first virtual idol. Described as a Chinese-French entrepreneur who cares for the environment and works within the beauty industry, he will contribute to the brand’s social media channels by posting about beauty trends, ingredients, sustainability initiatives, as well as interviews with other KOLs and celebrities.

PRO: Save costs related to traditional celebrity endorsement and directly communicate with new potential consumer groups

If brands do not have enough budget to target popular celebrities or top influencers, virtual idols may become a good alternative solution in the long run. They can save a lot of time and costs related to setting up ongoing collaborations, as well as the risk of being involved in real influencers’ scandals. If managed properly, virtual idols can be an effective choice to communicate with consumer groups that usually cannot be reached through traditional celebrity endorsements.

In the same way as movie stars’ popularity surpassed that of opera actors in the 1930s, as movie actors and traditional celebrities are being outshined by online influencers, virtual idols might become the new big trend in the entertainment industry. For this reason it should be considered as a long term investment.

PRO: More control over brand image and values

Compared to traditional real-life idols, virtual ones have a stable and reliable online presence. After all, they can be online 24 hours a day, never need a holiday, never fall sick, and if managed properly, never disappoint fans. They have a non-aging appearance, a fixed personality and are not affected by time or location constraints and the external environment. This gives the brand more control over their image and content development to create messages that speak directly to the target audience.

PRO: Resonate with Gen Z

Virtual idols can help brands reach the younger generation and enhance their customer experience through the creation of short films, interactive games and articles. Whilst there are too many real-life influencers creating similar content, virtual ones can represent an innovative way to resonate with Chinese Gen Z consumers. An example is Ling翎, who with her appearance and sense of fashion inspired by Guochao trends, has allowed Gen Z to appreciate the charm of traditional Chinese culture even more.

PRO: Generate a deeper sense of participation

In contrast to the relationship between real idols and fans, fans of virtual idols feel a greater sense of participation as virtual KOLs can provide more personalised products and services.

An example is given by Luo Tianyi’s tens of thousands of music works, 90% of which come from User Generated Content, and most of them are customized by fans and musicians. This allows brands to build a much closer community of fans.

CON: High investment is required to succeed

This is true when it comes to developing a branded virtual idol. Creating a unique and appreciated virtual idol cannot be done overnight. Depending on the type of virtual KOL, the production can cost as much as 2 million yuan, which includes carrying out image design, such as the crafting of character, personality and hobbies of the idol. The initial promotional stage also requires large investments from the team, as it is fundamental to obtain traffic, cultivate users and pave the way for the future success of the IP.

CON: Need to constantly keep the Virtual KOL “in context”

Creating a credible virtual character with an authentic personality is not an easy task. The brand needs a clear definition of the targets of its communication: it needs to understand their demographics and psychographics, what they are interested in, as well as the content and imagery they like. This data will then be used to craft the idol’s appearance, personality, behaviour, values and beliefs, to deliver a message in a way that will naturally appeal to their target audience.

In order to stay in line with changes in consumer sentiments, it is also necessary to constantly analyse and monitor conversations around a certain topic or niche and promptly review and steer the virtual idol’s public relations in the right direction.

If you need an agency that deeply understands trends and social media marketing in China or you’re looking for training for your executive or marketing team, we can help.

And if you have urgent questions about specific issues or the China market in general, ChoZan’s consultation services and expert calls are your shortcut to expertise.

Contact us with any questions you might have and we’ll put you on the right track.

By subscribing to Ashley Dudarenok’s China Newsletter, you’ll join a global community of professionals who rely on her insights to navigate the complexities of China’s dynamic market.

Don’t miss out—subscribe today and start learning for China and from China!

A List of 14 Major MCNs in China

Top Online B2B Chinese Channels

Ashley Dudarenok is a leading expert on China’s digital economy, a serial entrepreneur, and the author of 11 books on digital China. Recognized by Thinkers50 as a “Guru on fast-evolving trends in China” and named one of the world’s top 30 internet marketers by Global Gurus, Ashley is a trailblazer in helping global businesses navigate and succeed in one of the world’s most dynamic markets.

She is the founder of ChoZan 超赞, a consultancy specializing in China research and digital transformation, and Alarice, a digital marketing agency that helps international brands grow in China. Through research, consulting, and bespoke learning expeditions, Ashley and her team empower the world’s top companies to learn from China’s unparalleled innovation and apply these insights to their global strategies.

A sought-after keynote speaker, Ashley has delivered tailored presentations on customer centricity, the future of retail, and technology-driven transformation for leading brands like Coca-Cola, Disney, and 3M. Her expertise has been featured in major media outlets, including the BBC, Forbes, Bloomberg, and SCMP, making her one of the most recognized voices on China’s digital landscape.

With over 500,000 followers across platforms like LinkedIn and YouTube, Ashley shares daily insights into China’s cutting-edge consumer trends and digital innovation, inspiring professionals worldwide to think bigger, adapt faster, and innovate smarter.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.

Please check your email and confirm your subscription.